Question: present value for all please? (a) (b) Id $12 million, 11-year, 14% unsecured bonds, interest payable quarterly, Bonds were priced to yield 12%. $26 million

present value for all please?

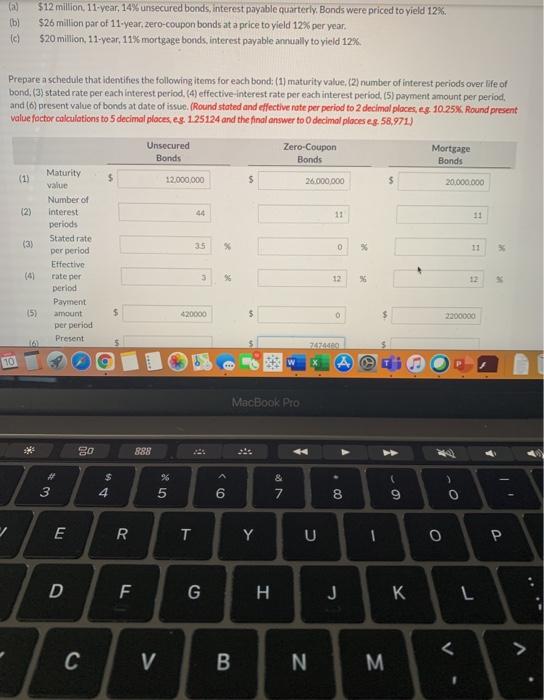

present value for all please?(a) (b) Id $12 million, 11-year, 14% unsecured bonds, interest payable quarterly, Bonds were priced to yield 12%. $26 million par of 11-year, zero-coupon bonds at a price to yield 12% per year. $20 million, 11-year, 11% mortgage bonds, interest payable annually to yield 12% Prepare a schedule that identifies the following items for each bond: (1) maturity value (2) number of interest periods over life of bond (3) stated rate per each interest period, (4) effective-interest rate per each interest period, (5) payment amount per period, and (6) present value of bonds at date of issue. (Round stated and effective rate per period to 2 decimal places, eg 10.25%. Round present value factor calculations to 5 decimal places, es. 1.25124 and the final answer to decimal places eg. 58,971) Unsecured Bonds Zero-Coupon Bonds Mortgage Bonds (1) $ 12.000.000 $ 26.000.000 20.000.000 123 11 (3) % 0 11 Maturity value Number of Interest periods Stated rate per period Effective rate per period Payment amount per period Present 3 36 12 12 15) $ 420000 0 2200000 16 24 10 MacBook Pro 80 888 1 $ 4 & 7 C 9 3 5 6 - - 8 o E R T Y U 1 o P D F G H J L C V B N. M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts