Question: PREPARING AND USING FINANCIAL STATEMENT Assume you have developed and tested a prototype electronic product and are about to start your new business. You purchase

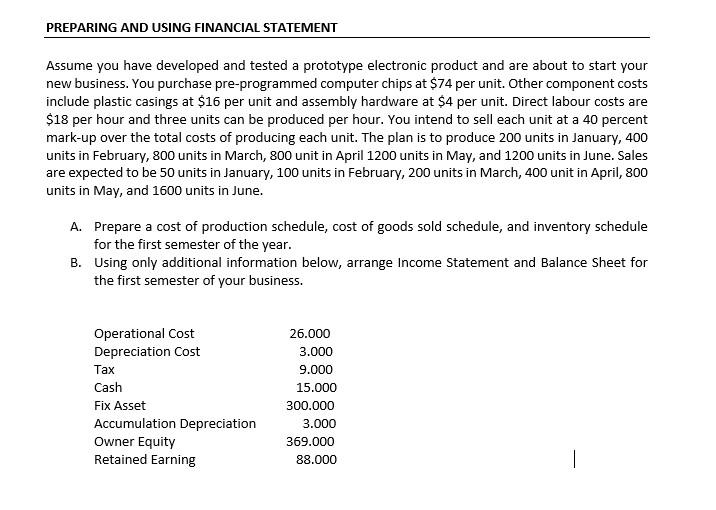

PREPARING AND USING FINANCIAL STATEMENT Assume you have developed and tested a prototype electronic product and are about to start your new business. You purchase pre-programmed computer chips at $74 per unit. Other component costs include plastic casings at $16 per unit and assembly hardware at $4 per unit. Direct labour costs are $18 per hour and three units can be produced per hour. You intend to sell each unit at a 40 percent mark-up over the total costs of producing each unit. The plan is to produce 200 units in January, 400 units in February, 800 units in March, 800 unit in April 1200 units in May, and 1200 units in June. Sales are expected to be 50 units in January, 100 units in February, 200 units in March, 400 unit in April, 800 units in May, and 1600 units in June. A. Prepare a cost of production schedule, cost of goods sold schedule, and inventory schedule for the first semester of the year. B. Using only additional information below, arrange Income Statement and Balance Sheet for the first semester of your business. Operational Cost Depreciation Cost Tax Cash Fix Asset Accumulation Depreciation Owner Equity Retained Earning 26.000 3.000 9.000 15.000 300.000 3.000 369.000 88.000 1 PREPARING AND USING FINANCIAL STATEMENT Assume you have developed and tested a prototype electronic product and are about to start your new business. You purchase pre-programmed computer chips at $74 per unit. Other component costs include plastic casings at $16 per unit and assembly hardware at $4 per unit. Direct labour costs are $18 per hour and three units can be produced per hour. You intend to sell each unit at a 40 percent mark-up over the total costs of producing each unit. The plan is to produce 200 units in January, 400 units in February, 800 units in March, 800 unit in April 1200 units in May, and 1200 units in June. Sales are expected to be 50 units in January, 100 units in February, 200 units in March, 400 unit in April, 800 units in May, and 1600 units in June. A. Prepare a cost of production schedule, cost of goods sold schedule, and inventory schedule for the first semester of the year. B. Using only additional information below, arrange Income Statement and Balance Sheet for the first semester of your business. Operational Cost Depreciation Cost Tax Cash Fix Asset Accumulation Depreciation Owner Equity Retained Earning 26.000 3.000 9.000 15.000 300.000 3.000 369.000 88.000 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts