Question: Preparing a consolidated income statement-Cost method with noncontrolling interest, AAP and upstream intercompany depreciable asset profits A parent company purchased an 80% controlling interest in

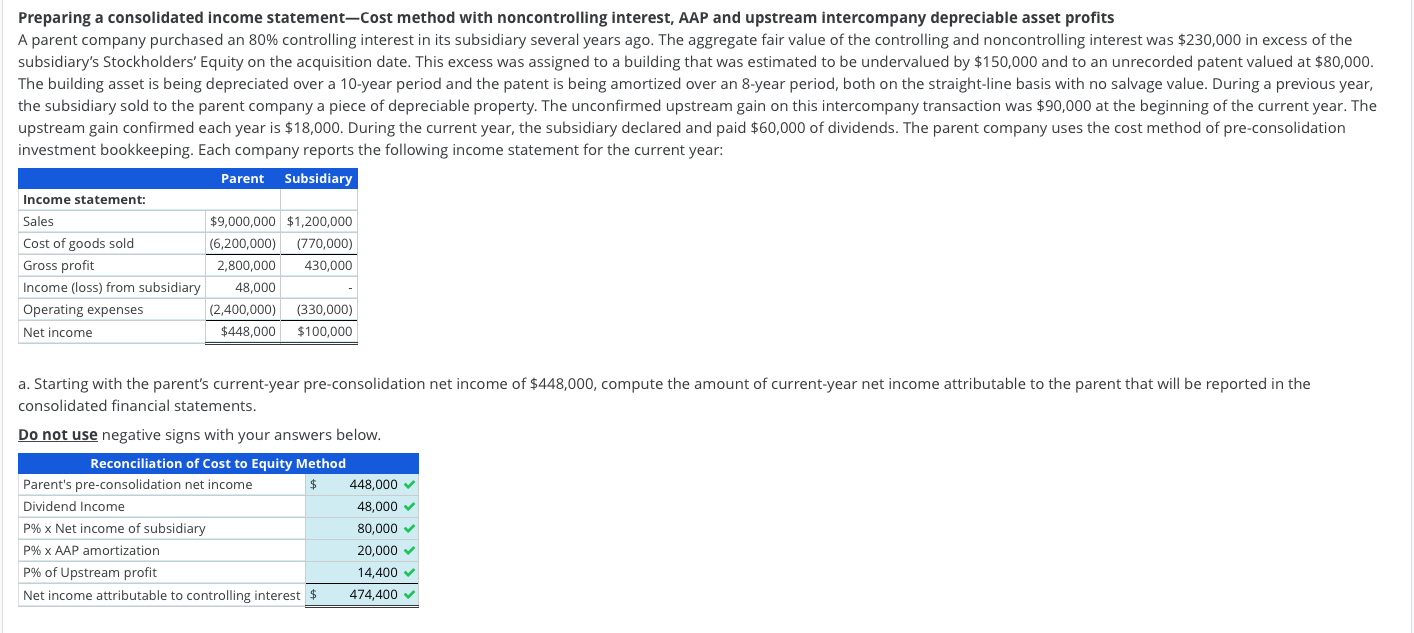

Preparing a consolidated income statement-Cost method with noncontrolling interest, AAP and upstream intercompany depreciable asset profits A parent company purchased an 80% controlling interest in its subsidiary several years ago. The aggregate fair value of the controlling and noncontrolling interest was $230,000 in excess of the subsidiary's Stockholders' Equity on the acquisition date. This excess was assigned to a building that was estimated to be undervalued by $150,000 and to an unrecorded patent valued at $80,000. The building asset is being depreciated over a 10-year period and the patent is being amortized over an 8-year period, both on the straight-line basis with no salvage value. During a previous year, the subsidiary sold to the parent company a piece of depreciable property. The unconfirmed upstream gain on this intercompany transaction was $90,000 at the beginning of the current year. The upstream gain confirmed each year is $18,000. During the current year, the subsidiary declared and paid $60,000 of dividends. The parent company uses the cost method of pre-consolidation investment bookkeeping. Each company reports the following income statement for the current year: Parent Subsidiary Income statement: Sales $9,000,000 $1,200,000 Cost of goods sold (6,200,000) (770,000) Gross profit 2,800,000 430,000 Income (loss) from subsidiary 48,000 Operating expenses (2,400,000) (330,000 Net income $448,000 $100,000 a. Starting with the parent's current-year pre-consolidation net income of $448,000, compute the amount of current-year net income attributable to the parent that will be reported in the consolidated financial statements. Do not use negative signs with your answers below. Reconciliation of Cost to Equity Method Parent's pre-consolidation net income $ 448,000 Dividend Income 48,000 P% x Net income of subsidiary 80,000 P% x AAP amortization 20,000 P% of Upstream profit 14,400 Net income attributable to controlling interest $ 474,400b. Prepare the consolidated income statement for the current year. Do not use negative signs with your answers below. Consolidated Income Statement Sales 5 10,200,000 J Cost of goods said 6,970,600 J Gross profit 3,230,000 Operating expenses 2,755,000 x Net income 3 .1 475,600 a: Net inmme attributable to noncontrclling interests V 95,600 a: Net income attributable to the parent c I S 380,000 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts