Question: Present Value Analysis onathan Butler, process engineer, knows that the acceptance of a new process design will depend on its economic feasibility. The new process

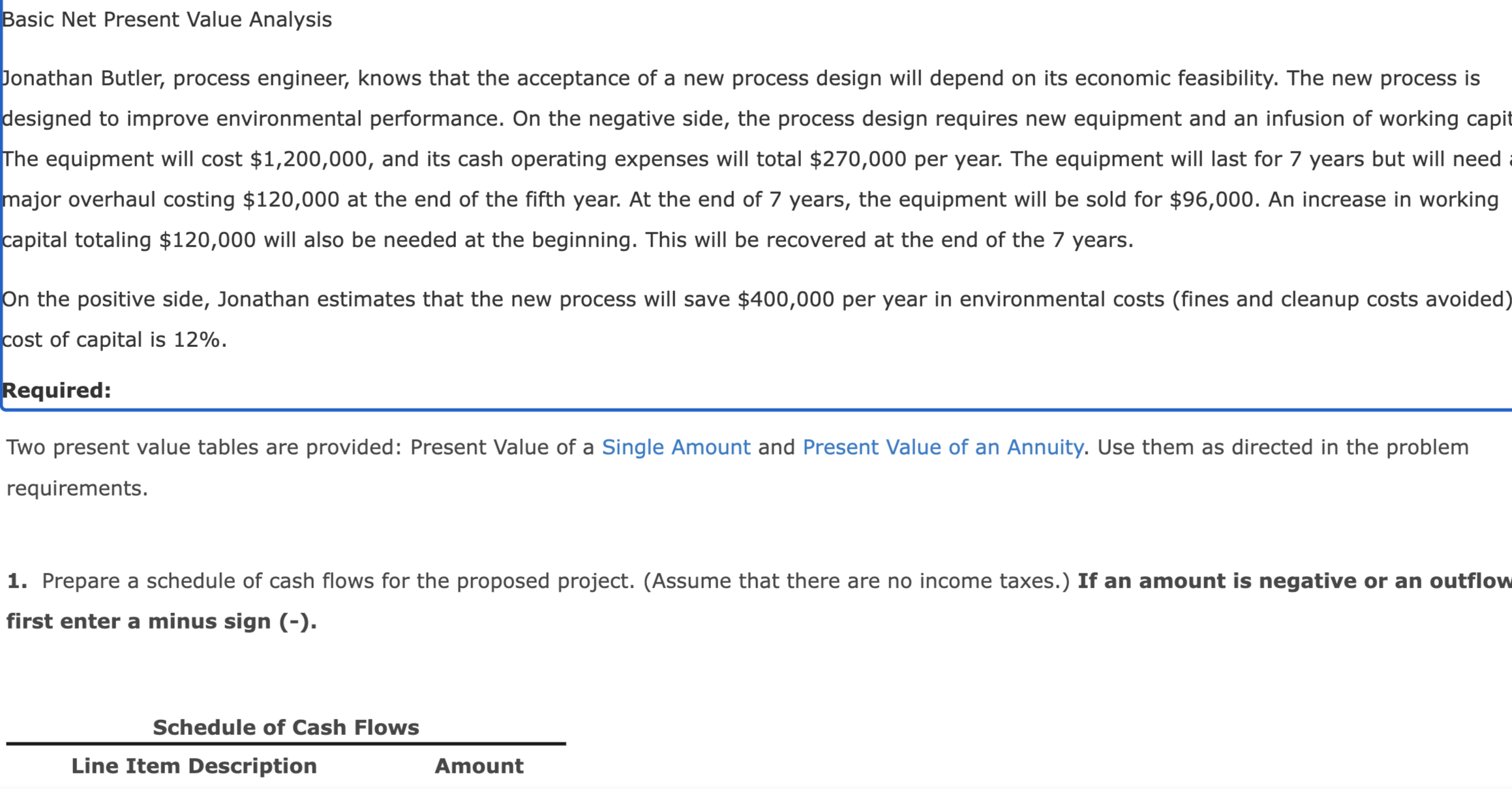

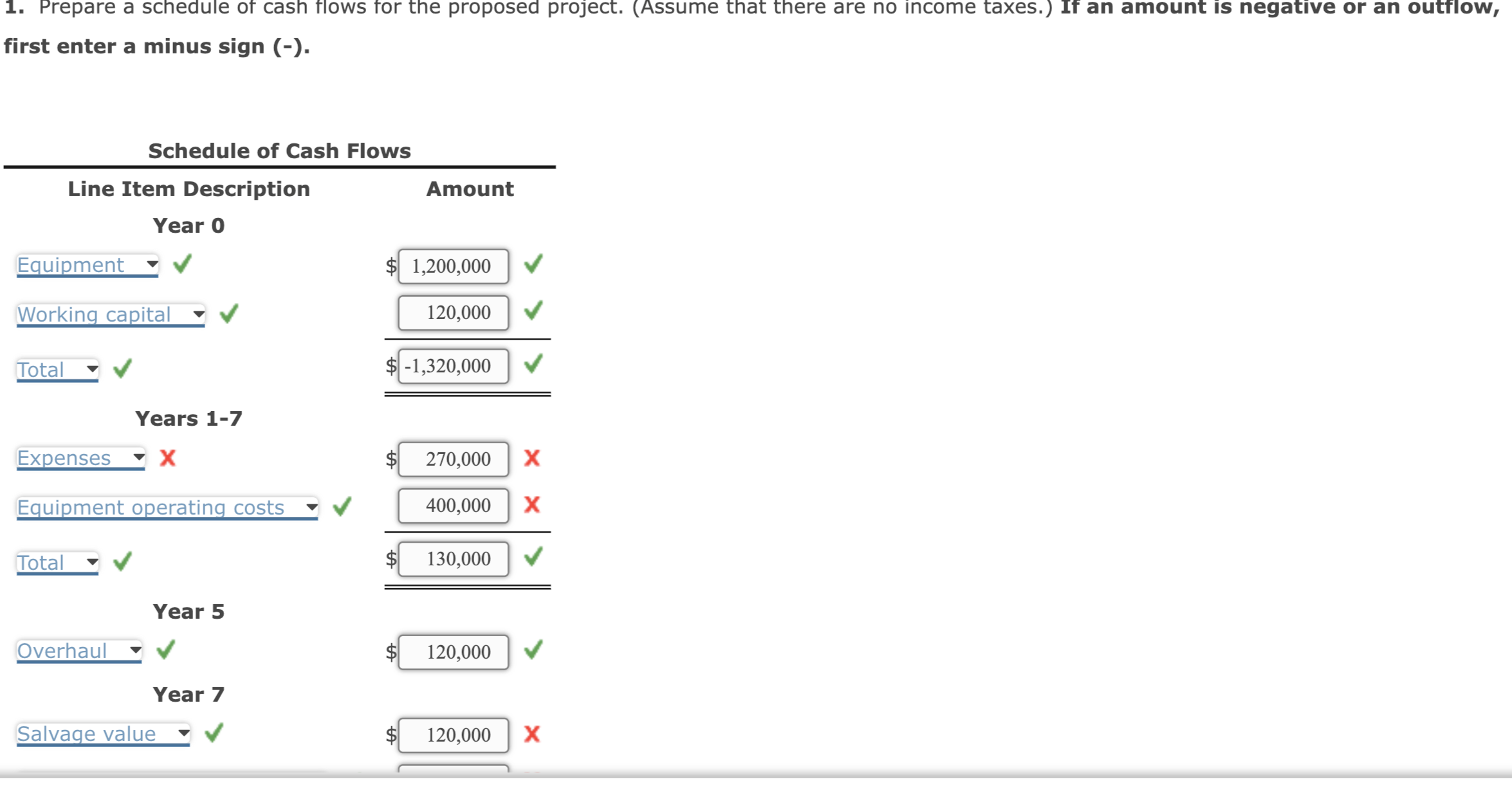

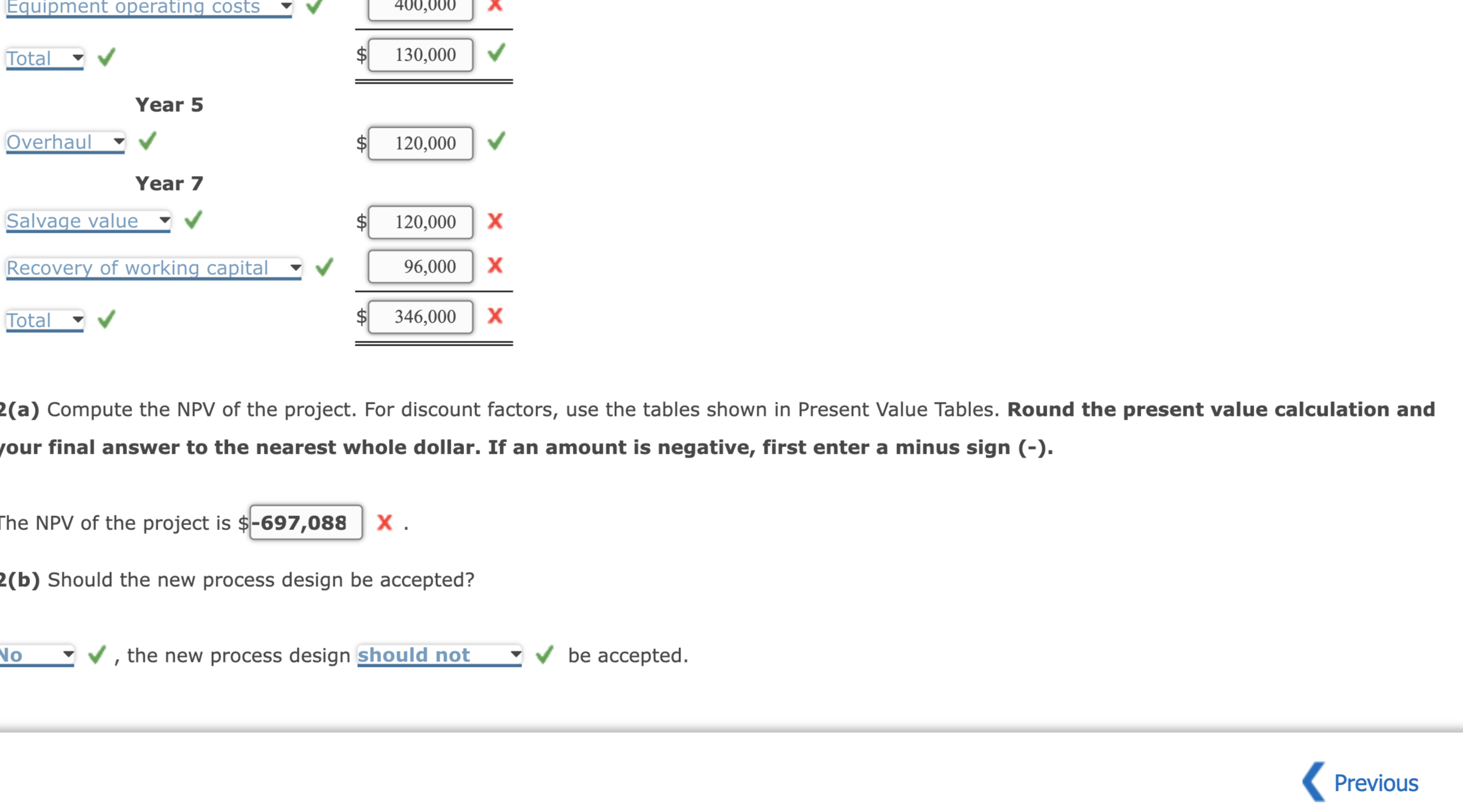

Present Value Analysis onathan Butler, process engineer, knows that the acceptance of a new process design will depend on its economic feasibility. The new process is lesigned to improve environmental performance. On the negative side, the process design requires new equipment and an infusion of working capi he equipment will cost $1,200,000, and its cash operating expenses will total $270,000 per year. The equipment will last for 7 years but will need najor overhaul costing $120,000 at the end of the fifth year. At the end of 7 years, the equipment will be sold for $96,000. An increase in working apital totaling $120,000 will also be needed at the beginning. This will be recovered at the end of the 7 years. In the positive side, Jonathan estimates that the new process will save $400,000 per year in environmental costs (fines and cleanup costs avoided ost of capital is 12%. Required: Two present value tables are provided: Present Value of a Single Amount and Present Value of an Annuity. Use them as directed in the problem requirements. 1. Prepare a schedule of cash flows for the proposed project. (Assume that there are no income taxes.) If an amount is negative or an outflor first enter a minus sign (-). 1. Prepare a schedule of cash flows for the proposed project. (Assume that there are no income taxes.) If an amount is negative or an outflow, first enter a minus sign (-). (a) Compute the NPV of the project. For discount factors, use the tables shown in Present Value Tables. Round the present value calculation and our final answer to the nearest whole dollar. If an amount is negative, first enter a minus sign (-). he NPV of the project is $ X. (b) Should the new process design be accepted? , the new process design be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts