Question: prepare wellingtons funds flow statement and explain why the company encountered an increasingly strained capital position RATIO ANALYSIS WELLINGTON AIRLINES is the new treasurer of

prepare wellingtons funds flow statement and explain why the company encountered an increasingly strained capital position

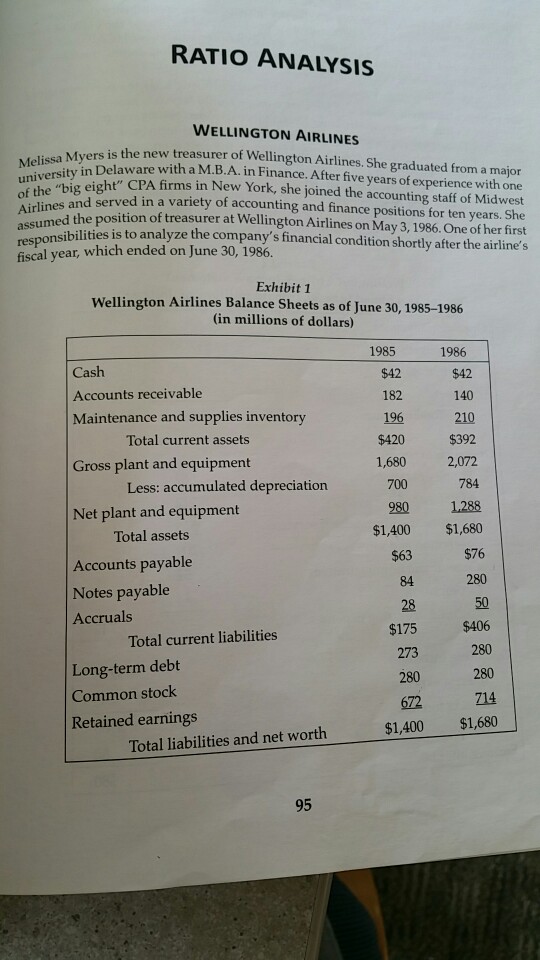

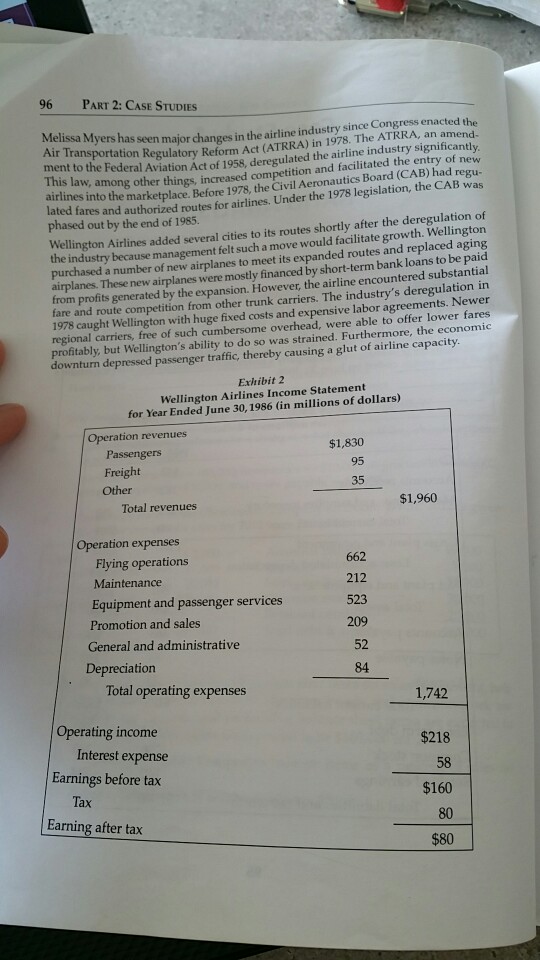

RATIO ANALYSIS WELLINGTON AIRLINES is the new treasurer of Wellington Airlines. She graduated from a major Delaware with a M.B.A. in Finance. After five years of experience with one t" CPA firms in New York, she joined the accounting staff of Midwest of theand served in a variety of accounting and finance positions for ten years. She he position of treasurer at Wellington Airlines on May 3, 1986. One of her first sibilities is to analyze the company's financial condition shortly after the airline's versity in uni assumed t respons fiscal year, which ended on June 30, 1986. Exhibit 1 Wellington Airlines Balance Sheets as of June 30, 1985-1986 (in millions of dollars) 1985 1986 Cash Accounts receivable Maintenance and supplies inventory 182 140 $392 $420 1,680 Total current assets Gross plant and equipment 2,072 Less: accumulated depreciation 980 1.288 $1,400 $1,680 $76 Net plant and equipment Total assets Accounts payable Notes payable Accruals $175 273 $406 280 Total current liabilities Long-term debt Common stock Retained earnings 672 714 $1,400 $1,680 Total liabilities and net worth 95 RATIO ANALYSIS WELLINGTON AIRLINES is the new treasurer of Wellington Airlines. She graduated from a major Delaware with a M.B.A. in Finance. After five years of experience with one t" CPA firms in New York, she joined the accounting staff of Midwest of theand served in a variety of accounting and finance positions for ten years. She he position of treasurer at Wellington Airlines on May 3, 1986. One of her first sibilities is to analyze the company's financial condition shortly after the airline's versity in uni assumed t respons fiscal year, which ended on June 30, 1986. Exhibit 1 Wellington Airlines Balance Sheets as of June 30, 1985-1986 (in millions of dollars) 1985 1986 Cash Accounts receivable Maintenance and supplies inventory 182 140 $392 $420 1,680 Total current assets Gross plant and equipment 2,072 Less: accumulated depreciation 980 1.288 $1,400 $1,680 $76 Net plant and equipment Total assets Accounts payable Notes payable Accruals $175 273 $406 280 Total current liabilities Long-term debt Common stock Retained earnings 672 714 $1,400 $1,680 Total liabilities and net worth 95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts