Question: Prepare the problem below using Excel, Uplosd the workbook using the link. 1. (24 points) The trial balance of Winsor Corporation is reproduced below. The

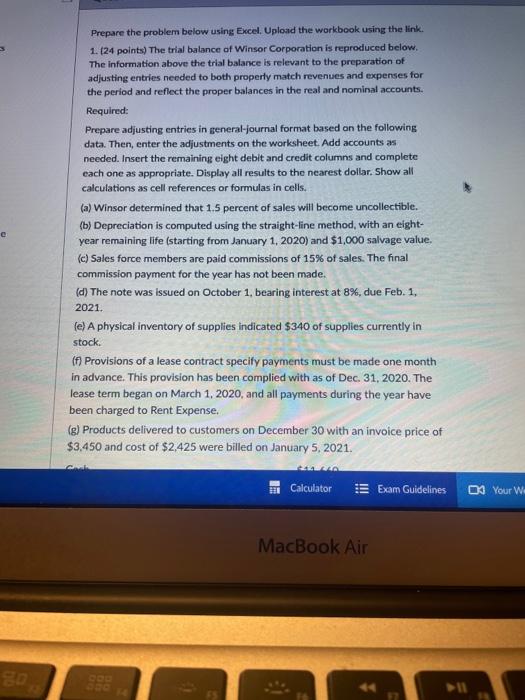

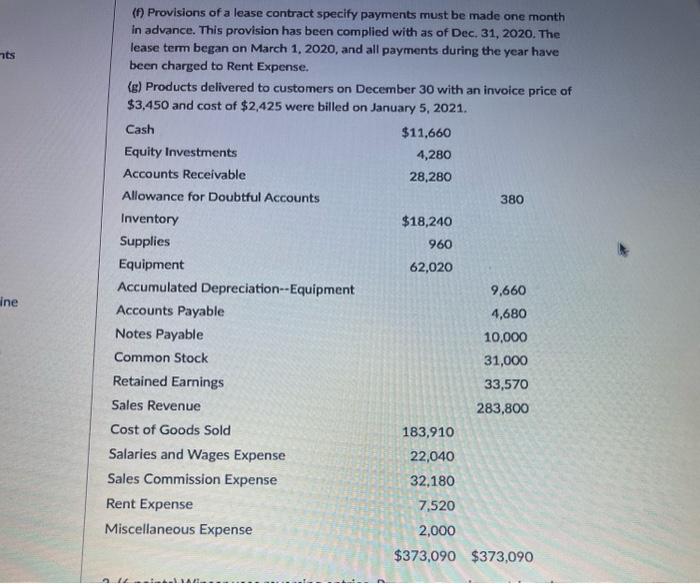

Prepare the problem below using Excel, Uplosd the workbook using the link. 1. (24 points) The trial balance of Winsor Corporation is reproduced below. The information above the trial balance is relevant to the preparation of adjusting entries necded to both property match revenues and expenses for the period and reflect the proper balances in the real and nominal accounts. Required: Prepare adjusting entries in general-journal format based on the following data. Then, enter the adjustments on the worksheet: Add accounts as needed. Insert the remaining eight debit and credit columns and complete each one as appropriate. Display all results to the nearest dollar. Show all calculations as cell references or formulas in cells. (a) Winsor determined that 1.5 percent of sales will become uncollectible. (b) Depreciation is computed using the straight-line method, with an eightyear remaining life (starting from January 1, 2020) and $1,000 salvage value. (c) Sales force members are paid commissions of 15% of sales. The final commission payment for the year has not been made. (d) The note was issued on October 1 , bearing interest at 8%, due Feb. 1 , 2021 (e) A physical inventory of supplies indicated $340 of supplies currently in stock. (f) Provisions of a lease contract specify payments must be made one month in advance. This provision has been complied with as of Dec, 31, 2020. The lease term began on March 1, 2020, and all payments during the year have been charged to Rent Expense. g) Products delivered to customers on December 30 with an invoice price of 3,450 and cost of $2,425 were billed on January 5,2021 . (f) Provisions of a lease contract specify payments must be made one month in advance. This provision has been complied with as of Dec, 31, 2020. The lease term began on March 1, 2020, and all payments during the year have been charged to Rent Expense. (g) Products delivered to customers on December 30 with an invoice price of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts