Question: Prepeare and complete a pension work sheet Current Attempt in Progress Carla Vista Corporation reports the following January 1, 2023 balances for its defined benefit

Prepeare and complete a pension work sheet

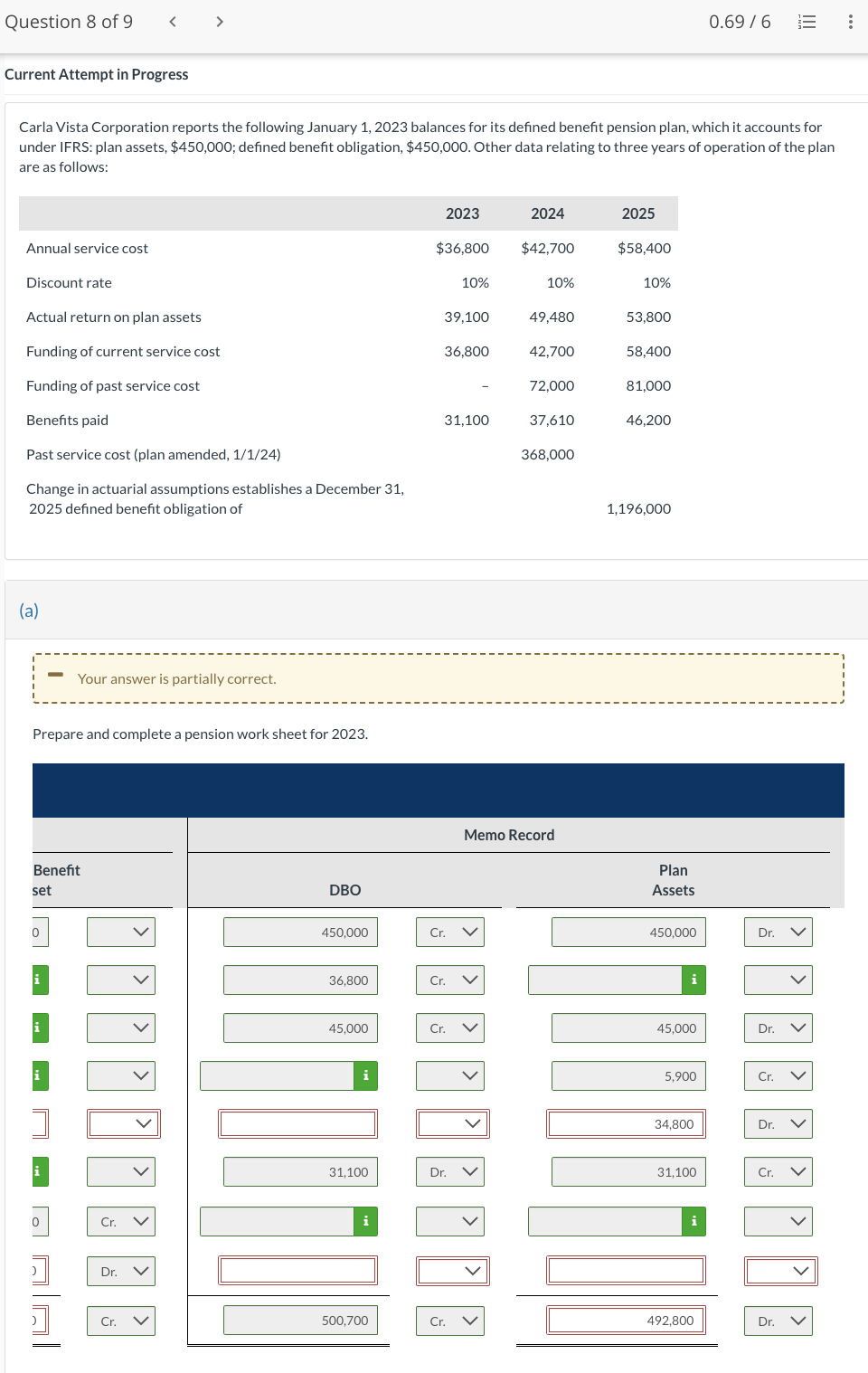

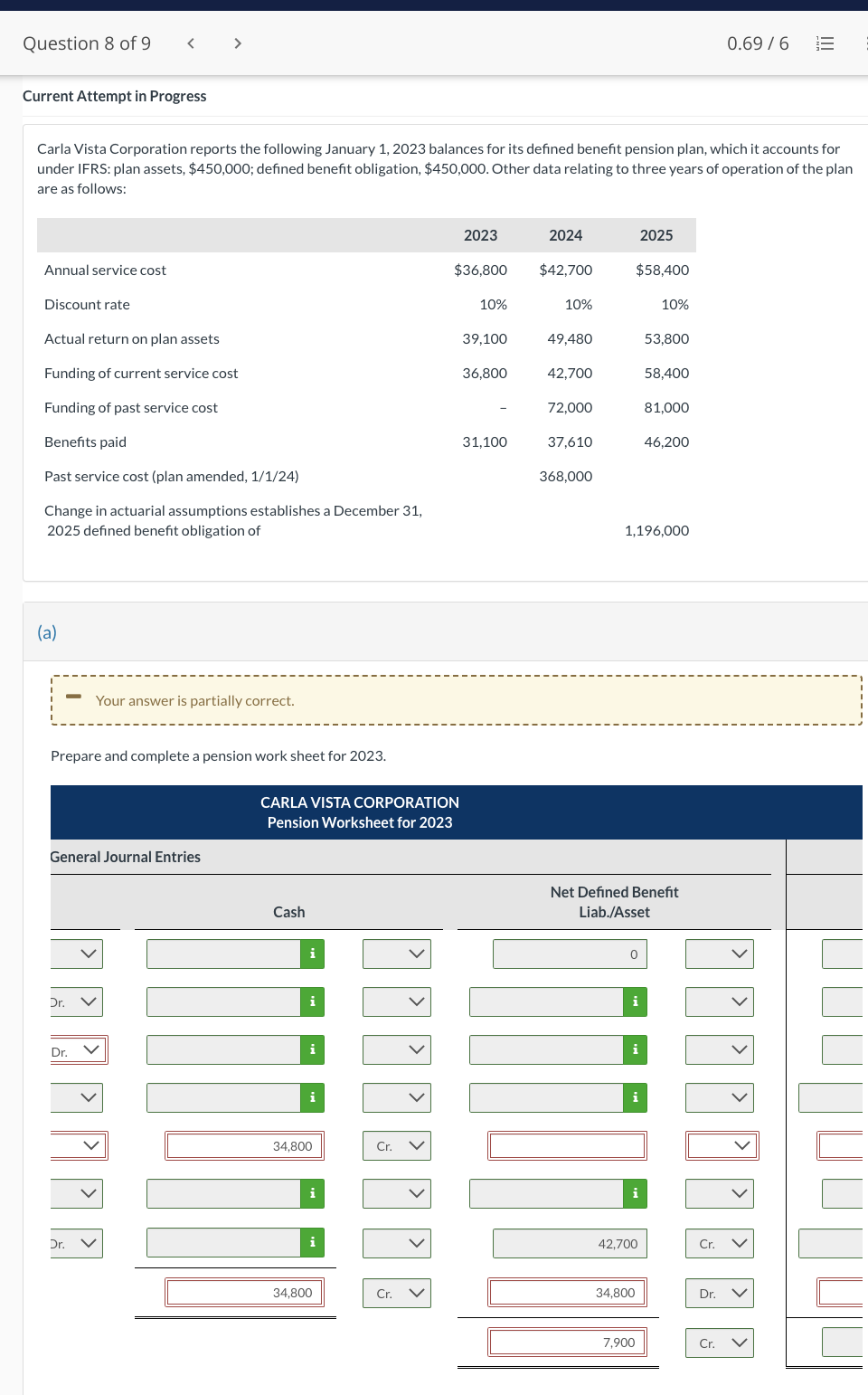

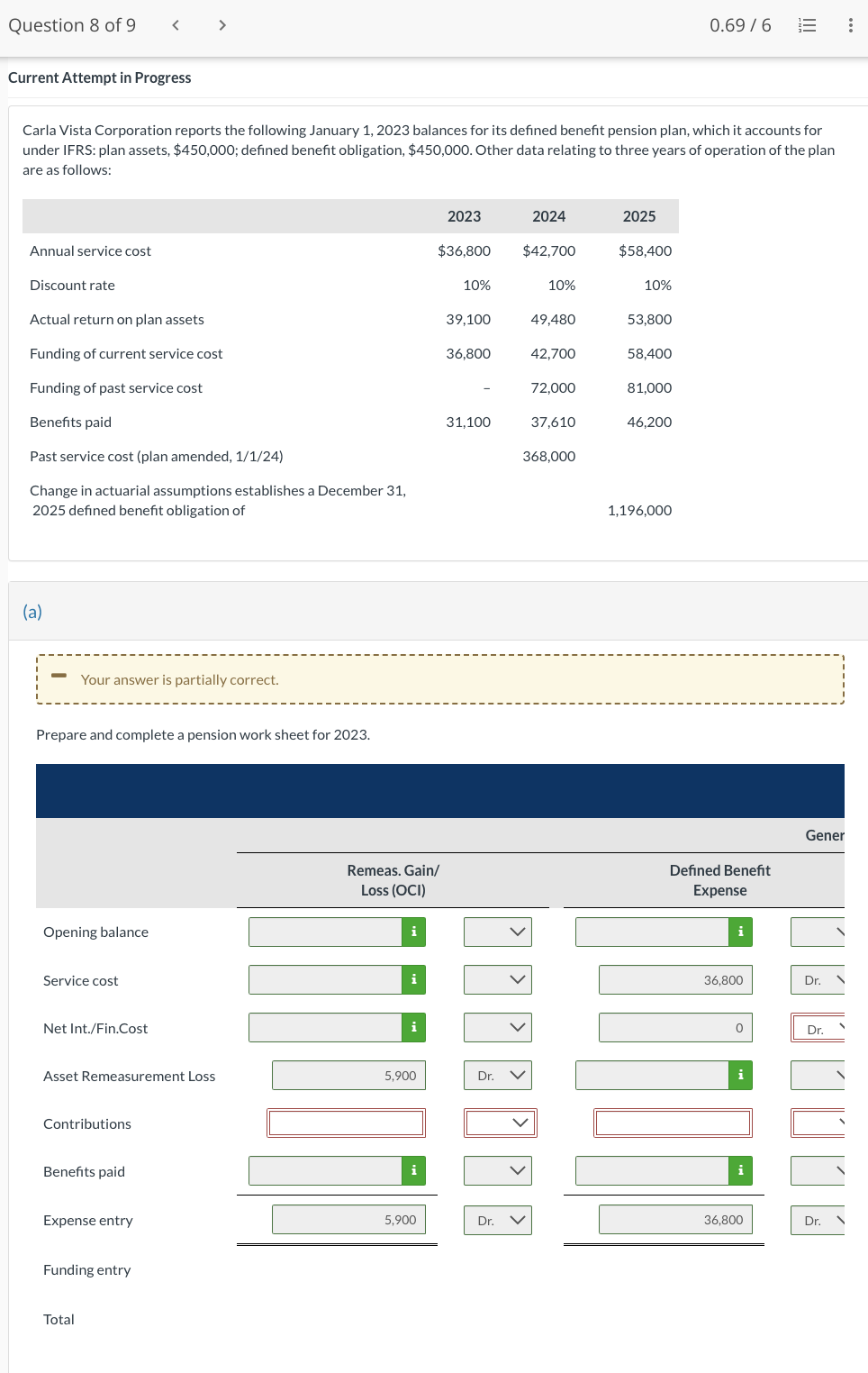

Current Attempt in Progress Carla Vista Corporation reports the following January 1, 2023 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $450,000; defined benefit obligation, $450,000. Other data relating to three years of operation of the plan are as follows: UJ aennea Denent obigation or 1,170,UU (a) Prepare and complete a pension work sheet for 2023. Current Attempt in Progress Carla Vista Corporation reports the following January 1, 2023 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $450,000; defined benefit obligation, $450,000. Other data relating to three years of operation of the plan are as follows: (a) Prepare and complete a pension work sheet for 2023. Current Attempt in Progress Carla Vista Corporation reports the following January 1, 2023 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $450,000; defined benefit obligation, $450,000. Other data relating to three years of operation of the plan are as follows: (a) Prepare and complete a pension work sheet for 2023. Current Attempt in Progress Carla Vista Corporation reports the following January 1, 2023 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $450,000; defined benefit obligation, $450,000. Other data relating to three years of operation of the plan are as follows: UJ aennea Denent obigation or 1,170,UU (a) Prepare and complete a pension work sheet for 2023. Current Attempt in Progress Carla Vista Corporation reports the following January 1, 2023 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $450,000; defined benefit obligation, $450,000. Other data relating to three years of operation of the plan are as follows: (a) Prepare and complete a pension work sheet for 2023. Current Attempt in Progress Carla Vista Corporation reports the following January 1, 2023 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $450,000; defined benefit obligation, $450,000. Other data relating to three years of operation of the plan are as follows: (a) Prepare and complete a pension work sheet for 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts