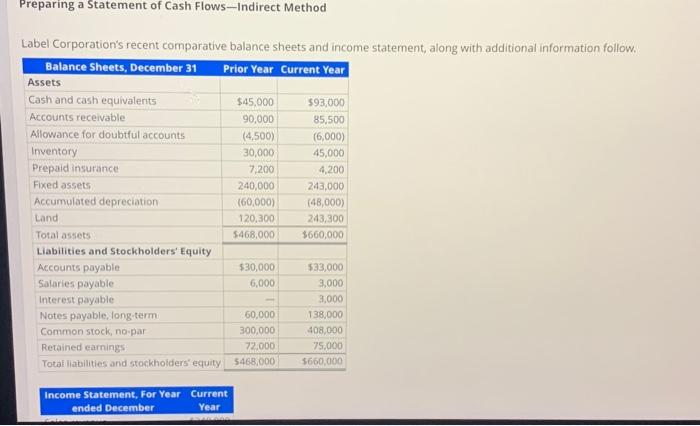

Question: Preparing a Statement of Cash Flows-Indirect Method Label Corporation's recent comparative balance sheets and income statement, along with additional information follow. Balance Sheets, December

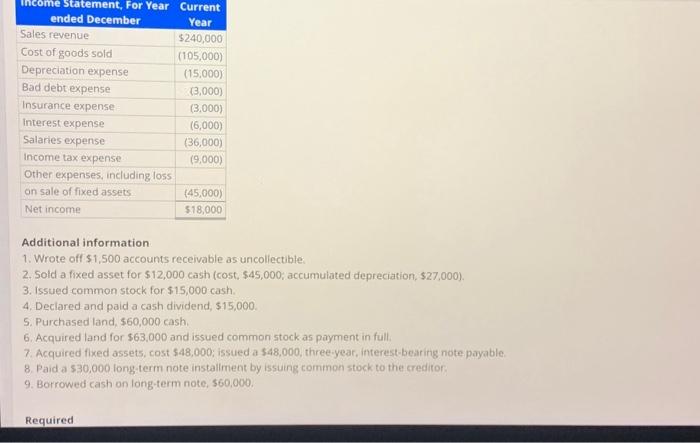

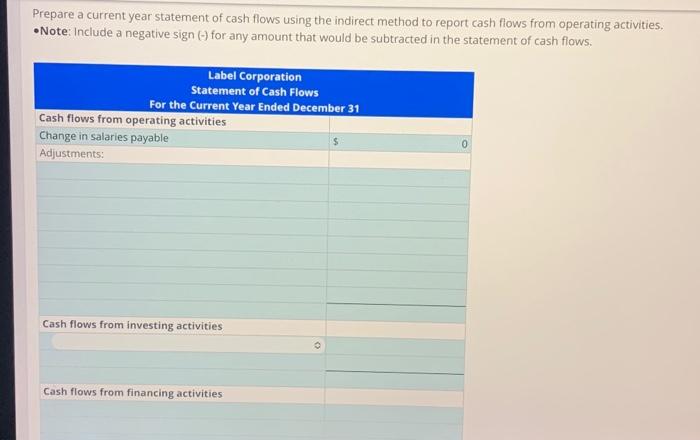

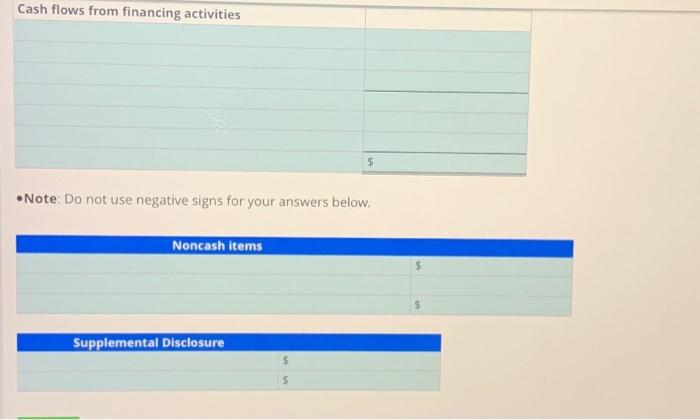

Preparing a Statement of Cash Flows-Indirect Method Label Corporation's recent comparative balance sheets and income statement, along with additional information follow. Balance Sheets, December 31 Prior Year Current Year Assets Cash and cash equivalents $45,000 $93,000 Accounts receivable 90,000 85,500 Allowance for doubtful accounts (4,500) (6,000) Inventory 30,000 45,000 Prepaid insurance 7,200 4,200 Fixed assets 240,000 243,000 Accumulated depreciation (60,000) (48,000) Land 120,300 243,300 Total assets $468,000 $660,000 Liabilities and Stockholders' Equity Accounts payable $30,000 $33,000 Salaries payable 6,000 3,000 Interest payable 3,000 Notes payable, long-term 60,000 138,000 Common stock, no-par 300,000 408,000 Retained earnings 72,000 75,000 $468,000 $660,000 Total liabilities and stockholders' equity Income Statement, For Year Current ended December Year Income Statement, For Year Current ended December Year Sales revenue $240,000 Cost of goods sold (105,000) Depreciation expense (15,000) Bad debt expense (3,000) Insurance expense (3,000) Interest expense (6,000) Salaries expense (36,000) Income tax expense (9,000) Other expenses, including loss on sale of fixed assets (45,000) Net income $18,000 Additional information 1. Wrote off $1,500 accounts receivable as uncollectible. 2. Sold a fixed asset for $12,000 cash (cost, $45,000; accumulated depreciation, $27,000). 3. Issued common stock for $15,000 cash. 4. Declared and paid a cash dividend, $15,000. 5. Purchased land, $60,000 cash. 6. Acquired land for $63,000 and issued common stock as payment in full. 7. Acquired fixed assets, cost $48,000; issued a $48,000, three-year, interest-bearing note payable. 8. Paid a $30,000 long-term note installment by issuing common stock to the creditor, 9. Borrowed cash on long-term note, $60,000. Required Prepare a current year statement of cash flows using the indirect method to report cash flows from operating activities. Note: Include a negative sign (-) for any amount that would be subtracted in the statement of cash flows. Label Corporation Statement of Cash Flows For the Current Year Ended December 31 Cash flows from operating activities Change in salaries payable Adjustments: Cash flows from investing activities Cash flows from financing activities Cash flows from financing activities $ Note: Do not use negative signs for your answers below. Noncash items Supplemental Disclosure $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts