Question: Prepare the lower potion if th current year incompetent beginning with income from continuing operations before income twxes go ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fconnect%252Fltiwrapper%25 al Exam i Saved 22

Prepare the lower potion if th current year incompetent beginning with income from continuing operations before income twxes

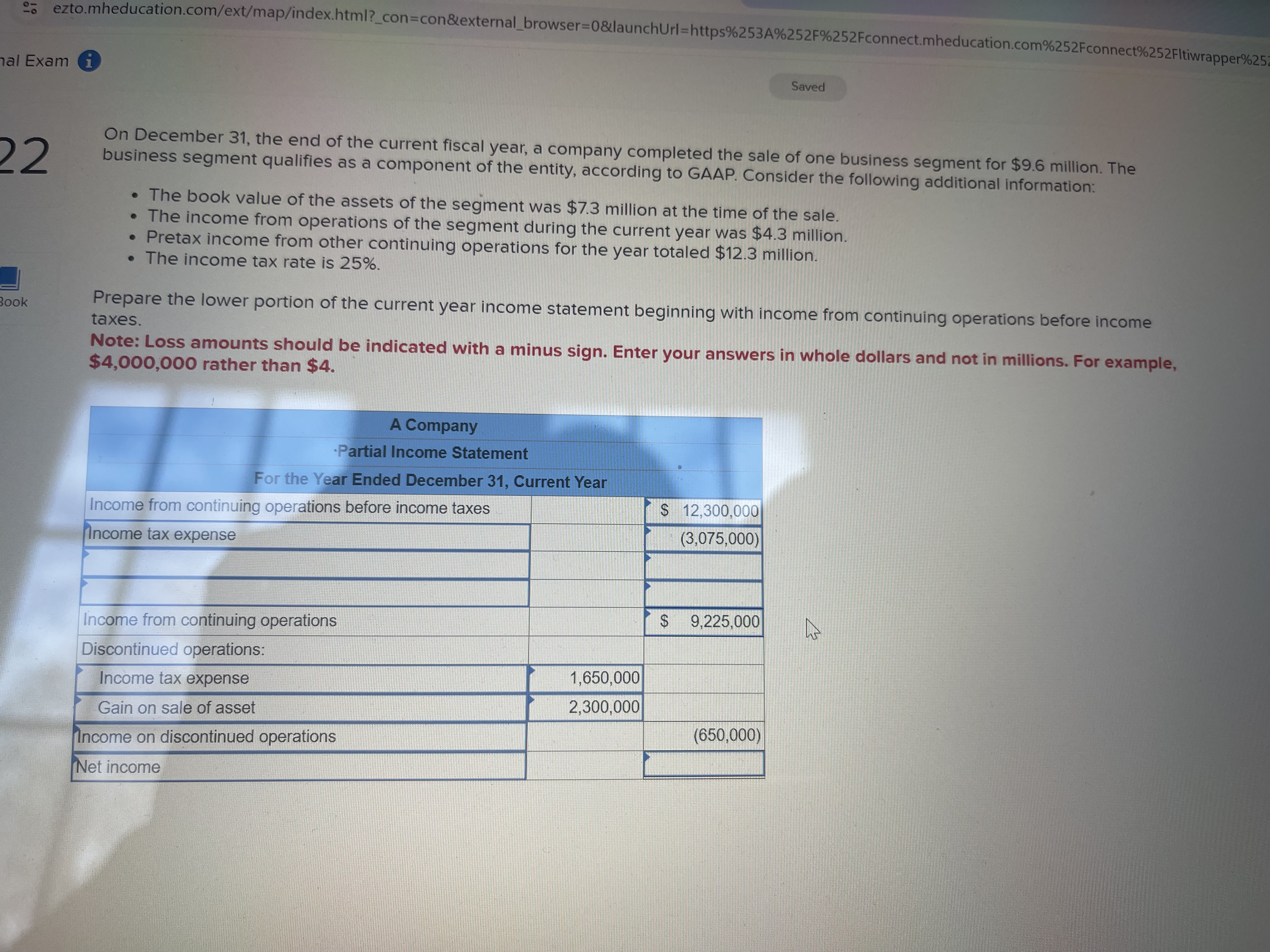

go ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fconnect%252Fltiwrapper%25 al Exam i Saved 22 On December 31, the end of the current fiscal year, a company completed the sale of one business segment for $9.6 million. The business segment qualifies as a component of the entity, according to GAAP. Consider the following additional information: The book value of the assets of the segment was $7.3 million at the time of the sale. . The income from operations of the segment during the current year was $4.3 million. Pretax income from other continuing operations for the year totaled $12.3 million. . The income tax rate is 25% Book Prepare the lower portion of the current year income statement beginning with income from continuing operations before income taxes. Note: Loss amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions. For example, $4,000,000 rather than $4. A Company .Partial Income Statement For the Year Ended December 31, Current Year Income from continuing operations before income taxes $ 12,300,000 Income tax expense (3,075,000) Income from continuing operations $ 9,225,000 Discontinued operations: Income tax expense ,650,000 Gain on sale of asset 2,300,000 (650,000) Income on discontinued operations Net income