Question: Prepare two (2) budgetary control statements for the planning and development department for the period ended 30 September 2021, showing variances between the budget and

Prepare two (2) budgetary control statements for the planning and development department for the period ended 30 September 2021, showing variances between the budget and actual costs, using the following:

i. Traditional overhead-based analysis

ii. Activity-based analysis

By using the most appropriate cost drivers, based on budgeted costs, calculate the attributable overheads for Division 1 and Division 2. (Figures are to be stated to the nearest round number).

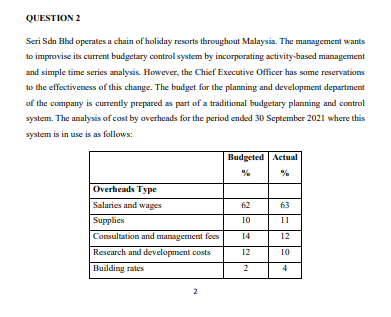

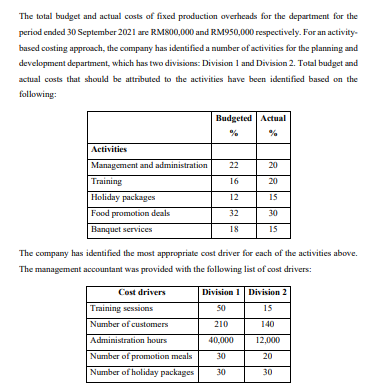

QUESTION 2 Seri Sdn Bhd operates a chain of holiday resorts throughout Malaysia. The management wants to improvise its current budgetary control system by incorporating activity-based management and simple time series analysis. However, the Chief Executive Officer has some reservations to the effectiveness of this change. The budget for the planning and development department of the company is currently prepared as part of a traditional budgetary planning and control system. The analysis of cast by averheads for the period ended 30 September 2021 where this system is in use is as follows: Budgeted Actual % 62 63 10 11 Overheads Type Salaries and wages Supplies Consultation and management fees Research and development costs Building rates 14 12 10 12 2 2 The total budget and actual costs of fixed production overheads for the department for the period ended 30 September 2021 are RM800,000 and RM950,000 respectively. For an activity based costing approach, the company has identified a number of activities for the planning and development department, which has two divisions: Division 1 and Division 2. Total budget and actual costs that should be attributed to the activities have been identified based on the following: Budgeted Actual 22 20 16 20 Activities Management and administration Training Holiday packages Food promotion deals Banquet services 12 15 32 30 18 15 The company has identified the most appropriate cost driver for each of the activities above. The management accountant was provided with the following list of cost drivers: Division 1 Division 2 SO 15 210 140 Cost drivers Training sessions Number of customers Administration hours Number of promotion meals Number of holiday packages 40,000 30 12.000 20 30 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts