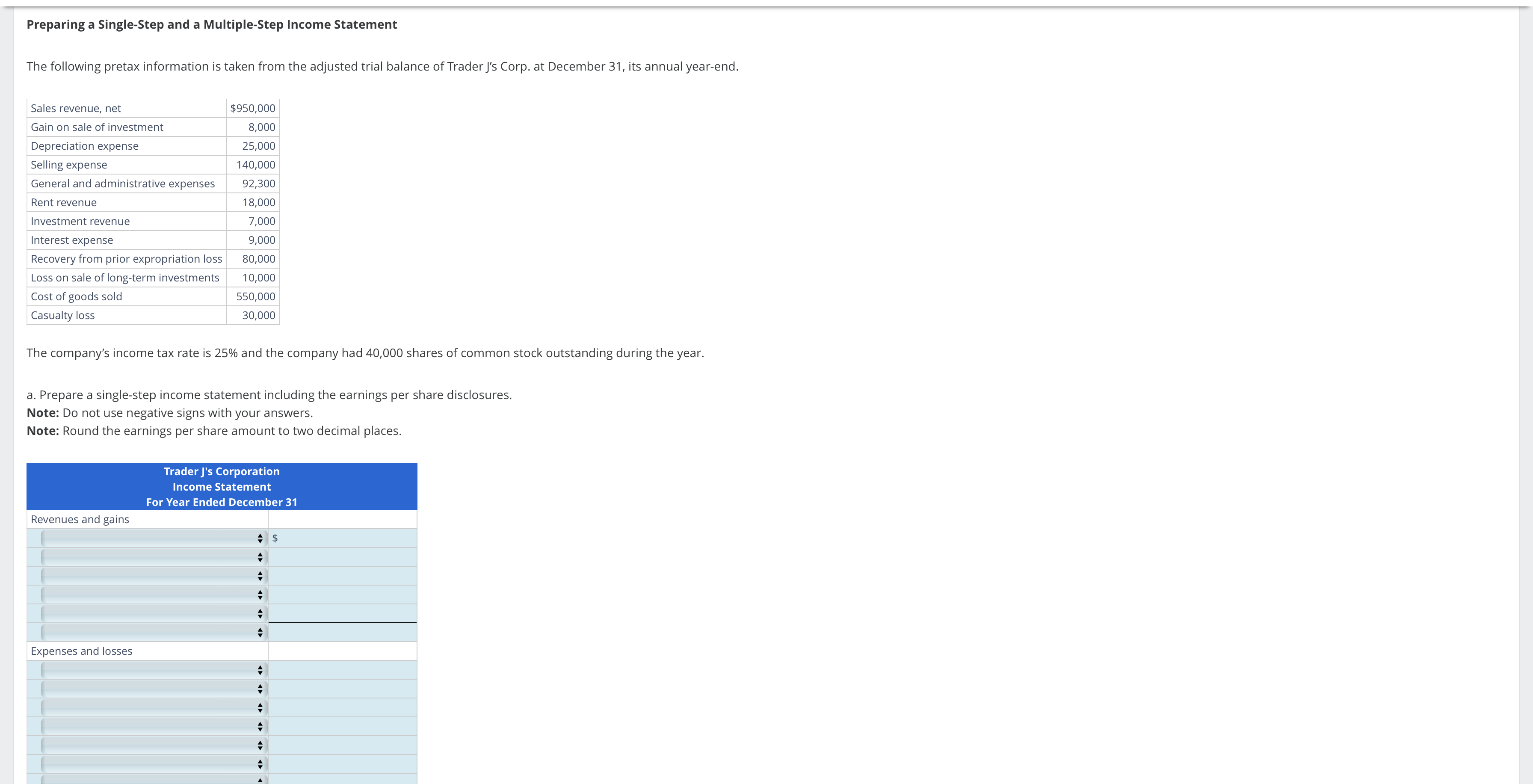

Question: Preparing a Single - Step and a Multiple - Step Income Statement The following pretax information is taken from the adjusted trial balance of Trader

Preparing a SingleStep and a MultipleStep Income Statement

The following pretax information is taken from the adjusted trial balance of Trader Js Corp. at December its annual yearend.

The company's income tax rate is and the company had shares of common stock outstanding during the year.

a Prepare a singlestep income statement including the earnings per share disclosures.

Note: Do not use negative signs with your answers.

Note: Round the earnings per share amount to two decimal places. Earnings per share

b Prepare a multiplestep income statement including the earnings per share disclosures. Assume that rent revenue is nonoperating.

Note: Use a negative sign only for an expense or loss item included in the section Other Revenues Expenses

Note: Round the earnings per share amount to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock