Question: Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On January 1 of Year 1. Stealth Company sold a machine (classified as

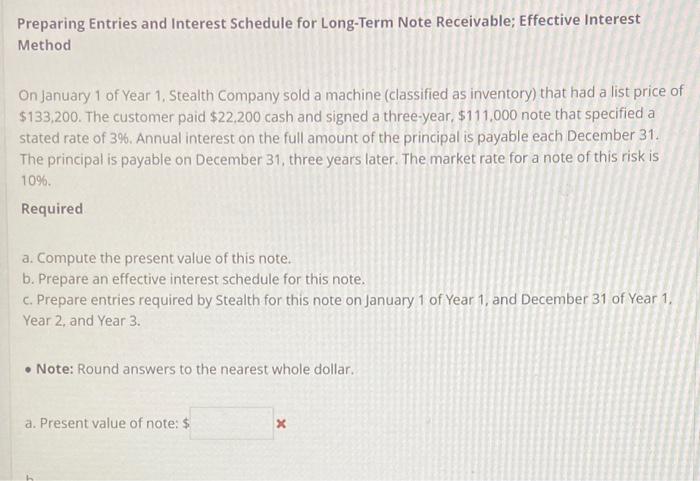

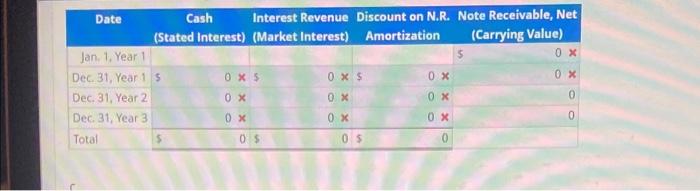

Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On January 1 of Year 1. Stealth Company sold a machine (classified as inventory) that had a list price of $133,200. The customer paid $22,200 cash and signed a three-year, $111,000 note that specified a stated rate of 3%. Annual interest on the full amount of the principal is payable each December 31 . The principal is payable on December 31, three years later. The market rate for a note of this risk is 10%. Required a. Compute the present value of this note. b. Prepare an effective interest schedule for this note. c. Prepare entries required by Stealth for this note on January 1 of Year 1 , and December 31 of Year 1 . Year 2 , and Year 3. - Note: Round answers to the nearest whole dollar. a. Present value of note: $ Io record settlement of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts