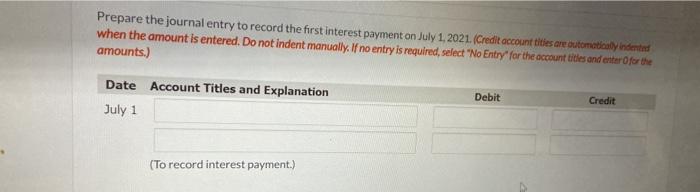

Question: Prepare the journal entry to record the first interest payment on July 1, 2021. (Credit account titles are automatically indented when the amount is entered.

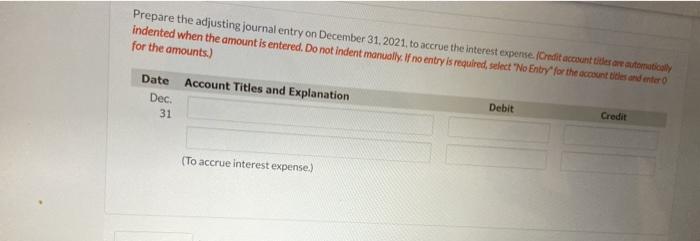

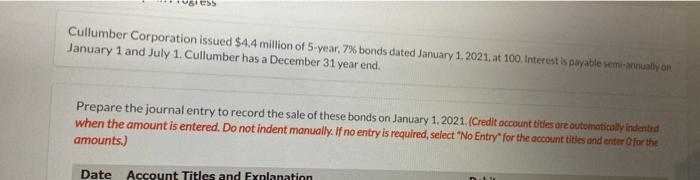

Prepare the journal entry to record the first interest payment on July 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation July 1 Debit Credit (To record interest payment.) Prepare the adjusting journal entry on December 31, 2021, to accrue the interest expense. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Account Titles and Explanation Date Dec. 31 Debit Credit (To accrue interest expense.) Cullumber Corporation issued $4.4 million of 5-year, 7% bonds dated January 1, 2021, at 100. Interest is payable semmilyon January 1 and July 1. Cullumber has a December 31 year end. Prepare the journal entry to record the sale of these bonds on January 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account tities and enter for the amounts.) Date Account Titles and Fxnlanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts