Question: Prepare the required adjusting entry for transactions ( a ) and ( b ) . Note: If no entry is required for a transaction /

Prepare the required adjusting entry for transactions a and b

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

A

B

Prepare the adjusting entry needed at December On March of the

current year, the company borrowed $ at a percent interest rate to

be repaid in five years.

Note: Enter debits before credits. Prepare the required adjusting entry for transactions a and b

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Prepare the adjusting entry needed at December On the last day of the

current year, the company received a $ utility bill for utilities used in

December. The bill will be paid in January of next year.

Note: Enter debits before credits.Elana's Traveling Veterinary Services, Incorporated, completed its first year of operations on December All of the year's entries hav

been recorded except for the following:

a On March of the current year, the company borrowed $ at a percent interest rate to be repaid in five years.

b On the last day of the current year, the company received a $ utility bill for utilities used in December. The bill will be paid in

January of next year.

Required:

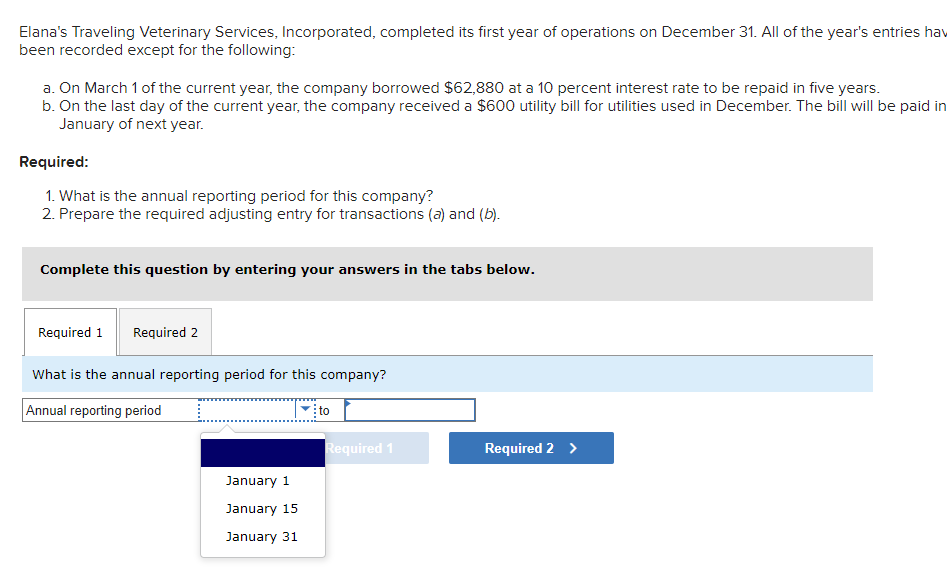

What is the annual reporting period for this company?

Prepare the required adjusting entry for transactions a and b

Complete this question by entering your answers in the tabs below.

What is the annual reporting period for this company?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock