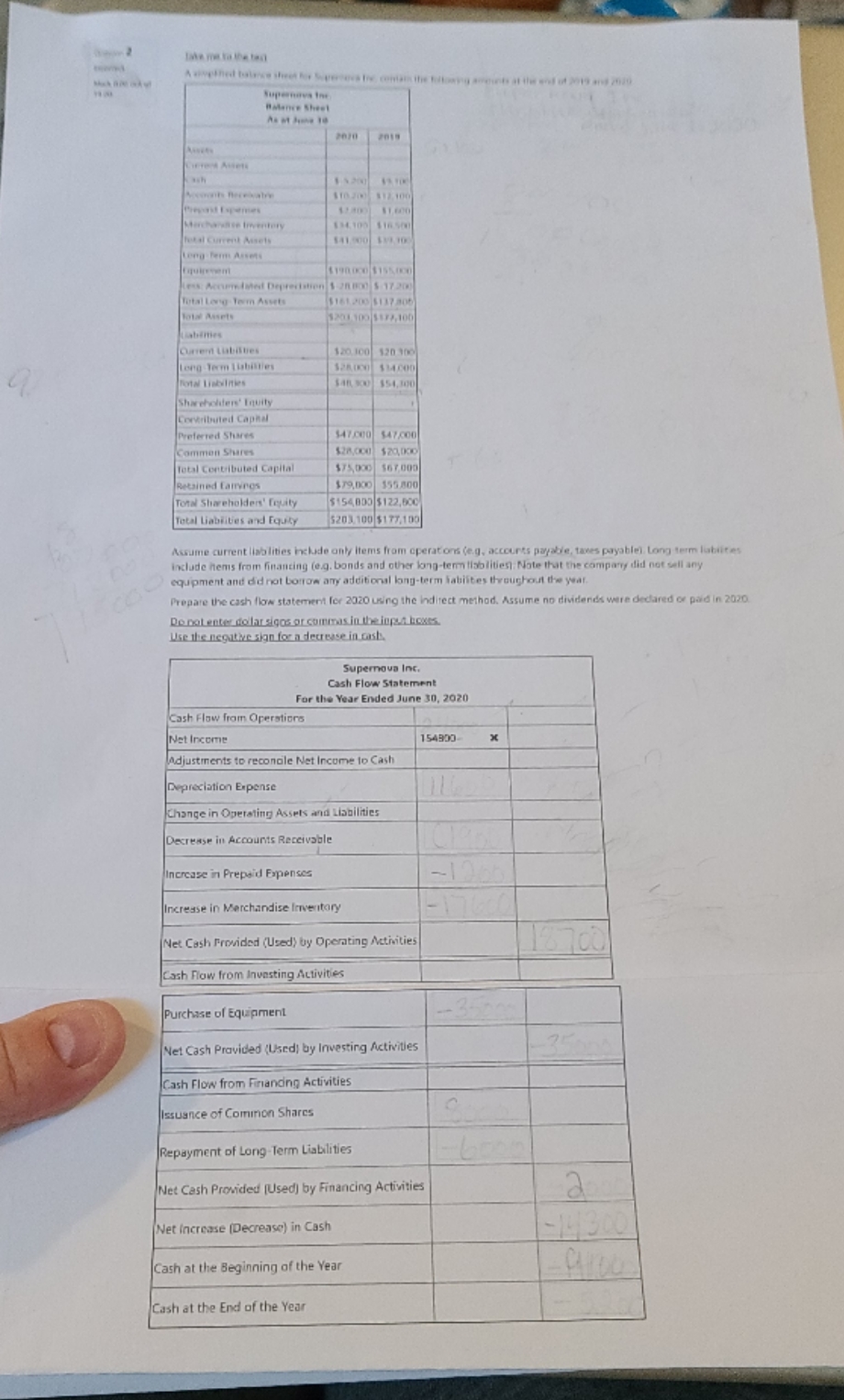

Question: prepare the cash flow statement for 2020 using the indirect method. assume no dividends were declared or paid in 2020. A slepthed babeice sheet for

prepare the cash flow statement for 2020 using the indirect method. assume no dividends were declared or paid in 2020.

A slepthed babeice sheet for Spurious bic, contain the followgig ancies at the end of 20919 and 2020 Supernoes In I Mance Sheel 1520 1310 $10309 812,100 Marchesfive Inventory 154,100 4 18 560 Total Current Assets 841.500 183, 10 Long Term Assets $190 050 $155060 Less: Accumulated Depreciation $ 28 190 $ 1720 Total Long Term Assets $161 200 5137 205 Total Assets $201 100 5872,100 abdities Current Lubites $20.100 120 150 long Term Liabilities $28009 424800 Total Liabilities $48 30 454,390 Shareholders' Equity Contributed Caphal Preferred Shares $47,090 547000 Common Shares $28,000 $20,030 Total Contributed Capital $75,000 567,009 Retained Canvines $79,100 355800 Total Shareholders' Fruity $154 0DO $122,60C Total Liabilities and Equity $203 100 $177.105 Assume current liabilities include only items from operations (e.g, accounts payable, taxes payable]. Long term labtities include hems from financing (e.g. bonds and other long-term lisblities); Note that the company did not sell any equipment and did not borrow any additional long-term Sabiites throughout the year. Prepare the cash flow statement for 2020 using the Indirect method. Assume no dividends were declared or paid in 2020 Do not enter dolar signs or commas in the inpo boxes. Use the neguthe sign for a decrease in.casts Supernova Inc. Cash Flow Statement For the Year Ended June 30, 2020 Cash Flow from Operations Net Income 154303 x adjustments to reconcile Net Income to Cash Depreciation Expense Change in Operating Assets and Liabilities Decrease in Accounts Receivable Increase in Prepaid Expenses Increase in Merchandise Inventory Net Cash Provided (Used) by Operating Activities 137co Cash Flow from Investing Activities Purchase of Equipment Net Cash Provided (Used) by Investing Activities Cash Flow from Financing Activities Issuance of Common Shares Repayment of Long-Term Liabilities Net Cash Provided [Used) by Financing Activities a Net Increase [Decrease) in Cash -14300 Cash at the Beginning of the Year Cash at the End of the Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts