Question: Prepare the income statement for Aqua SourceAqua Source Company, for the most recent year, using the amounts and the schedule of cost of goods manufactured

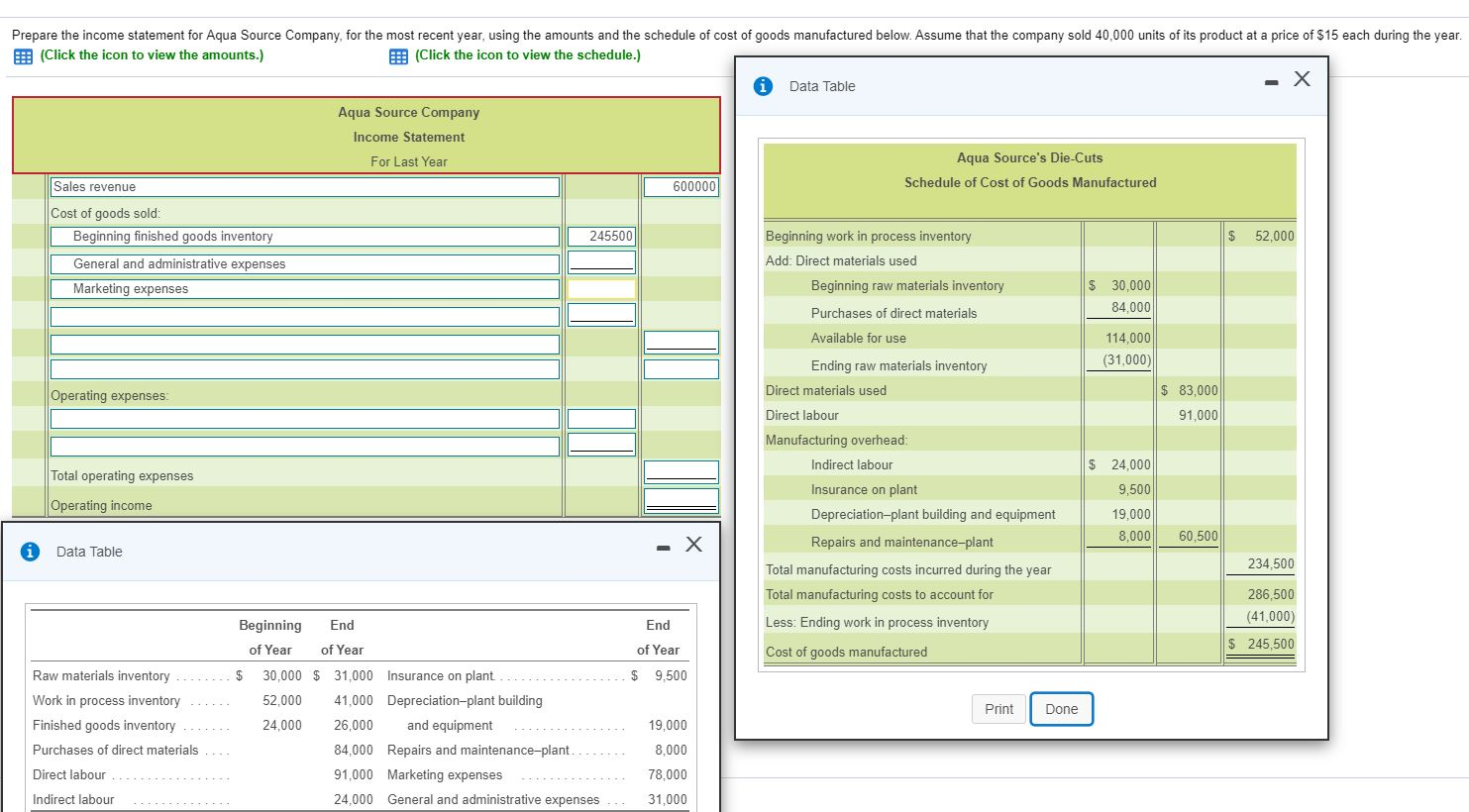

Prepare the income statement for Aqua SourceAqua Source Company, for the most recent year, using the amounts and the schedule of cost of goods manufactured below. Assume that the company sold 40,000 units of its product at a price of $15 each during the year.

Prepare the income statement for Aqua Source Company, for the most recent year, using the amounts and the schedule of cost of goods manufactured below. Assume that the company sold 40,000 units of its product at a price of $15 each during the year. E (Click the icon to view the amounts.) 23 (Click the icon to view the schedule.) * Data Table Aqua Source Company Income Statement For Last Year Aqua Source's Die-Cuts Schedule of Cost of Goods Manufactured 600000 Sales revenue Cost of goods sold: Beginning finished goods inventory 245 $ 52,000 General and administrative expenses Marketing expenses Beginning work in process inventory Add: Direct materials used Beginning raw materials inventory $ 30,000 84,000 Purchases of direct materials Available for use 114,000 (31,000) Operating expenses: Ending raw materials inventory Direct materials used Direct labour Manufacturing overhead: Indirect labour $ 83,000 91,000 $ Total operating expenses Operating income Insurance on plant Depreciation-plant building and equipment 24,000 9,500 19,000 8.000 60.500 || A Data Table Repairs and maintenance-plant Total manufacturing costs incurred during the year Total manufacturing costs to account for 234,500 Less: Ending work in process inventory 286,500 (41,000) $ 245,500 Cost of goods manufactured Beginning End End of Year of Year of Year Raw materials inventory.. ...$ 30,000 $ 31,000 Insurance on plant ..$ 9,500 Work in process inventory ... 52,000 41,000 Depreciation-plant building Finished goods inventory ....... 24,000 26,000 and equipment 19,000 Purchases of direct materials .... 84,000 Repairs and maintenance-plant...... 8,000 Direct labour. 91,000 Marketing expenses 78,000 Indirect labour ....... . 24,000 General and administrative expenses 31,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts