Question: Preparing a Cash Budget with Supporting Schedules using Excel's Multi-Tab Cell Referencing and Basic Math Functions S&P Enterprises has provided data from the first three

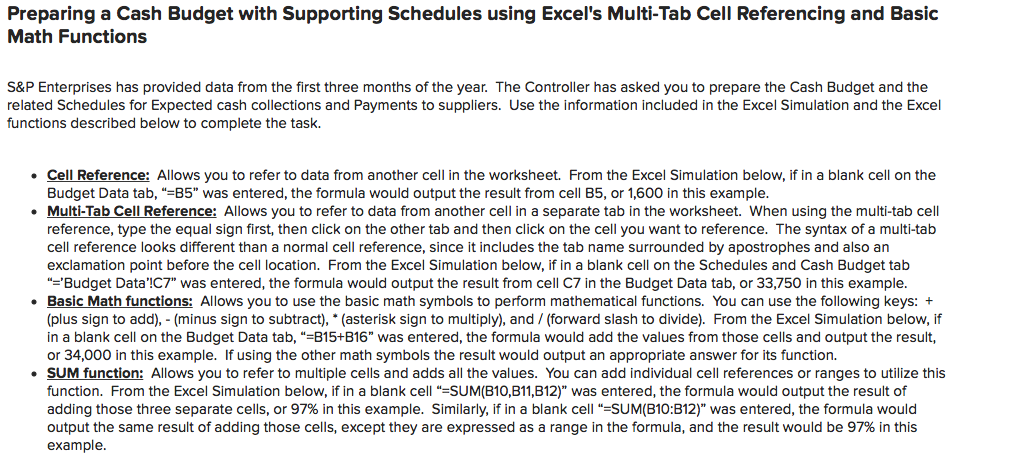

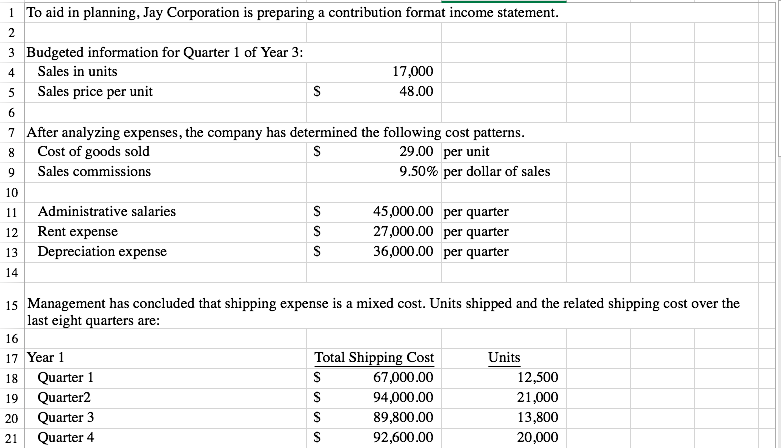

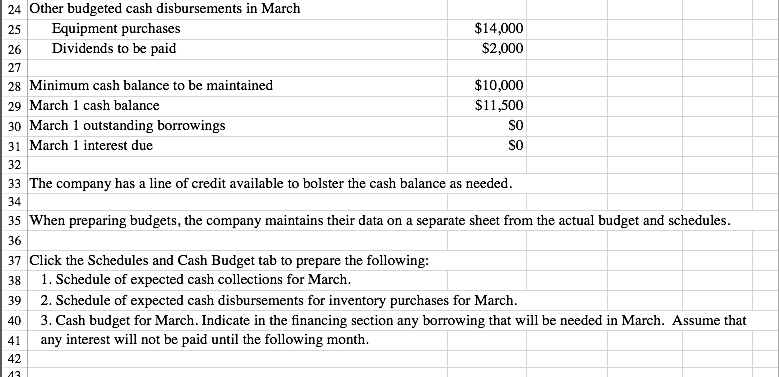

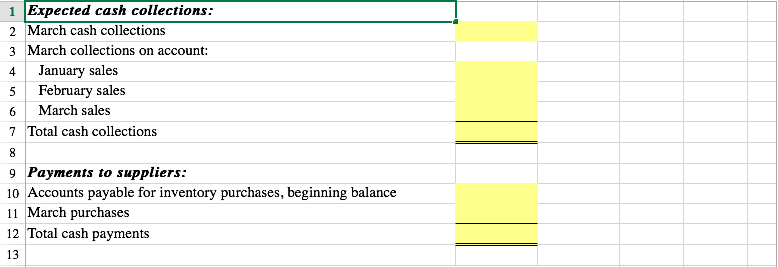

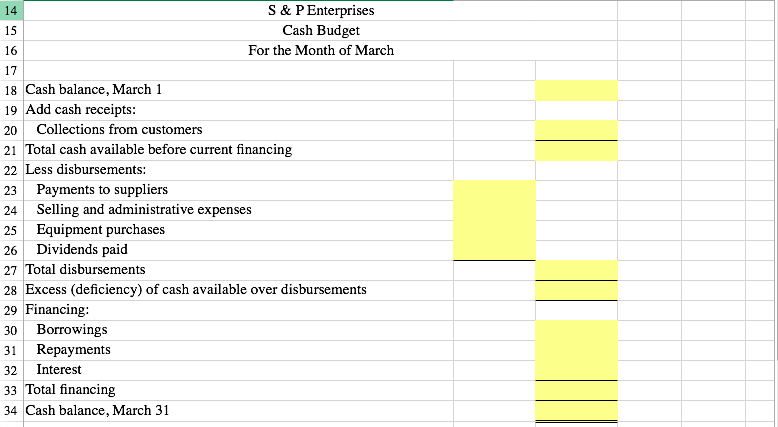

Preparing a Cash Budget with Supporting Schedules using Excel's Multi-Tab Cell Referencing and Basic Math Functions S&P Enterprises has provided data from the first three months of the year. The Controller has asked you to prepare the Cash Budget and the related Schedules for Expected cash collections and Payments to suppliers. Use the information included in the Excel Simulation and the Excel functions described below to complete the task. Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell on the Budget Data tab, "=B5" was entered, the formula would output the result from cell B5, or 1,600 in this example. Multi-Tab Cell Reference: Allows you to refer to data from another cell in a separate tab in the worksheet. When using the multi-tab cell reference, type the equal sign first, then click on the other tab and then click on the cell you want to reference. The syntax of a multi-tab cell reference looks different than a normal cell reference, since it includes the tab name surrounded by apostrophes and also an exclamation point before the cell location. From the Excel Simulation below, if in a blank cell on the Schedules and Cash Budget tab "='Budget Data'!C7" was entered, the formula would output the result from cell C7 in the Budget Data tab, or 33,750 in this example. Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), * (asterisk sign to multiply), and / (forward slash to divide). From the Excel Simulation below, if in a blank cell on the Budget Data tab, "=B15+B16" was entered, the formula would add the values from those cells and output the result, or 34,000 in this example. If using the other math symbols the result would output an appropriate answer for its function. SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. From the Excel Simulation below, if in a blank cell"=SUM(B10,111,112)" was entered, the formula would output the result of adding those three separate cells, or 97% in this example. Similarly, if in a blank cell"=SUM(B10:B12)" was entered, the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 97% in this example. 1 To aid in planning, Jay Corporation is preparing a contribution format income statement. 2 4 5 3 Budgeted information for Quarter 1 of Year 3: Sales in units 17,000 Sales price per unit S 48.00 6 7 After analyzing expenses, the company has determined the following cost patterns. Cost of goods sold S 29.00 per unit Sales commissions 9.50% per dollar of sales 10 Administrative salaries S 45,000.00 per quarter Rent expense S 27,000.00 per quarter Depreciation expense S 36,000.00 per quarter 8 9 11 12 13 14 15 Management has concluded that shipping expense is a mixed cost. Units shipped and the related shipping cost over the last eight quarters are: 16 17 Year 1 Total Shipping Cost Units 18 Quarter 1 S 67,000.00 12,500 19 Quarter2 S 94,000.00 21,000 20 Quarter 3 S 89,800.00 13,800 21 Quarter 4 S 92,600.00 20,000 24 Other budgeted cash disbursements in March 25 Equipment purchases 26 Dividends to be paid $14,000 $2,000 27 28 Minimum cash balance to be maintained $10,000 29 March 1 cash balance $11,500 30 March 1 outstanding borrowings SO 31 March 1 interest due SO 32 33 The company has a line of credit available to bolster the cash balance as needed. 34 35 When preparing budgets, the company maintains their data on a separate sheet from the actual budget and schedules. 36 38 39 37 Click the Schedules and Cash Budget tab to prepare the following: 1. Schedule of expected cash collections for March. 2. Schedule of expected cash disbursements for inventory purchases for March. 40 3. Cash budget for March. Indicate in the financing section any borrowing that will be needed in March. Assume that any interest will not be paid until the following month. 41 42 13 1 Expected cash collections: 2 March cash collections 3 March collections on account: 4 January sales 5 February sales 6 March sales 7 Total cash collections 8 9 Payments to suppliers: 10 Accounts payable for inventory purchases, beginning balance 11 March purchases 12 Total cash payments 13 14 S & P Enterprises 15 Cash Budget 16 For the Month of March 17 18 Cash balance, March 1 19 Add cash receipts: 20 Collections from customers 21 Total cash available before current financing 22 Less disbursements: 23 Payments to suppliers 24 Selling and administrative expenses 25 Equipment purchases Dividends paid 27 Total disbursements 28 Excess (deficiency) of cash available over disbursements 29 Financing: 30 Borrowings 31 Repayments 32 Interest 33 Total financing 34 Cash balance, March 31 26 Preparing a Cash Budget with Supporting Schedules using Excel's Multi-Tab Cell Referencing and Basic Math Functions S&P Enterprises has provided data from the first three months of the year. The Controller has asked you to prepare the Cash Budget and the related Schedules for Expected cash collections and Payments to suppliers. Use the information included in the Excel Simulation and the Excel functions described below to complete the task. Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell on the Budget Data tab, "=B5" was entered, the formula would output the result from cell B5, or 1,600 in this example. Multi-Tab Cell Reference: Allows you to refer to data from another cell in a separate tab in the worksheet. When using the multi-tab cell reference, type the equal sign first, then click on the other tab and then click on the cell you want to reference. The syntax of a multi-tab cell reference looks different than a normal cell reference, since it includes the tab name surrounded by apostrophes and also an exclamation point before the cell location. From the Excel Simulation below, if in a blank cell on the Schedules and Cash Budget tab "='Budget Data'!C7" was entered, the formula would output the result from cell C7 in the Budget Data tab, or 33,750 in this example. Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), * (asterisk sign to multiply), and / (forward slash to divide). From the Excel Simulation below, if in a blank cell on the Budget Data tab, "=B15+B16" was entered, the formula would add the values from those cells and output the result, or 34,000 in this example. If using the other math symbols the result would output an appropriate answer for its function. SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. From the Excel Simulation below, if in a blank cell"=SUM(B10,111,112)" was entered, the formula would output the result of adding those three separate cells, or 97% in this example. Similarly, if in a blank cell"=SUM(B10:B12)" was entered, the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 97% in this example. 1 To aid in planning, Jay Corporation is preparing a contribution format income statement. 2 4 5 3 Budgeted information for Quarter 1 of Year 3: Sales in units 17,000 Sales price per unit S 48.00 6 7 After analyzing expenses, the company has determined the following cost patterns. Cost of goods sold S 29.00 per unit Sales commissions 9.50% per dollar of sales 10 Administrative salaries S 45,000.00 per quarter Rent expense S 27,000.00 per quarter Depreciation expense S 36,000.00 per quarter 8 9 11 12 13 14 15 Management has concluded that shipping expense is a mixed cost. Units shipped and the related shipping cost over the last eight quarters are: 16 17 Year 1 Total Shipping Cost Units 18 Quarter 1 S 67,000.00 12,500 19 Quarter2 S 94,000.00 21,000 20 Quarter 3 S 89,800.00 13,800 21 Quarter 4 S 92,600.00 20,000 24 Other budgeted cash disbursements in March 25 Equipment purchases 26 Dividends to be paid $14,000 $2,000 27 28 Minimum cash balance to be maintained $10,000 29 March 1 cash balance $11,500 30 March 1 outstanding borrowings SO 31 March 1 interest due SO 32 33 The company has a line of credit available to bolster the cash balance as needed. 34 35 When preparing budgets, the company maintains their data on a separate sheet from the actual budget and schedules. 36 38 39 37 Click the Schedules and Cash Budget tab to prepare the following: 1. Schedule of expected cash collections for March. 2. Schedule of expected cash disbursements for inventory purchases for March. 40 3. Cash budget for March. Indicate in the financing section any borrowing that will be needed in March. Assume that any interest will not be paid until the following month. 41 42 13 1 Expected cash collections: 2 March cash collections 3 March collections on account: 4 January sales 5 February sales 6 March sales 7 Total cash collections 8 9 Payments to suppliers: 10 Accounts payable for inventory purchases, beginning balance 11 March purchases 12 Total cash payments 13 14 S & P Enterprises 15 Cash Budget 16 For the Month of March 17 18 Cash balance, March 1 19 Add cash receipts: 20 Collections from customers 21 Total cash available before current financing 22 Less disbursements: 23 Payments to suppliers 24 Selling and administrative expenses 25 Equipment purchases Dividends paid 27 Total disbursements 28 Excess (deficiency) of cash available over disbursements 29 Financing: 30 Borrowings 31 Repayments 32 Interest 33 Total financing 34 Cash balance, March 31 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts