Question: prepare the statement of cash flows using the indirect method Question 1 View Policies Current Attempt in Progress Shown below are comparative balance sheets for

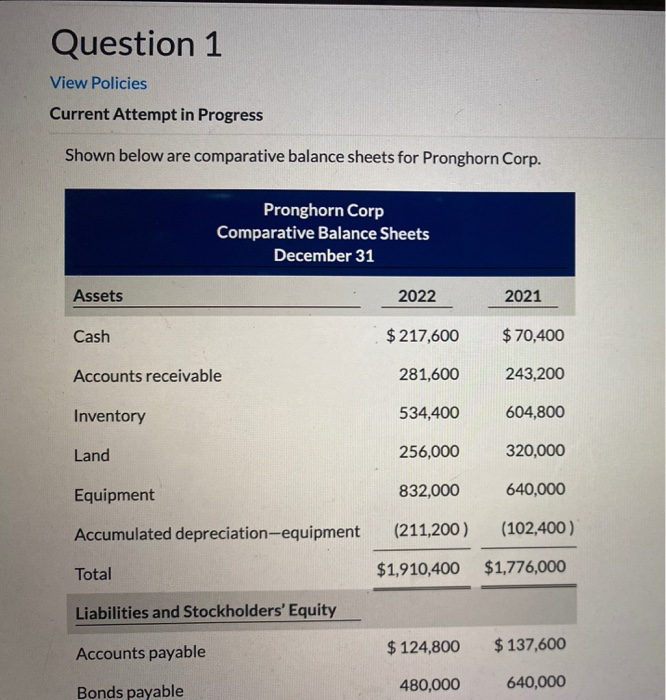

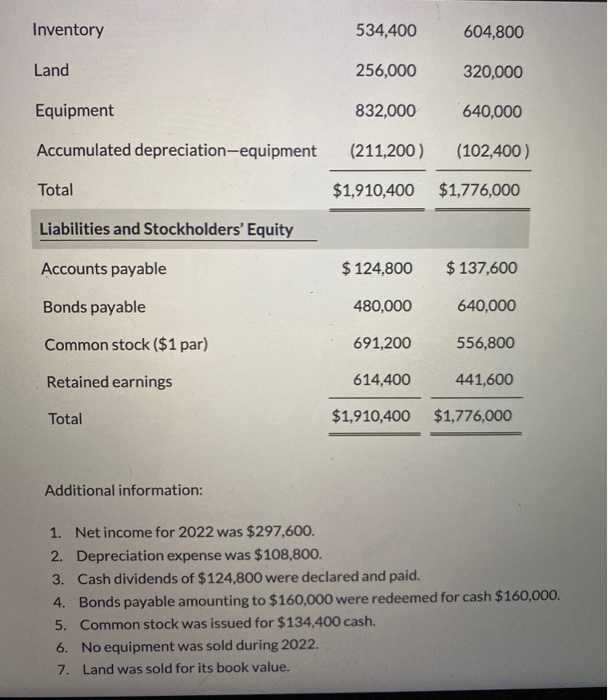

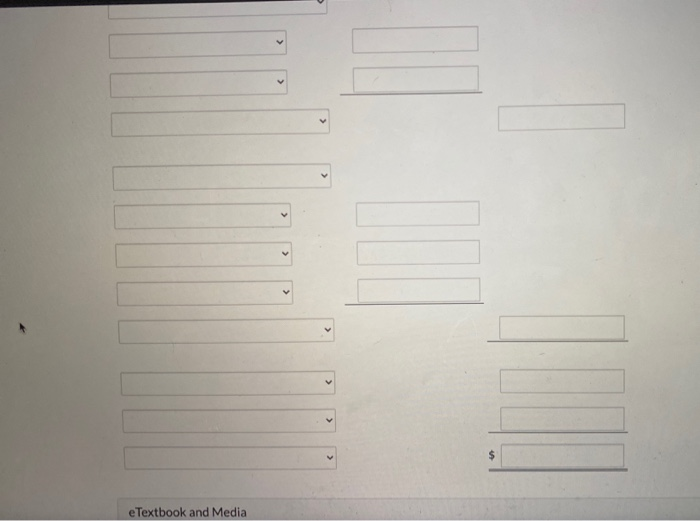

Question 1 View Policies Current Attempt in Progress Shown below are comparative balance sheets for Pronghorn Corp. Pronghorn Corp Comparative Balance Sheets December 31 Assets 2022 2021 Cash $ 217,600 $ 70,400 Accounts receivable 281,600 243,200 Inventory 534,400 604,800 Land 256,000 320,000 Equipment 832,000 640,000 Accumulated depreciation-equipment (211,200) (102,400) Total $1,910,400 $1,776,000 Liabilities and Stockholders' Equity $ 124,800 $ 137,600 Accounts payable 480,000 640,000 Bonds payable Inventory 534,400 604,800 Land 256,000 320,000 Equipment 832,000 640,000 Accumulated depreciation-equipment (211,200) (102,400) Total $1,910,400 $1,776,000 Liabilities and Stockholders' Equity Accounts payable $ 124,800 $ 137,600 Bonds payable 480,000 640,000 Common stock ($1 par) 691,200 556,800 Retained earnings 614,400 441,600 Total $1,910,400 $1,776,000 Additional information: 1. Net income for 2022 was $297,600. 2. Depreciation expense was $108,800. 3. Cash dividends of $124,800 were declared and paid. 4. Bonds payable amounting to $160,000 were redeemed for cash $160,000. 5. Common stock was issued for $134,400 cash. 6. No equipment was sold during 2022. 7. Land was sold for its book value. Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a - sigg. -45,000, or in parenthesis e.g. (45,000)). Pronghorn Corp Statement of Cash Flows Adjustments to reconcile net income to $ C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts