Question: Prepare the worksheet (WP-2) for year-end procedures Suggested steps are as follows: a. Complete the chart of accounts that is provided for Veggies-R-Us. (page 5

Prepare the worksheet (WP-2) for year-end procedures

Suggested steps are as follows:

a. Complete the chart of accounts that is provided for Veggies-R-Us. (page 5 of these instructions), i.e., state whether each account is an asset, liability, shareholders equity, revenue, or expense account.

b. Transfer the account names from the chart of accounts, (page 5 of these instructions) to the worksheet that is provided (WP-2). Make sure that you list all of these accounts on the worksheet (even if they dont currently have balances) and make sure that you list them in the order that they are listed on the chart of accounts.

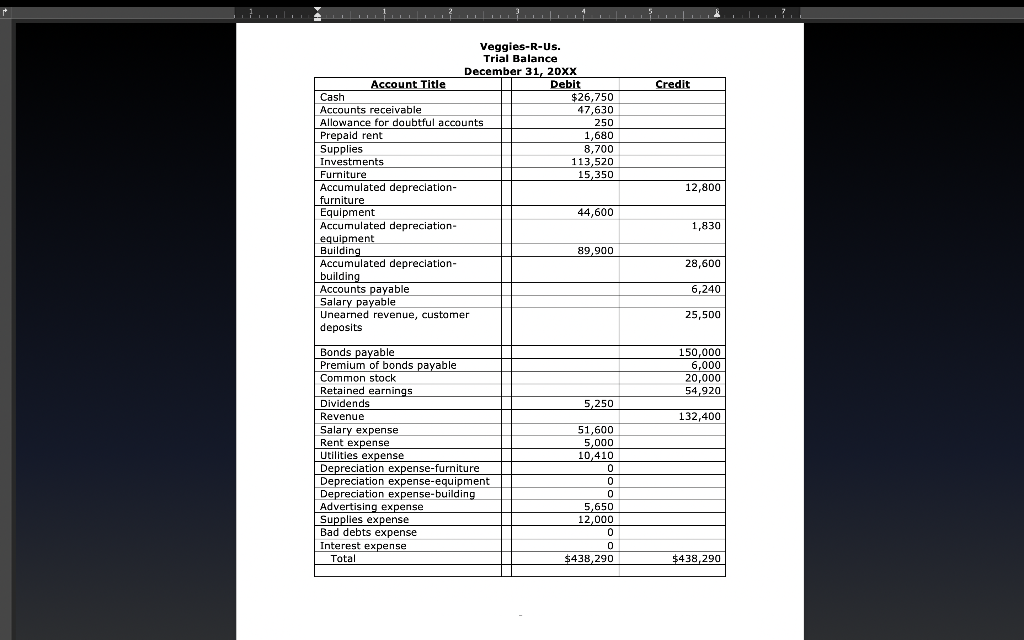

c. Transfer the balances that you have from your general ledger (completed in step #1) to the worksheet started in step 2.a. [Check figures are debit/credit = $438,290]

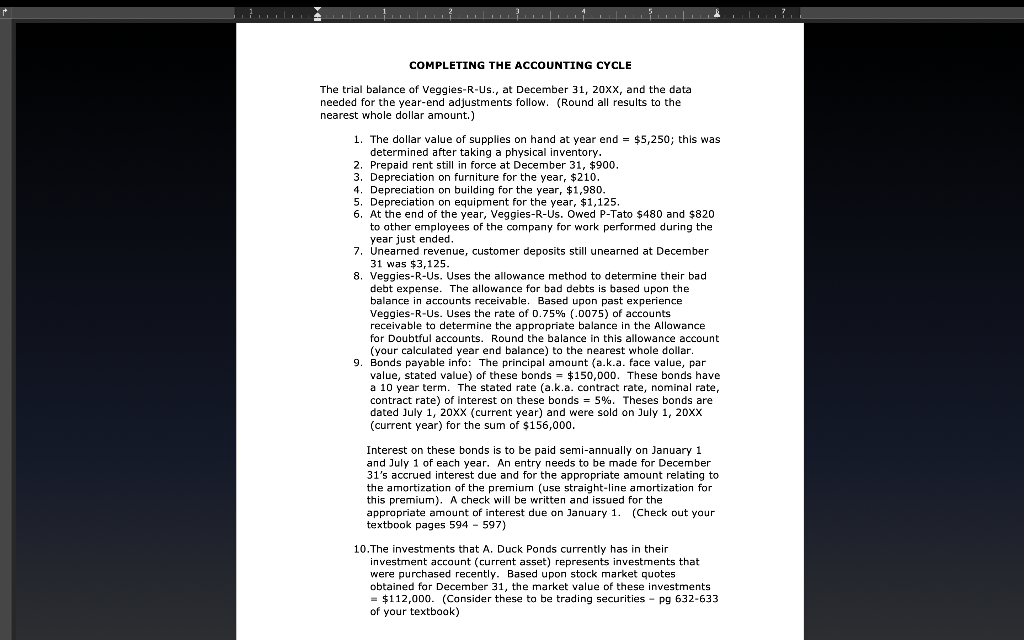

COMPLETING THE ACCOUNTING CYCLE The trial balance of Veggies-R-Us., at December 31, 20xx, and the data needed for the year-end adjustments follow. (Round all results to the nearest whole dollar amount.) 1. The dollar value of supplies on hand at year end = $5,250; this was determined after taking a physical inventory. 2. Prepaid rent still in force at December 31, $900. 3. Depreciation on furniture for the year, $210. 4. Depreciation on building for the year, $1,980. 5. Depreciation on equipment for the year, $1,125. 6. At the end of the year, Veggies-R-Us. Owed P-Tato $480 and $820 to other employees of the company for work performed during the year just ended. 7. Unearned revenue, customer deposits still unearned at December 31 was $3,125. 8. Veggies-R-Us. Uses the allowance method to determine their bad debt expense. The allowance for bad debts is based upon the balance in accounts receivable. Based upon past experience Veggies-R-Us. Uses the rate of 0.75% (.0075) of accounts receivable to determine the appropriate balance in the Allowance for Doubtful accounts. Round the balance in this allowance account (your calculated year end balance) to the nearest whole dollar. 9. Bonds payable info: The principal amount (a.k.a. face value, par value, stated value) of these bonds = $150,000. These bonds have a 10 year term. The stated rate (a.k.a. contract rate, nominal rate, contract rate) of interest on these bonds = 5%. Theses bonds are dated July 1, 20XX (current year) and were sold on July 1, 20XX (current year) for the sum of $156,000. Interest on these bonds is to be paid semi-annually on January 1 and July 1 of each year. An entry needs to be made for December 31's accrued interest due and for the appropriate amount relating to the amortization of the premium (use straight-line amortization for this premium). A check will be written and issued for the appropriate amount of interest due on January 1. (Check out your textbook pages 594 - 597) 10. The investments that A. Duck Ponds currently has in their investment account (current asset) represents investments that were purchased recently. Based upon stock market quotes obtained for December 31, the market value of these investments = $112,000. (Consider these to be trading securities - pg 632-633 of your textbook) COMPLETING THE ACCOUNTING CYCLE The trial balance of Veggies-R-Us., at December 31, 20xx, and the data needed for the year-end adjustments follow. (Round all results to the nearest whole dollar amount.) 1. The dollar value of supplies on hand at year end = $5,250; this was determined after taking a physical inventory. 2. Prepaid rent still in force at December 31, $900. 3. Depreciation on furniture for the year, $210. 4. Depreciation on building for the year, $1,980. 5. Depreciation on equipment for the year, $1,125. 6. At the end of the year, Veggies-R-Us. Owed P-Tato $480 and $820 to other employees of the company for work performed during the year just ended. 7. Unearned revenue, customer deposits still unearned at December 31 was $3,125. 8. Veggies-R-Us. Uses the allowance method to determine their bad debt expense. The allowance for bad debts is based upon the balance in accounts receivable. Based upon past experience Veggies-R-Us. Uses the rate of 0.75% (.0075) of accounts receivable to determine the appropriate balance in the Allowance for Doubtful accounts. Round the balance in this allowance account (your calculated year end balance) to the nearest whole dollar. 9. Bonds payable info: The principal amount (a.k.a. face value, par value, stated value) of these bonds = $150,000. These bonds have a 10 year term. The stated rate (a.k.a. contract rate, nominal rate, contract rate) of interest on these bonds = 5%. Theses bonds are dated July 1, 20XX (current year) and were sold on July 1, 20XX (current year) for the sum of $156,000. Interest on these bonds is to be paid semi-annually on January 1 and July 1 of each year. An entry needs to be made for December 31's accrued interest due and for the appropriate amount relating to the amortization of the premium (use straight-line amortization for this premium). A check will be written and issued for the appropriate amount of interest due on January 1. (Check out your textbook pages 594 - 597) 10. The investments that A. Duck Ponds currently has in their investment account (current asset) represents investments that were purchased recently. Based upon stock market quotes obtained for December 31, the market value of these investments = $112,000. (Consider these to be trading securities - pg 632-633 of your textbook)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts