Question: Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On April 1, 2020, Mountain Company sold merchandise and received a $31,200, three-year,

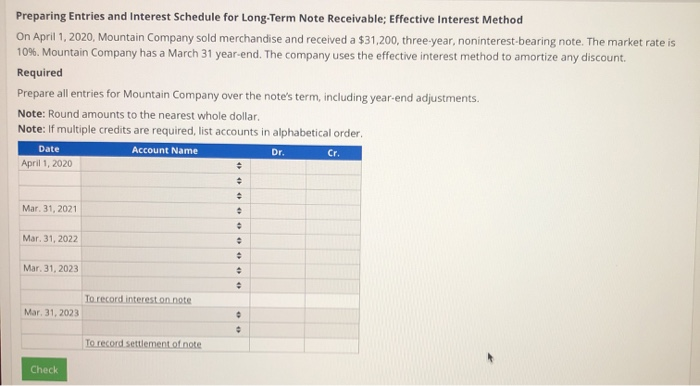

Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On April 1, 2020, Mountain Company sold merchandise and received a $31,200, three-year, noninterest bearing note. The market rate is 10%. Mountain Company has a March 31 year-end. The company uses the effective interest method to amortize any discount. Required Prepare all entries for Mountain Company over the note's term, including year-end adjustments. Note: Round amounts to the nearest whole dollar. Note: If multiple credits are required, list accounts in alphabetical order. Cr. April 1, 2020 Date Account Name Dr. Mar. 31, 2021 Mar 31, 2022 e Mar. 31, 2023 To record interest on note Mar 31, 2023 . To record settlement of note Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts