Question: Prepare the December 3 1 entry assuming it is probable that Marigold will be liable for $ 8 8 6 , 7 0 0 as

Prepare the December entry assuming it is probable that Marigold will be liable for $ as a result of this suit. If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.

tableDateAccount Titles and Explanation,DebitDecemberStellar Factory provides a year warranty with one of its products which was first sold in Stellar sold $ of products subject to the warranty. Stellar expects $ of warranty costs over the next years. In that year, Stellar spent $ servicing warranty claims. Prepare Stellar's journal entry to record the sales ignore cost of goods sold and the December adjusting entry, assuming the expenditures are inventory costs. If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.

tableDateAccount Titles and ExplanationDuring record payment for warranty costs incurred ubraceSplish Inc. provides paid vacations to its employees. At December employees have each earned weeks of vacation time. The employees' average salary is $ per week. Prepare Splish's December adjusting entry. If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.

tableAccount Titles and Explanation,Debit,Credit,Current Attempt in Progress

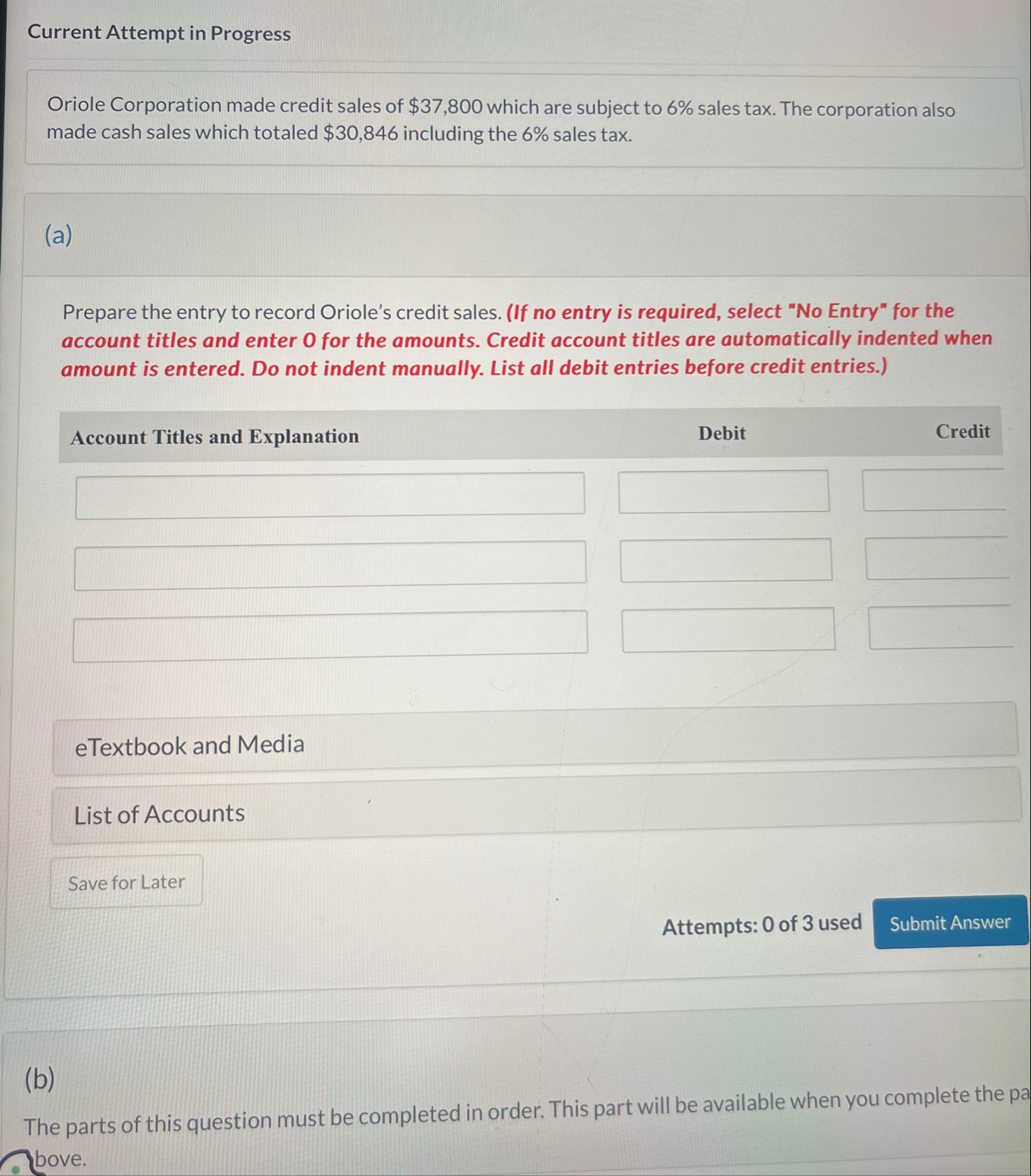

Oriole Corporation made credit sales of $ which are subject to sales tax. The corporation also made cash sales which totaled $ including the sales tax.

a

Prepare the entry to record Oriole's credit sales. If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.

Account Titles and Explanation

Debit

Credit

eTextbook and Media

List of Accounts

Attempts: of used

b

The parts of this question must be completed in order. This part will be available when you complete the pa bove.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock