Question: Preparing a cash budget Step 1 : Determining cash inflows from operations Projected sales revenue: December $ 9 0 , 0 0 0 ( end

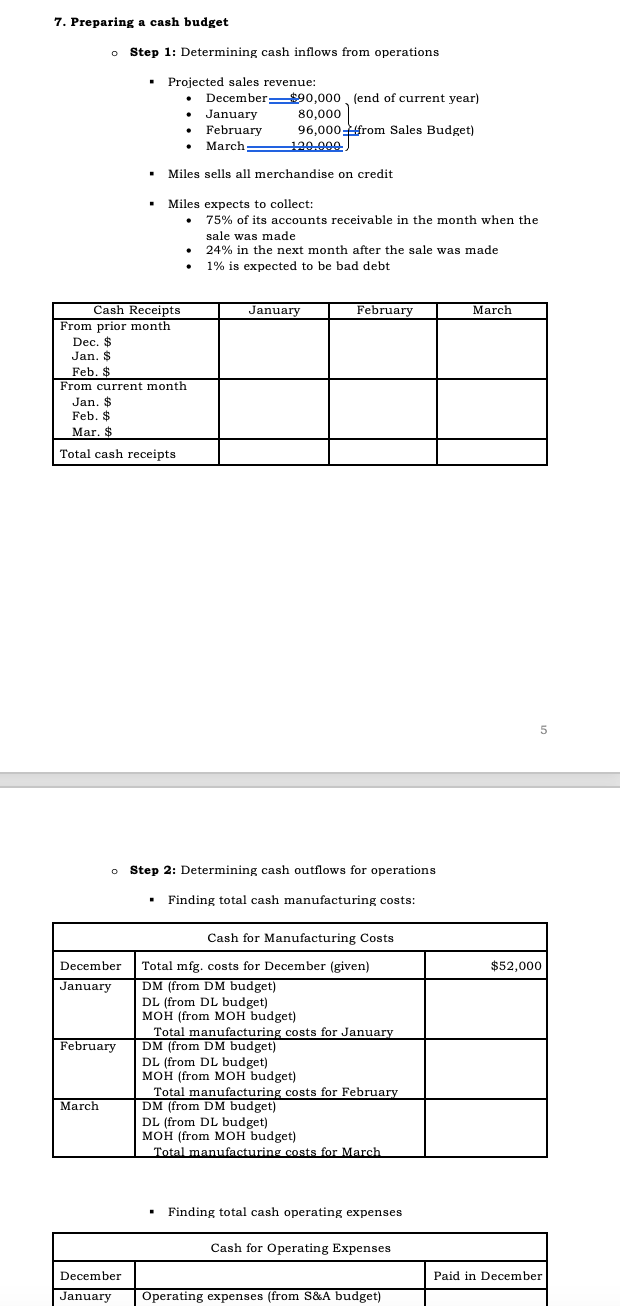

Preparing a cash budget

Step : Determining cash inflows from operations

Projected sales revenue:

December $end of current year

January

February ffrom Sales Budget

March

Miles sells all merchandise on credit

Miles expects to collect:

of its accounts receivable in the month when the

sale was made

in the next month after the sale was made

is expected to be bad debt

Step : Determining cash outflows for operations

Finding total cash manufacturing costs:

Finding total cash operating expenses Cash for Operating Expenses

December Paid in December

January Operating expenses from S&A budget

Less: Depreciation

Total cash operating expenses for January

February Operating expenses from S&A budget

Less: Depreciation

Total cash operating expenses for February

March Operating expenses from S&A budget

Less: Depreciation

Total cash operating expenses for March

Finding total cash outflows for operations

Miles pays of its manufacturing. costs in the month incurred, and the rest the following month

The firm expects to have $ of manufacturing costs in December of the previous year

The firms $ depreciationmonth is a noncash operating expense

All other operating expenses are paid in the month when they are incurred

Cash Payments January February March

Manufacturing costs

Paid for last month:

Dec. $

Jan. $

Feb. $

Paid for this month:

Jan. $

Feb. $

Mar. $

Operating expenses paid

Total payments

o Step : Determining other cash flows and preparing a budgeted statement of cash flows

Miles plans to buy new equipment for $ during Q of next year

Miles expects to pay its regular quarterly dividend of $ and to retire $ of bonds during Q

The firm wants to have $ in the bank at all times to meet its cash needs

Miles Manufacturing

Budgeted Statement of Cash Flows

For the quarter ending March XX

Cash Flows from Operating Activities

Cash inflows from customers

$ Jan $ Feb $ March

Cash outflows for expenses Sum of Jan.March

$ Jan $ Feb $ March

Net cash flows from operating activities

Cash Flows from Investing Activities

Purchase of equipment

Cash Flows from Financing Activities

Payment of dividends

Retirement of bonds

Net cash flows from financing activities

Net change in cash

Cash balance, January

Cash balance, March

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock