Question: Prepare the worksheet adjustments for the December 3 1 , 2 0 2 4 , consolidation of Corgan and Smashing. Note: If no entry is

Prepare the worksheet adjustments for the December consolidation of Corgan and Smashing.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

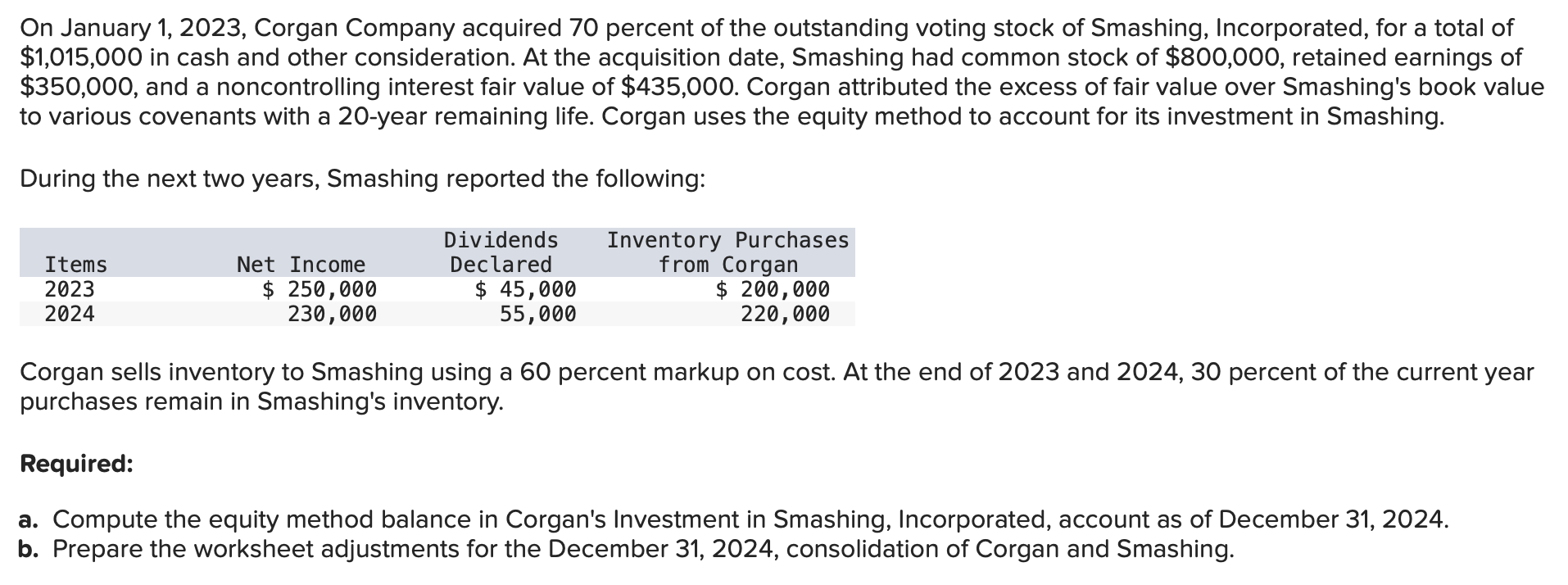

tableNoTransaction,Accounts,Debit,CreditInvestment in Smashing,,Cost of goods sold,,SCommon stock Smashing,,Retained earnings Smashing,,Investment in Smashing,,Noncontrolling interest,,ACovenants,,Investment in Smashing,,Noncontrolling interest,,I,Equity in earnings of Smashing,,Investment in Smashing,,DInvestment in Smashing,,Dividends declared,,EAmortization expense,,Noncontrolling interest times Covenants times TISales,,Cost of goods sold,,GNo Transaction Recorded,,On January Corgan Company acquired percent of the outstanding voting stock of Smashing, Incorporated, for a total of

$ in cash and other consideration. At the acquisition date, Smashing had common stock of $ retained earnings of

$ and a noncontrolling interest fair value of $ Corgan attributed the excess of fair value over Smashing's book value

to various covenants with a year remaining life. Corgan uses the equity method to account for its investment in Smashing.

During the next two years, Smashing reported the following:

Corgan sells inventory to Smashing using a percent markup on cost At the end of and percent of the current year

purchases remain in Smashing's inventory.

Required:

a Compute the equity method balance in Corgan's Investment in Smashing, Incorporated, account as of December

b Prepare the worksheet adjustments for the December consolidation of Corgan and Smashing.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock