Question: Preparing Adjusting Entries : A. Prepare the adjusting entry for each of the following situations . The last day of the accounting period is Dec

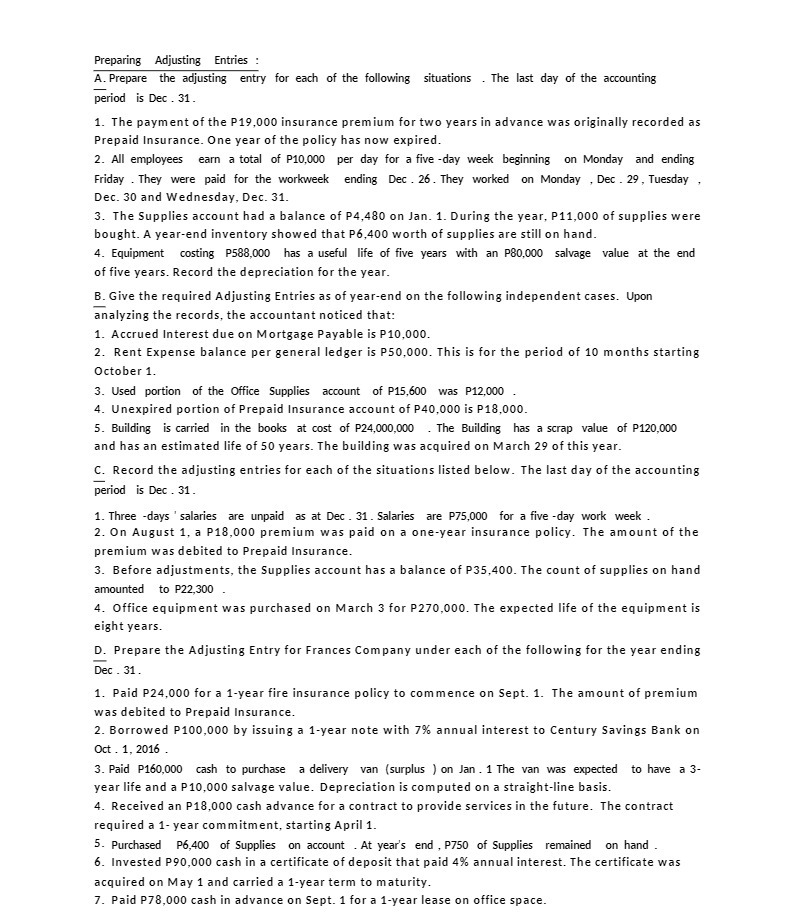

Preparing Adjusting Entries : A. Prepare the adjusting entry for each of the following situations . The last day of the accounting period is Dec . 31 . 1. The payment of the P19,000 insurance premium for two years in advance was originally recorded as Prepaid Insurance. One year of the policy has now expired. 2. All employees earn a total of P10,000 per day for a five -day week beginning on Monday and ending Friday . They were paid for the workweek ending Dec . 26 . They worked on Monday , Dec . 29 , Tuesday Dec. 30 and Wednesday, Dec. 31. 3. The Supplies account had a balance of P4,480 on Jan. 1. During the year, P11,000 of supplies were bought. A year-end inventory showed that P6,400 worth of supplies are still on hand. 4. Equipment costing P588,000 has a useful life of five years with an P80,000 salvage value at the end of five years. Record the depreciation for the year. B. Give the required Adjusting Entries as of year-end on the following independent cases. Upon analyzing the records, the accountant noticed that: 1. Accrued Interest due on Mortgage Payable is P10,000. 2. Rent Expense balance per general ledger is P50,000. This is for the period of 10 months starting October 1. 3. Used portion of the Office Supplies account of P15,600 was P12,000 4. Unexpired portion of Prepaid Insurance account of P40,000 is P18,000 5. Building is carried in the books at cost of P24,000,000 . The Building has a scrap value of P120,000 and has an estimated life of 50 years. The building was acquired on March 29 of this year. C. Record the adjusting entries for each of the situations listed below. The last day of the accounting period is Dec . 31. 1. Three -days ' salaries are unpaid as at Dec . 31 . Salaries are P75,000 for a five -day work week . 2. On August 1, a P18,000 premium was paid on a one-year insurance policy. The amount of the premium was debited to Prepaid Insurance. 3. Before adjustments, the Supplies account has a balance of P35,400. The count of supplies on hand amounted to P22,300 4. Office equipment was purchased on March 3 for P270,000. The expected life of the equipment is eight years. D. Prepare the Adjusting Entry for Frances Company under each of the following for the year ending Dec . 31 . 1. Paid P24,000 for a 1-year fire insurance policy to commence on Sept. 1. The amount of premium was debited to Prepaid Insurance. 2. Borrowed P100,000 by issuing a 1-year note with 7% annual interest to Century Savings Bank on Oct . 1, 2016 . 3. Paid P160,000 cash to purchase a delivery van (surplus ) on Jan . 1 The van was expected to have a 3- year life and a P10,000 salvage value. Depreciation is computed on a straight-line basis. 4. Received an P18,000 cash advance for a contract to provide services in the future. The contract required a 1- year commitment, starting April 1. 5. Purchased P6,400 of Supplies on account . At year's end , P750 of Supplies remained on hand 6. Invested P90,000 cash in a certificate of deposit that paid 4% annual interest. The certificate was acquired on May 1 and carried a 1-year term to maturity. 7. Paid P78,000 cash in advance on Sept. 1 for a 1-year lease on office space

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts