Question: Prepare using 2020 tax forms 1. Prepare a MI 1040 for Donald (bd 3-3-1949) and Sandra Earle (bd 4-11-1955), ages 71 and 65 respectively. They

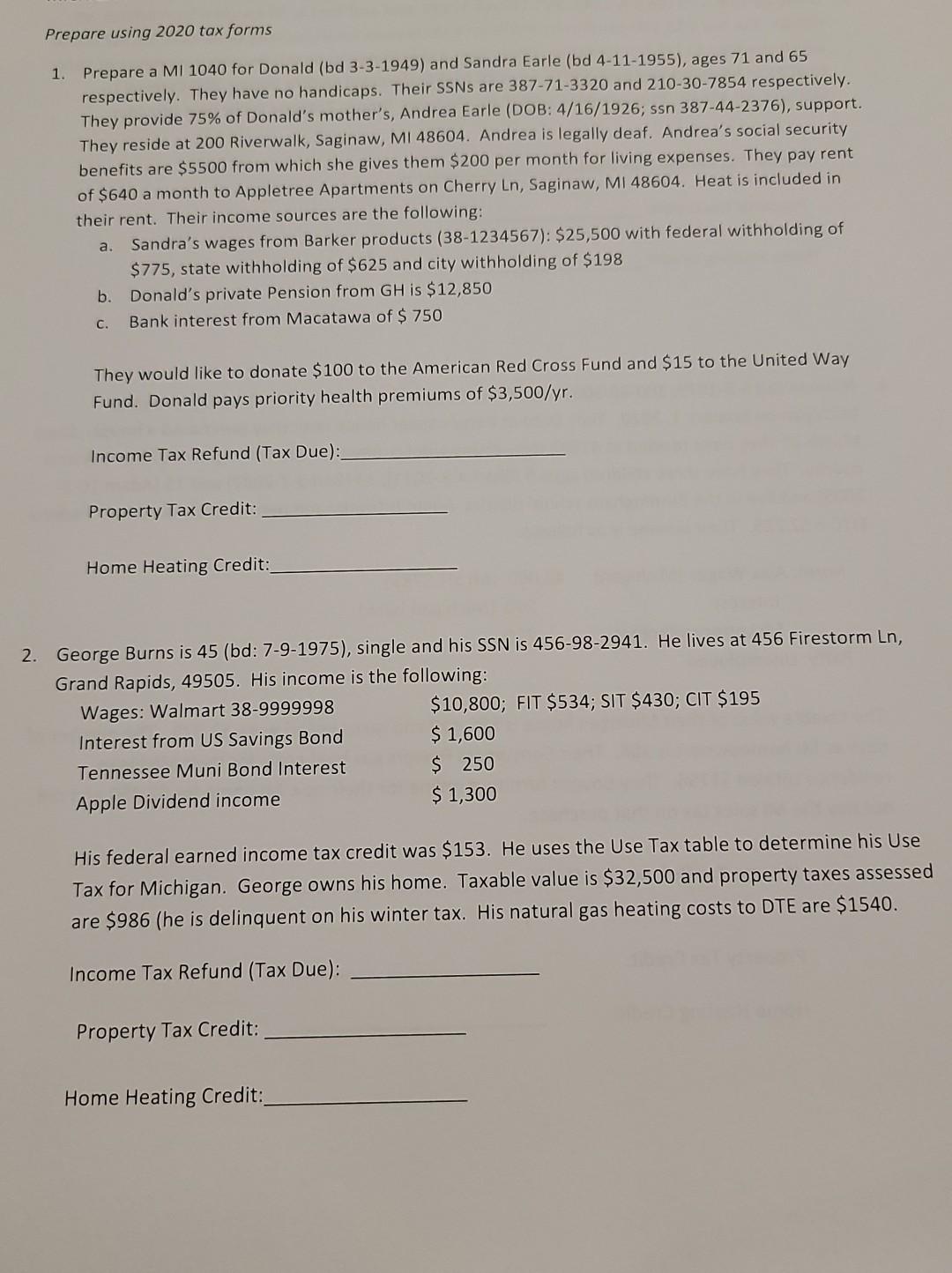

Prepare using 2020 tax forms 1. Prepare a MI 1040 for Donald (bd 3-3-1949) and Sandra Earle (bd 4-11-1955), ages 71 and 65 respectively. They have no handicaps. Their SSNs are 387-71-3320 and 210-30-7854 respectively. They provide 75% of Donald's mother's, Andrea Earle (DOB: 4/16/1926; ssn 387-44-2376), support. They reside at 200 Riverwalk, Saginaw, MI 48604. Andrea is legally deaf. Andrea's social security benefits are $5500 from which she gives them $200 per month for living expenses. They pay rent of $640 a month to Appletree Apartments on Cherry Ln, Saginaw, MI 48604. Heat is included in their rent. Their income sources are the following: a. Sandra's wages from Barker products (38-1234567): $25,500 with federal withholding of $775, state withholding of $625 and city withholding of $198 b. Donald's private Pension from GH is $12,850 Bank interest from Macatawa of $ 750 C. They would like to donate $100 to the American Red Cross Fund and $15 to the United Way Fund. Donald pays priority health premiums of $3,500/yr. Income Tax Refund (Tax Due): Property Tax Credit: Home Heating Credit: 2. George Burns is 45 (bd: 7-9-1975), single and his SSN is 456-98-2941. He lives at 456 Firestorm Ln, Grand Rapids, 49505. His income is the following: Wages: Walmart 38-9999998 $10,800; FIT $534; SIT $430; CIT $195 Interest from US Savings Bond $ 1,600 Tennessee Muni Bond Interest $ 250 Apple Dividend income $ 1,300 His federal earned income tax credit was $153. He uses the Use Tax table to determine his Use Tax for Michigan. George owns his home. Taxable value is $32,500 and property taxes assessed are $986 (he is delinquent on his winter tax. His natural gas heating costs to DTE are $1540. Income Tax Refund (Tax Due): Property Tax Credit: Home Heating Credit: Prepare using 2020 tax forms 1. Prepare a MI 1040 for Donald (bd 3-3-1949) and Sandra Earle (bd 4-11-1955), ages 71 and 65 respectively. They have no handicaps. Their SSNs are 387-71-3320 and 210-30-7854 respectively. They provide 75% of Donald's mother's, Andrea Earle (DOB: 4/16/1926; ssn 387-44-2376), support. They reside at 200 Riverwalk, Saginaw, MI 48604. Andrea is legally deaf. Andrea's social security benefits are $5500 from which she gives them $200 per month for living expenses. They pay rent of $640 a month to Appletree Apartments on Cherry Ln, Saginaw, MI 48604. Heat is included in their rent. Their income sources are the following: a. Sandra's wages from Barker products (38-1234567): $25,500 with federal withholding of $775, state withholding of $625 and city withholding of $198 b. Donald's private Pension from GH is $12,850 Bank interest from Macatawa of $ 750 C. They would like to donate $100 to the American Red Cross Fund and $15 to the United Way Fund. Donald pays priority health premiums of $3,500/yr. Income Tax Refund (Tax Due): Property Tax Credit: Home Heating Credit: 2. George Burns is 45 (bd: 7-9-1975), single and his SSN is 456-98-2941. He lives at 456 Firestorm Ln, Grand Rapids, 49505. His income is the following: Wages: Walmart 38-9999998 $10,800; FIT $534; SIT $430; CIT $195 Interest from US Savings Bond $ 1,600 Tennessee Muni Bond Interest $ 250 Apple Dividend income $ 1,300 His federal earned income tax credit was $153. He uses the Use Tax table to determine his Use Tax for Michigan. George owns his home. Taxable value is $32,500 and property taxes assessed are $986 (he is delinquent on his winter tax. His natural gas heating costs to DTE are $1540. Income Tax Refund (Tax Due): Property Tax Credit: Home Heating Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts