Question: Prepare the appropriate journal entries for each situation below. Be sure to show all your work and calculations. a) Jan 1-You received $6,000 cash

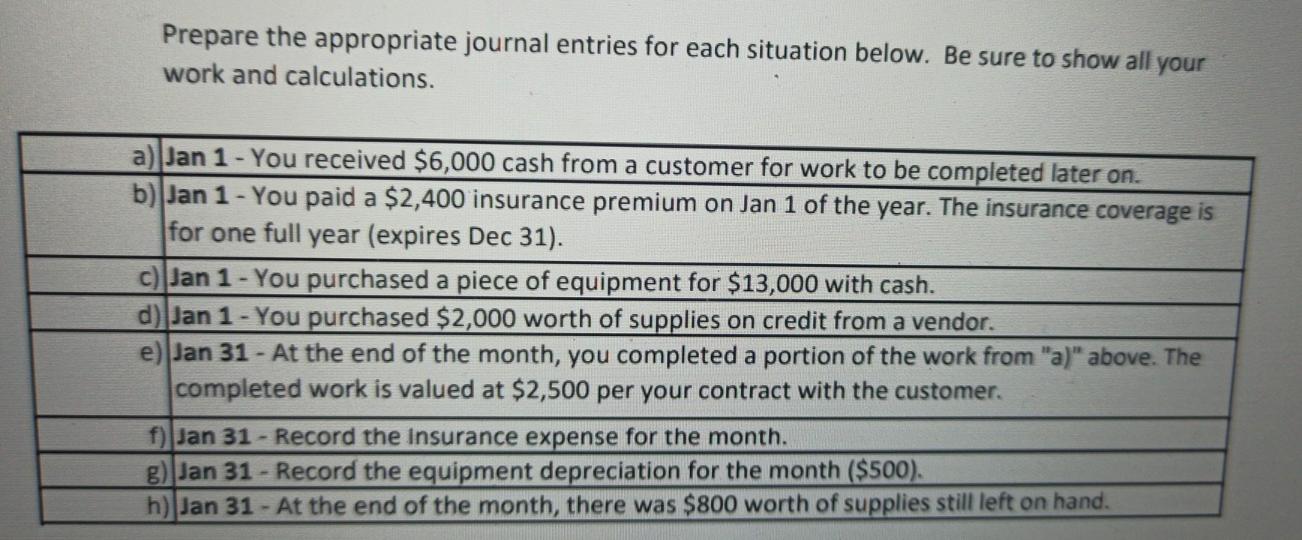

Prepare the appropriate journal entries for each situation below. Be sure to show all your work and calculations. a) Jan 1-You received $6,000 cash from a customer for work to be completed later on. b) Jan 1-You paid a $2,400 insurance premium on Jan 1 of the year. The insurance coverage is for one full year (expires Dec 31). c) Jan 1-You purchased a piece of equipment for $13,000 with cash. d) Jan 1-You purchased $2,000 worth of supplies on credit from a vendor. e) Jan 31 - At the end of the month, you completed a portion of the work from "a)" above. The completed work is valued at $2,500 per your contract with the customer. f) Jan 31-Record the Insurance expense for the month. g) Jan 31-Record the equipment depreciation for the month ($500). h) Jan 31-At the end of the month, there was $800 worth of supplies still left on hand.

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

A Jan 1st Received 6000 cash from a customer for work to be completed later on Journal entry Debit C... View full answer

Get step-by-step solutions from verified subject matter experts