Question: Preparing a Multiple- Step Income Statement The following items are from the adjusted trial balance of Bailey Corp. on December 31 , the end of

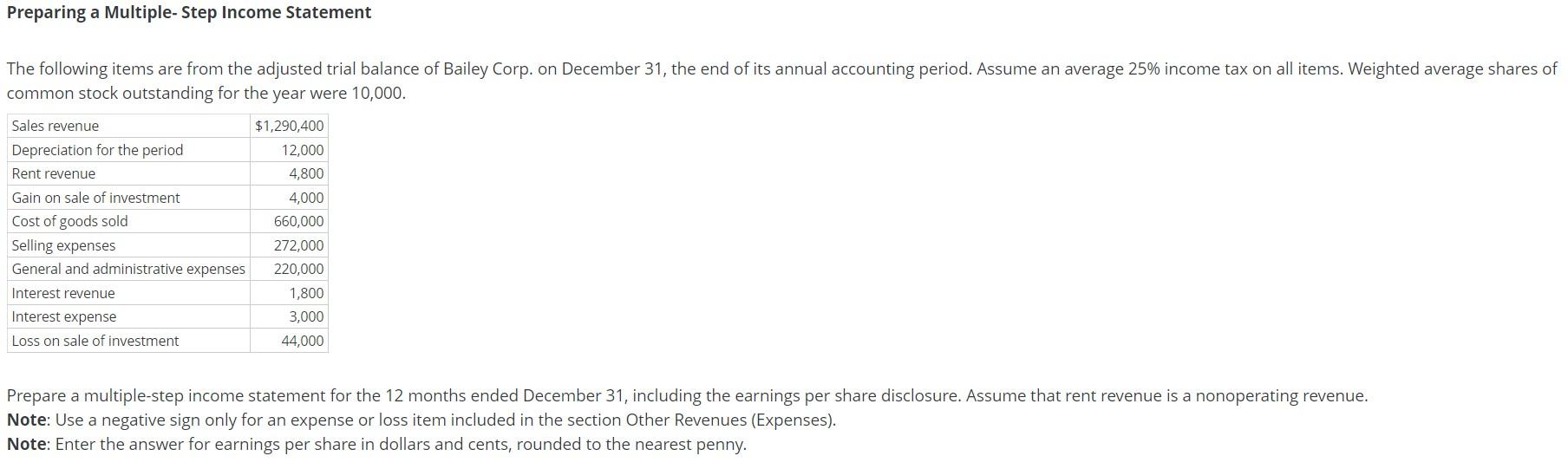

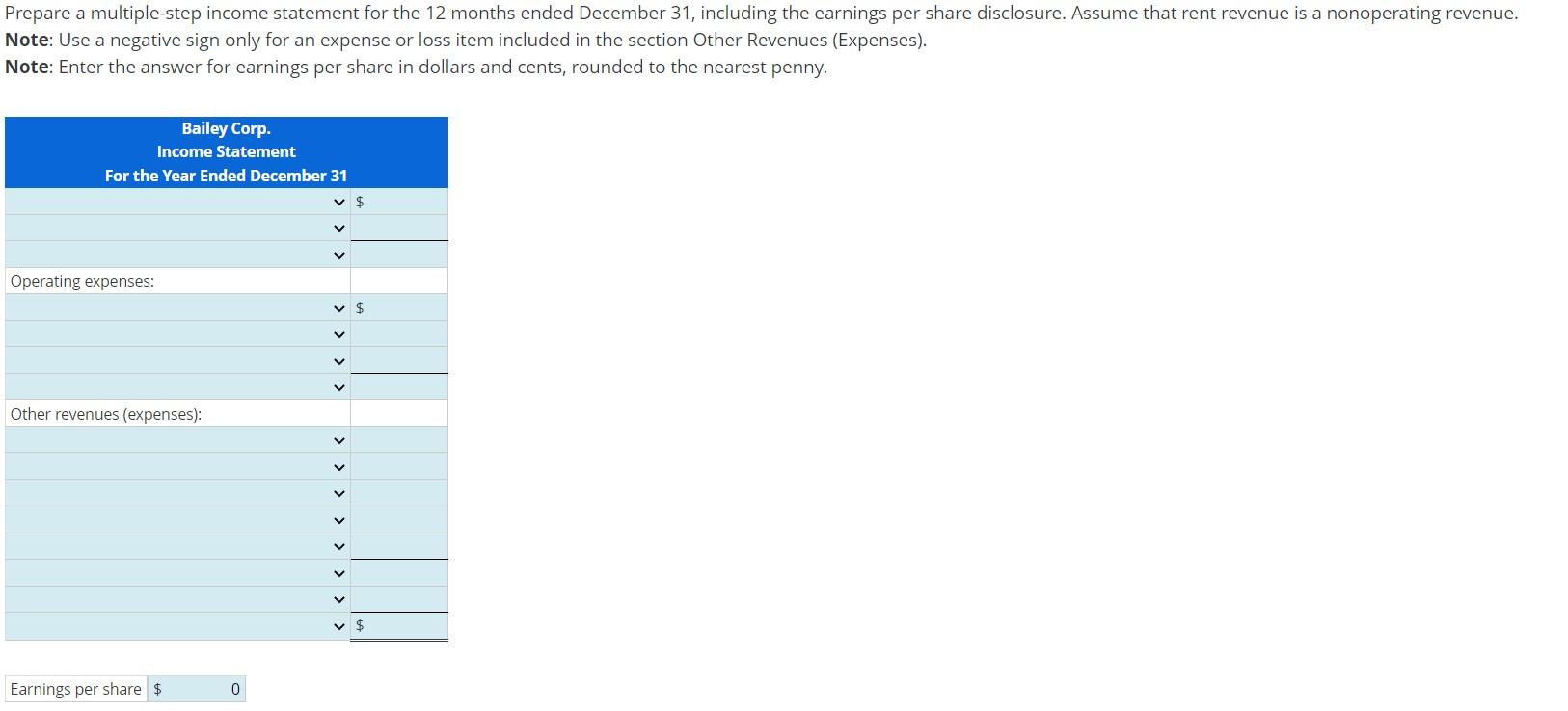

Preparing a Multiple- Step Income Statement The following items are from the adjusted trial balance of Bailey Corp. on December 31 , the end of its annual accounting period. Assume an average 25% income tax on all items. Weighted average shares of common stock outstanding for the year were 10,000 . Prepare a multiple-step income statement for the 12 months ended December 31 , including the earnings per share disclosure. Assume that rent revenue is a nonoperating revenue. Note: Use a negative sign only for an expense or loss item included in the section Other Revenues (Expenses). Note: Enter the answer for earnings per share in dollars and cents, rounded to the nearest penny. Prepare a multiple-step income statement for the 12 months ended December 31 , including the earnings per share disclosure. Assume that rent revenue is a nonoperating revenue. Note: Use a negative sign only for an expense or loss item included in the section Other Revenues (Expenses). Note: Enter the answer for earnings per share in dollars and cents, rounded to the nearest penny

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts