Question: PREPARE THE CLOSING ENTRY REQUIRED AT SEPTEMBER 30, 2021. Required information [The following information applies to the questions displayed below) Starbooks Corporation provides an online

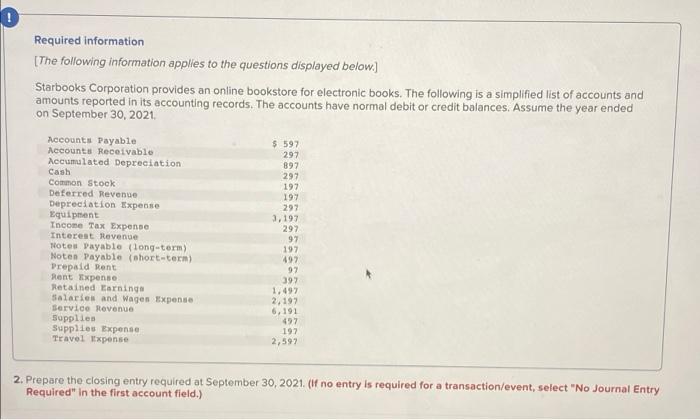

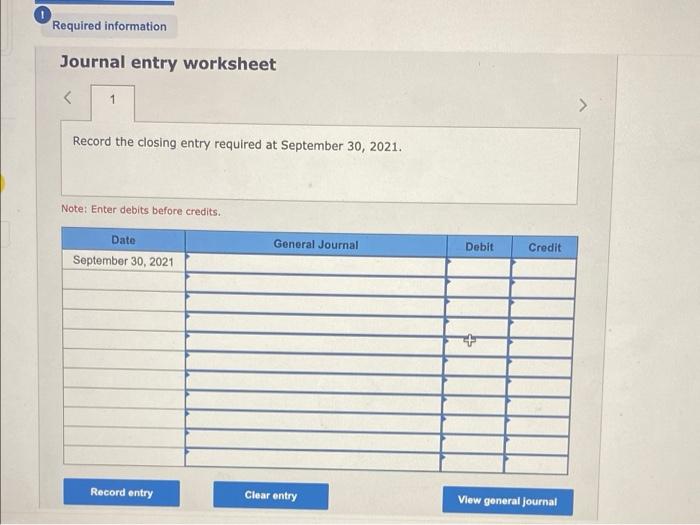

Required information [The following information applies to the questions displayed below) Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified list of accounts and amounts reported in its accounting records. The accounts have normal debit or credit balances. Assume the year ended on September 30, 2021, Accounts Payable Accounts Receivable Accumulated Depreciation Cash Common Stock Deferred Revenge Depreciation Expense Equipment Income Tax Expenso Interest Revenue Notes Payable (long-term) Noten Payable (short-term) Prepaid Rent Rent Expense Retained Earnings Salaries and Wages Expense Service Revenue Supplies Supplies Expense Travel Ixpense $ 597 297 897 297 197 197 297 3,197 297 97 197 1492 97 397 1,497 2,197 6,191 497 197 2,597 2. Prepare the closing entry required at September 30, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required information Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

To prepare the closing entries for Starbooks Corporation for the year ended September 30 2021 we will need to close the temporary accounts revenues ex... View full answer

Get step-by-step solutions from verified subject matter experts