Question: Prepare three different tranfer prices on a per unit basis and total basis for prabh to consider Exhibit 7-More Problems in Candy Prab is having

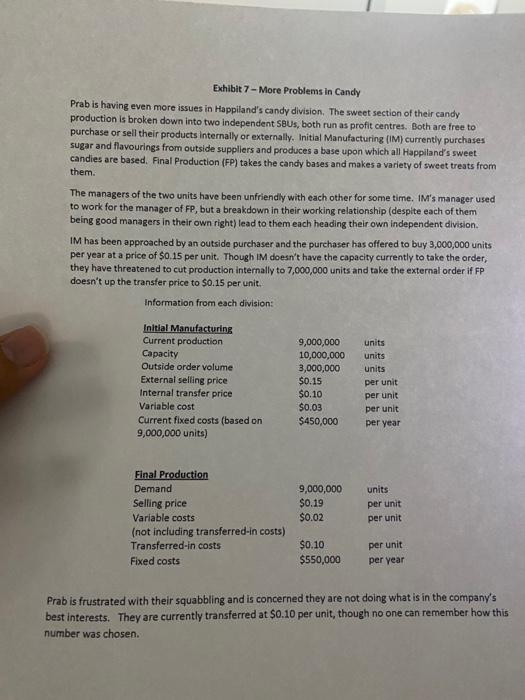

Exhibit 7-More Problems in Candy Prab is having even more issues in Happiland's candy division. The sweet section of their candy production is broken down into two independent Seus, both run as profit centres. Both are free to purchase or sell their products Internally or externally. Initial Manufacturing (IM) currently purchases sugar and flavourings from outside suppliers and produces a base upon which all Happiland's sweet candies are based. Final Production (FP) takes the candy bases and makes a variety of sweet treats from them. The managers of the two units have been unfriendly with each other for some time. IM's manager used to work for the manager of FP, but a breakdown in their working relationship (despite each of them being good managers in their own right) lead to them each heading their own independent division. IM has been approached by an outside purchaser and the purchaser has offered to buy 3,000,000 units per year at a price of $0.15 per unit. Though IM doesn't have the capacity currently to take the order, they have threatened to cut production internally to 7,000,000 units and take the external order if FP doesn't up the transfer price to $0.15 per unit. Information from each division: Initial Manufacturing Current production Capacity Outside order volume External selling price Internal transfer price Variable cost Current fixed costs (based on 9,000,000 units) 9,000,000 10,000,000 3,000,000 $0.15 $0.10 $0.03 $450,000 units units units per unit per unit per unit per year Final Production Demand Selling price Variable costs (not including transferred-in costs) Transferred-in costs Fixed costs 9,000,000 $0.19 $0.02 units per unit per unit per unit $0.10 $550,000 per year Prab is frustrated with their squabbling and is concerned they are not doing what is in the company's best interests. They are currently transferred at $0.10 per unit, though no one can remember how this number was chosen. Exhibit 7-More Problems in Candy Prab is having even more issues in Happiland's candy division. The sweet section of their candy production is broken down into two independent Seus, both run as profit centres. Both are free to purchase or sell their products Internally or externally. Initial Manufacturing (IM) currently purchases sugar and flavourings from outside suppliers and produces a base upon which all Happiland's sweet candies are based. Final Production (FP) takes the candy bases and makes a variety of sweet treats from them. The managers of the two units have been unfriendly with each other for some time. IM's manager used to work for the manager of FP, but a breakdown in their working relationship (despite each of them being good managers in their own right) lead to them each heading their own independent division. IM has been approached by an outside purchaser and the purchaser has offered to buy 3,000,000 units per year at a price of $0.15 per unit. Though IM doesn't have the capacity currently to take the order, they have threatened to cut production internally to 7,000,000 units and take the external order if FP doesn't up the transfer price to $0.15 per unit. Information from each division: Initial Manufacturing Current production Capacity Outside order volume External selling price Internal transfer price Variable cost Current fixed costs (based on 9,000,000 units) 9,000,000 10,000,000 3,000,000 $0.15 $0.10 $0.03 $450,000 units units units per unit per unit per unit per year Final Production Demand Selling price Variable costs (not including transferred-in costs) Transferred-in costs Fixed costs 9,000,000 $0.19 $0.02 units per unit per unit per unit $0.10 $550,000 per year Prab is frustrated with their squabbling and is concerned they are not doing what is in the company's best interests. They are currently transferred at $0.10 per unit, though no one can remember how this number was chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts