Question: Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance In the Allowance for Doubtful

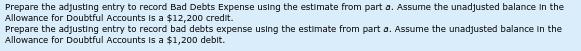

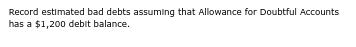

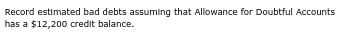

Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance In the Allowance for Doubtful Accounts is a $12,200 credit. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $1,200 debit. Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $1,200 debit balance. Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $12,200 credit balance.

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

a Determine the estimated balance of allowance for uncollectibles Estimated balance of ... View full answer

Get step-by-step solutions from verified subject matter experts