Question: Preparing a consolidated income statement - Cost method with noncontrolling interest and AAP A parent company purchased a 7 5 % controlling interest in its

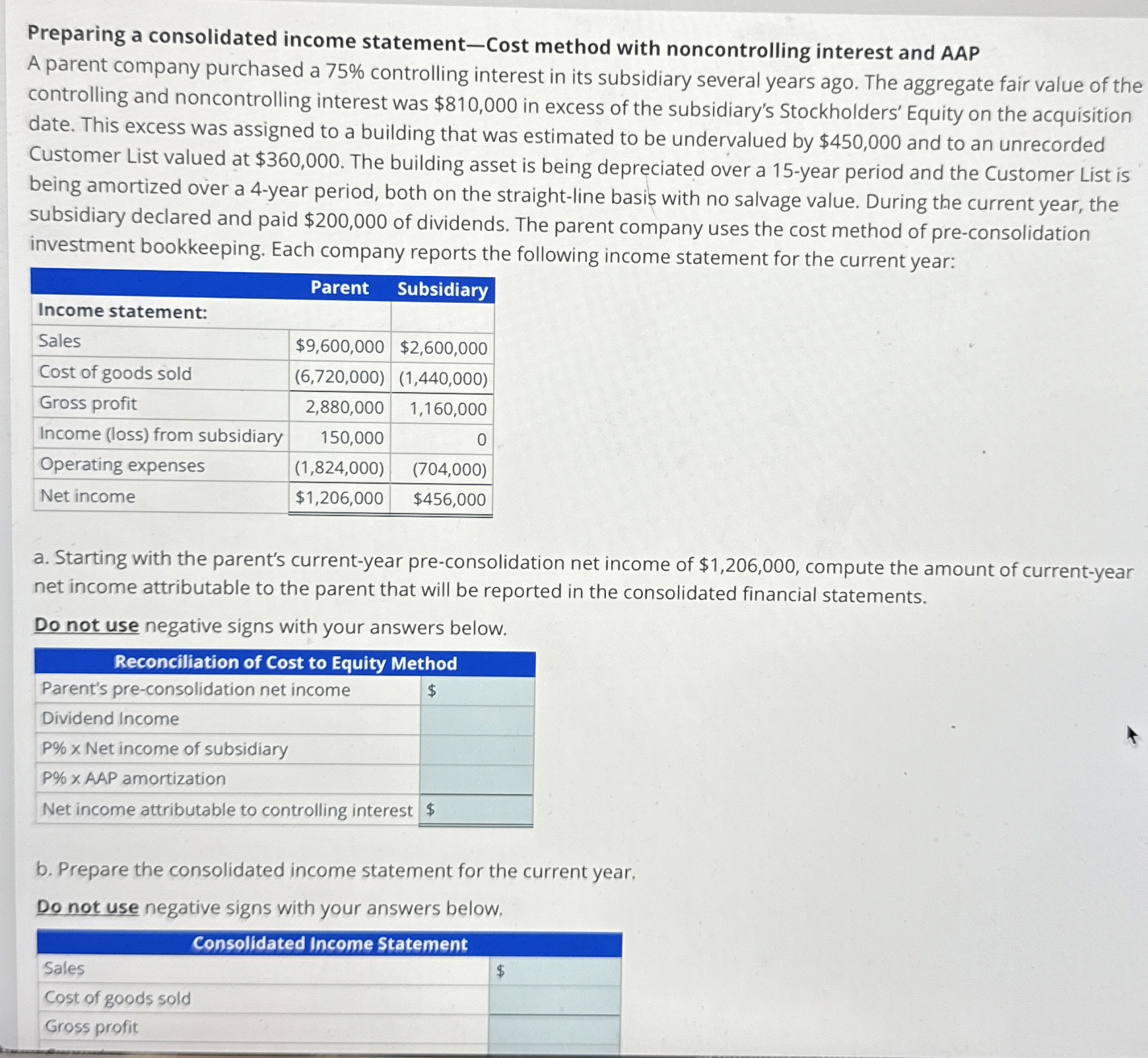

Preparing a consolidated income statementCost method with noncontrolling interest and AAP

A parent company purchased a controlling interest in its subsidiary several years ago. The aggregate fair value of the

controlling and noncontrolling interest was $ in excess of the subsidiary's Stockholders' Equity on the acquisition

date. This excess was assigned to a building that was estimated to be undervalued by $ and to an unrecorded

Customer List valued at $ The building asset is being depreciated over a year period and the Customer List is

being amortized over a year period, both on the straightline basis with no salvage value. During the current year, the

subsidiary declared and paid $ of dividends. The parent company uses the cost method of preconsolidation

investment bookkeeping. Each company reports the following income statement for the current year:

a Starting with the parent's currentyear preconsolidation net income of $ compute the amount of currentyear

net income attributable to the parent that will be reported in the consolidated financial statements.

Do not use negative signs with your answers below.

b Prepare the consolidated income statement for the current year.

Do not use negative signs with your answers below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock