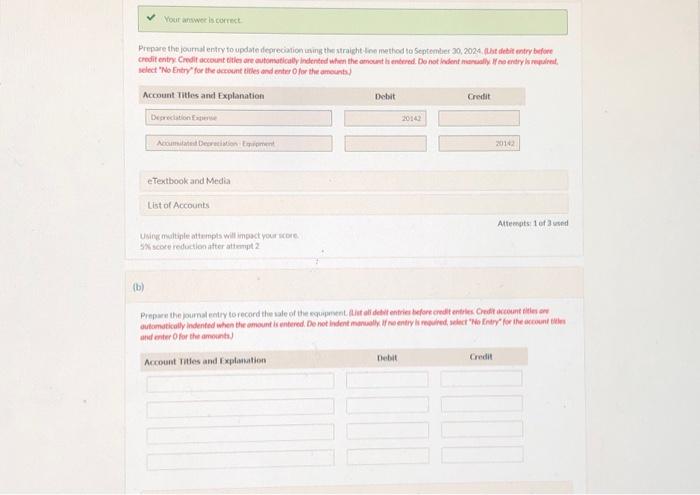

Question: Prepare the journal entry to update depreciation using the straight Ine methed to Stptember 30,2024 , (Lht detit entry before select No Entry for the

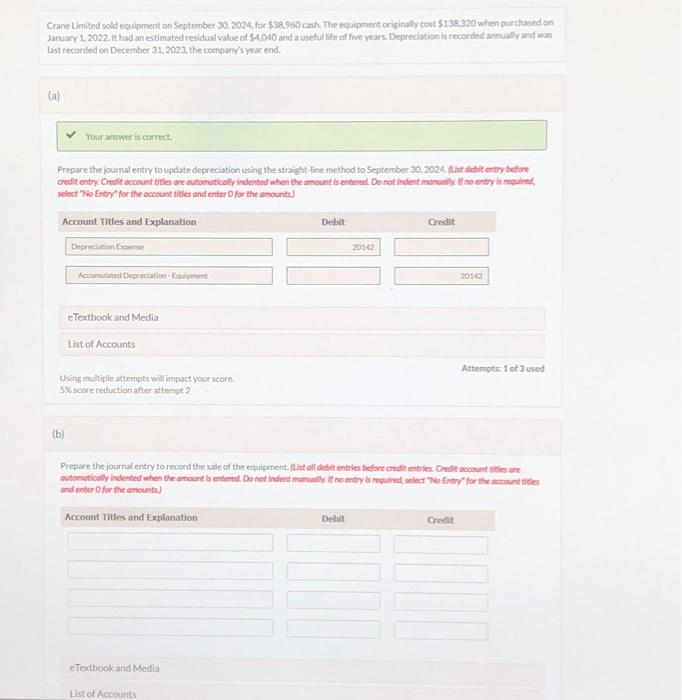

Prepare the journal entry to update depreciation using the straight Ine methed to Stptember 30,2024 , (Lht detit entry before select "No Entry" for the dockount tilles and enter O for the amounts) eTextbook and Media List of Accounts Altempts: 1 of 3 ined Usine oudtiple attempts will imsact vour score. 5x scoke reduction atter attenpt 2 (b) and inter ofor the amoints) Crane Limited sold equipment on September 30, 2024, for \$38,960 cah The equipment originaly cont $138,320 when purchased on last reconded on December 31,2023, the comparv's year end. (a) Your ansmer is correct. Prepare the journal entry to update depreciation using the straight -line method to September 30,2004 . Iut datit entry befark refect "Wh Enery" for the occoumt tities and enter ofor the amounts]. eTectbock and Media List of Accounts Attemptse 1 of 3 used Using multiple atteargts will impact your score. 5s score reduction after atterngt ? (b) Prepare the journal entry to record the sale of the equipment. Aht all debit entries befort condic entries. Ondit account tidles an and enter 0 for the amomis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts