Question: present the answer in a tabular form as shown below please Question 2 [12 Marks] You have been presented with following information from Fair Play

present the answer in a tabular form as shown below please

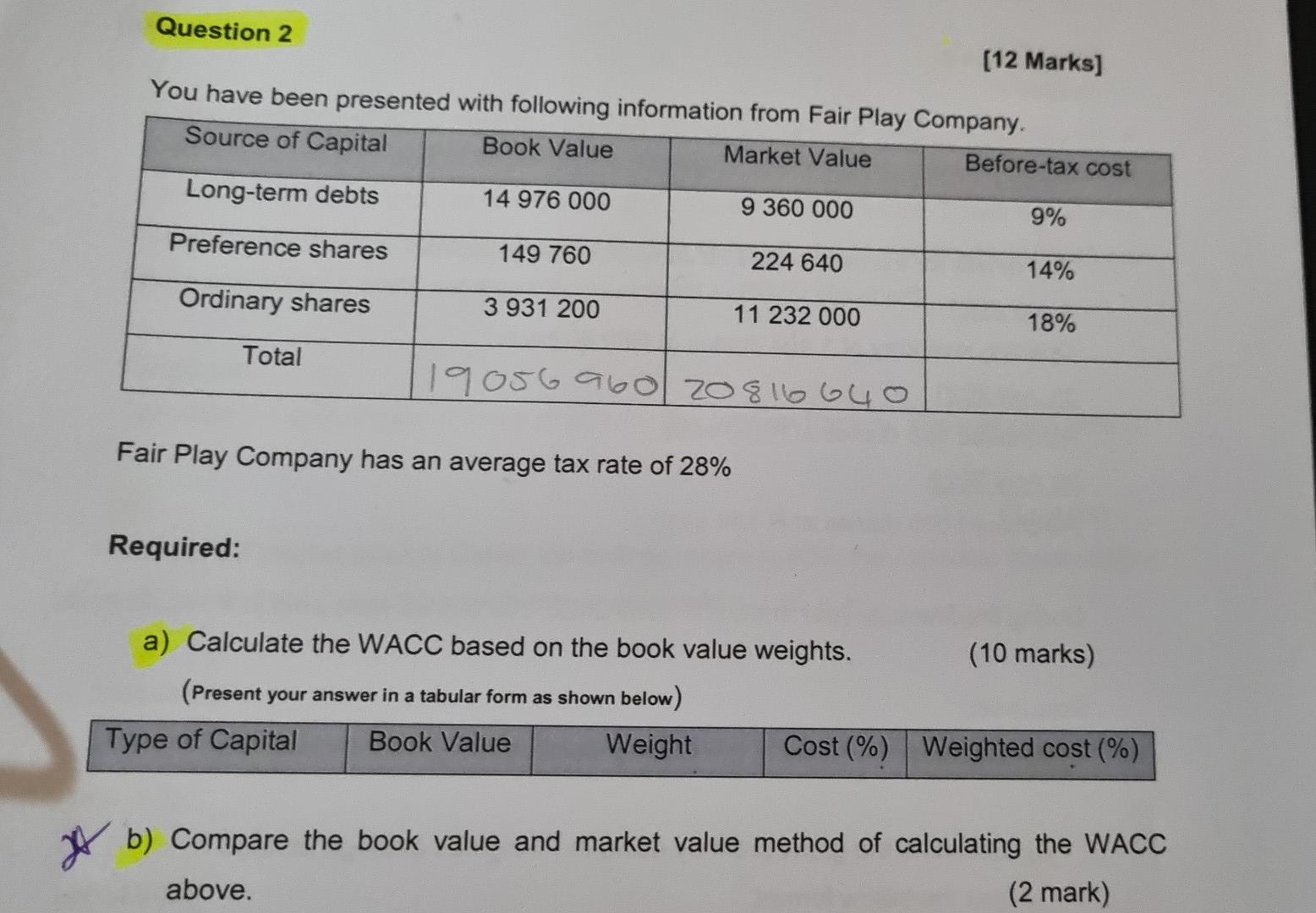

Question 2 [12 Marks] You have been presented with following information from Fair Play Company. Source of Capital Book Value Market Value Before-tax cost Long-term debts 14 976 000 9 360 000 9% Preference shares 149 760 224 640 14% Ordinary shares 3 931 200 11 232 000 18% Total 19056960 20816 640 Fair Play Company has an average tax rate of 28% Required: a) Calculate the WACC based on the book value weights. (10 marks) (Present your answer in a tabular form as shown below) Type of Capital Book Value Weight Cost (%) Weighted cost (%) b) Compare the book value and market value method of calculating the WACC (2 mark) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts