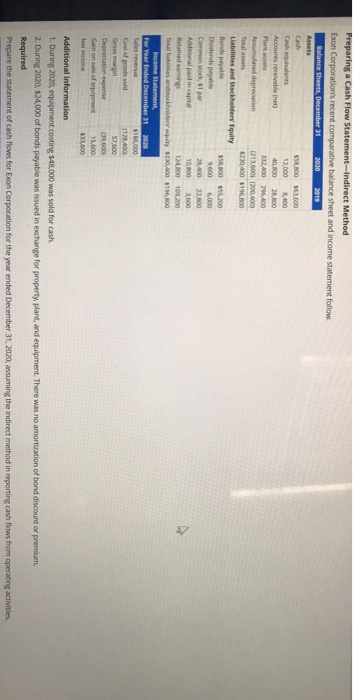

Question: Preparing a Cash Flow Statement-Indirect Method Exon Corporation's recent comparative balance sheet and income statement follow Balance Sheets, December 31 2020 2019 Assets $58,800 163,000

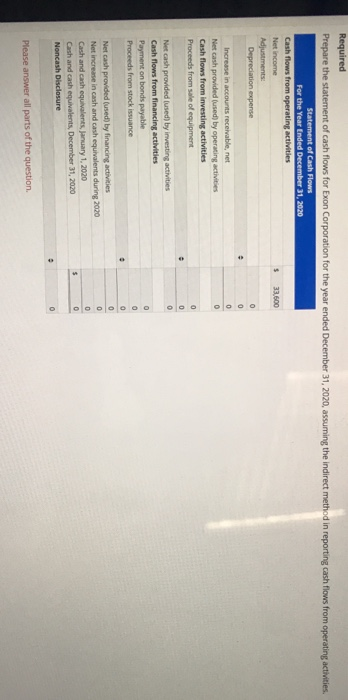

Preparing a Cash Flow Statement-Indirect Method Exon Corporation's recent comparative balance sheet and income statement follow Balance Sheets, December 31 2020 2019 Assets $58,800 163,000 Cath equivalents 12,000 8400 Accounts receivable net) 40,800 2,800 Plantas 32.400 29,400 Acumulated depreciation 213.000 12004001 Total assets 5230 400 5196,500 Liabilities and Stockholders' Equity Bonds payable 158,800 $55,200 Dividends payable 9,000 ,000 Common ok. 51 par Additional paid in capital 10.800 600 12800 109,200 Total e s and holders equity 120,400 1196,500 income statement For Year Ended December 312020 18000 Cost of goods sold 1128.4000 Gross margin 57,600 Depreciation expense 019,600 Gain on sale of equipment 15,600 133,600 Additional information 1. During 2020, equipment costing 148,000 was sold for cash. 2. During 2020, $24,000 of bonds payable was issued in exchange for property, plant, and equipment. There was no amortization of bond discount or premium Required Prepare the statement of cash flows for Exon Corporation for the year ended December 31, 2020, assuming the indirect method in reporting cash flows from operating activities. Required Prepare the statement of cash flows for Exon Corporation for the year ended December 31, 2020, assuming the indirect method in reporting cash flows from operating activities. Statement of Cash Flows For the Year Ended December 31, 2020 Cash flows from operating activities Net income $ 33.600 Adjustments: Depreciation expense Increase in accounts receivable, net Net cash provided (used) by operating activities Cash flows from investing activities Proceeds from sale of equipment Net cash provided lused) by investing activities Cash flows from financing activities Payment on bonds payable Proceeds from stock issuance Net cash provided (used) by financing activities Net increase in cash and cash equivalents during 2020 Cash and cash equivalents, January 1, 2020 Cash and cash equivalents, December 31, 2020 Noncash Disclosure Please answer all parts of the question. Preparing a Cash Flow Statement-Indirect Method Exon Corporation's recent comparative balance sheet and income statement follow Balance Sheets, December 31 2020 2019 Assets $58,800 163,000 Cath equivalents 12,000 8400 Accounts receivable net) 40,800 2,800 Plantas 32.400 29,400 Acumulated depreciation 213.000 12004001 Total assets 5230 400 5196,500 Liabilities and Stockholders' Equity Bonds payable 158,800 $55,200 Dividends payable 9,000 ,000 Common ok. 51 par Additional paid in capital 10.800 600 12800 109,200 Total e s and holders equity 120,400 1196,500 income statement For Year Ended December 312020 18000 Cost of goods sold 1128.4000 Gross margin 57,600 Depreciation expense 019,600 Gain on sale of equipment 15,600 133,600 Additional information 1. During 2020, equipment costing 148,000 was sold for cash. 2. During 2020, $24,000 of bonds payable was issued in exchange for property, plant, and equipment. There was no amortization of bond discount or premium Required Prepare the statement of cash flows for Exon Corporation for the year ended December 31, 2020, assuming the indirect method in reporting cash flows from operating activities. Required Prepare the statement of cash flows for Exon Corporation for the year ended December 31, 2020, assuming the indirect method in reporting cash flows from operating activities. Statement of Cash Flows For the Year Ended December 31, 2020 Cash flows from operating activities Net income $ 33.600 Adjustments: Depreciation expense Increase in accounts receivable, net Net cash provided (used) by operating activities Cash flows from investing activities Proceeds from sale of equipment Net cash provided lused) by investing activities Cash flows from financing activities Payment on bonds payable Proceeds from stock issuance Net cash provided (used) by financing activities Net increase in cash and cash equivalents during 2020 Cash and cash equivalents, January 1, 2020 Cash and cash equivalents, December 31, 2020 Noncash Disclosure Please answer all parts of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts