Question: Preparing the Shareholders' Equity Section after Selected Transactions (AP11-3) Eddie Edwards Limited, a public company, was formed on January 2, 2017, with the following authorized

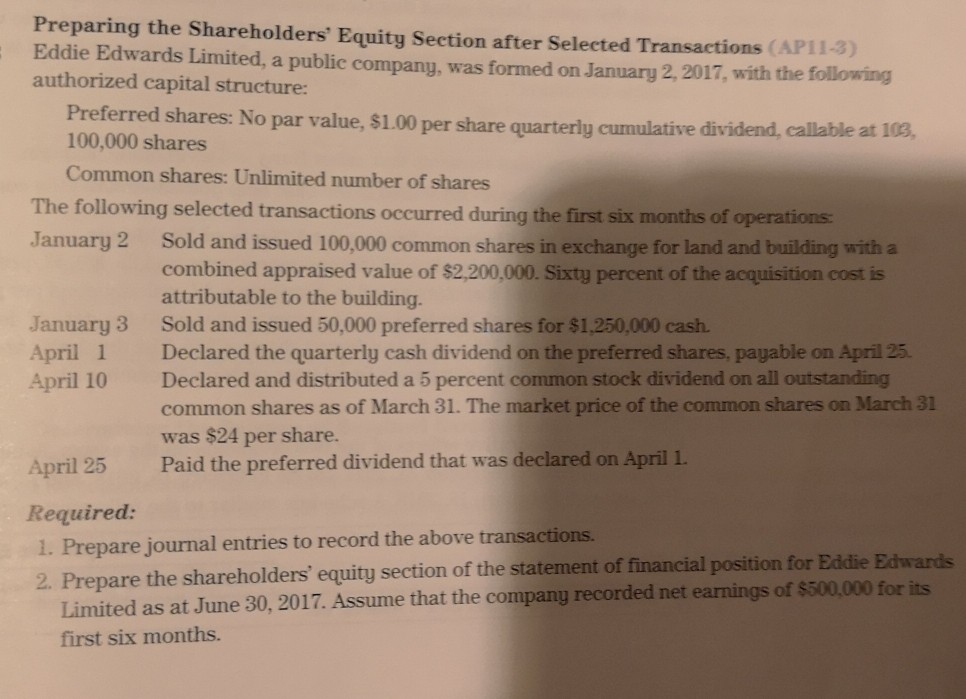

Preparing the Shareholders' Equity Section after Selected Transactions (AP11-3) Eddie Edwards Limited, a public company, was formed on January 2, 2017, with the following authorized capital structure: Preferred shares: No par value, $1.00 per share quarterly cumulative dividend, 100,000 shares Common shares: Unlimited number of shares callable at 103, The following selected transactions occurred during the first six months of January 2 Sold and issued 100,000 common shares in exchange for land and building witha operations combined appraised value of $2,200,000. Sixty percent of the acquisition cost is attributable to the building. January 3 Sold and issued 50,000 preferred shares for $1,250,000 cash. April 1 Declared the quarterly cash dividend on the preferred shares, payable on April 25 April 10 Declared and distributed a 5 percent common stock dividend on all outstanding common shares as of March 31. The market price of the common shares on March 31 was $24 per share. April 25 Paid the preferred dividend that was declared on April 1. Required: 1. Prepare journal entries to record the above transactions. 2. Prepare the shareholders' equity section of the statement of financial position for Eddie Edwards t the company recorded net earnings of $500,000 for its Limited as at June 30, 2017. Assume tha first six months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts