Question: Preparing a consolidated income statement-Equity method with noncontrolling interest, AAP and upstream and downstream intercompany inventory profits A parent company purchased a 70% controlling interest

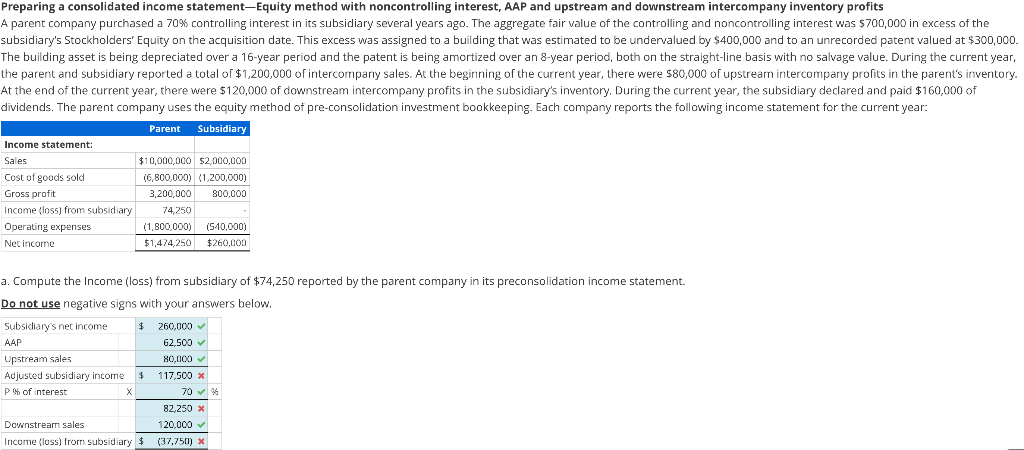

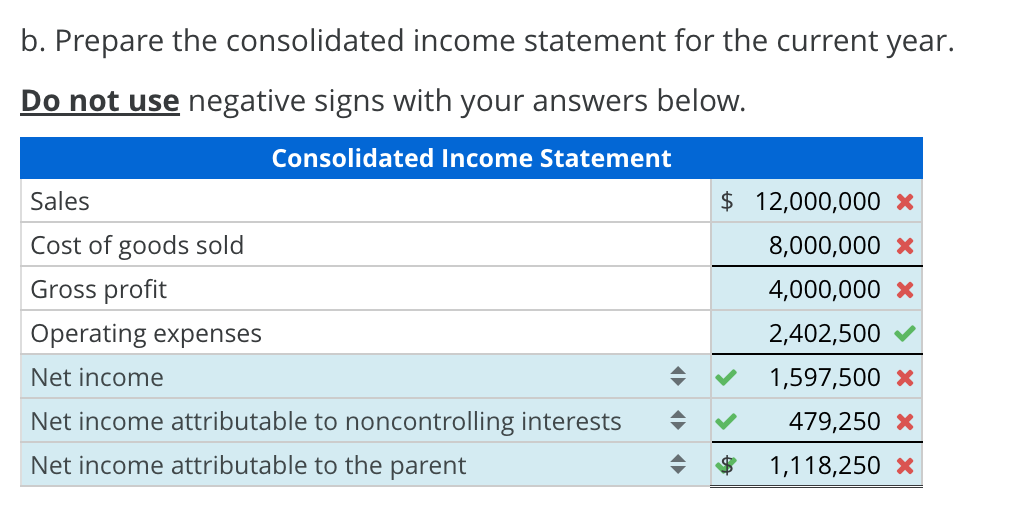

Preparing a consolidated income statement-Equity method with noncontrolling interest, AAP and upstream and downstream intercompany inventory profits A parent company purchased a 70% controlling interest in its subsidiary several years ago. The aggregate fair value of the controlling and noncontrolling interest was $700,000 in excess of the subsidiary's Stockholders' Equity on the acquisition date. This excess was assigned to a building that was estimated to be undervalued by $400,000 and to an unrecorded patent valued at $300,000. The building asset is being depreciated over a 16 -year period and the patent is being amortized over an 8 -year period, both on the straight-line basis with no salvage value. During the current year, the parent and subsidiary reported a total of $1,200,000 of intercompany sales. At the beginning of the current year, there were $80,000 of upstream intercompary profits in the parent's inventory. At the end of the current year, there were $120,000 of downstream intercompany profits in the subsidiary's inventory. During the current year, the subsidiary declared and paid $160,000 of dividends. The parent company uses the equity method of pre-consolidation investment bookkeeping. Each company reports the following income statement for the current year: a. Compute the Income (loss) from subsidiary of $74,250 reported by the parent company in its preconsolidation income statement. Do not use negative signs with your answers below. b. Prepare the consolidated income statement for the current year. Do not use negative signs with your answers below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts