Question: Present Value Index Montana Grill has computed the net present value for capital expenditures for the Billings and Great Falls locations using the net present

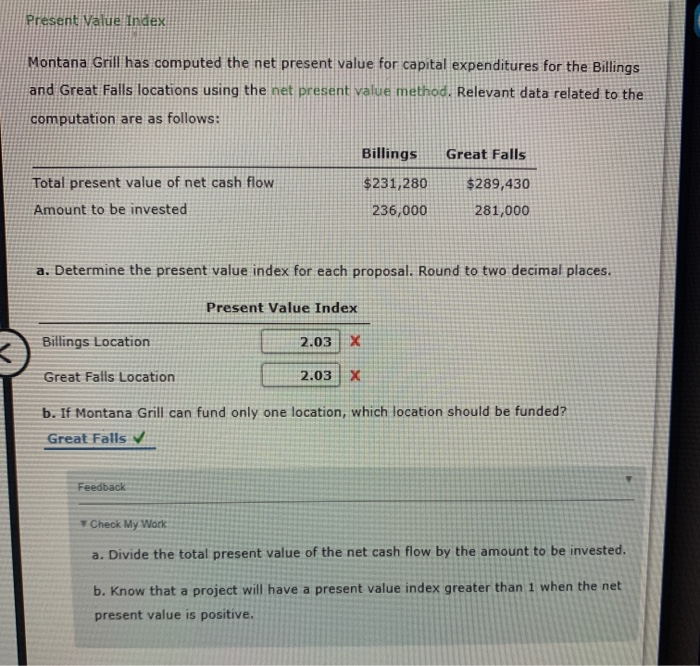

Present Value Index Montana Grill has computed the net present value for capital expenditures for the Billings and Great Falls locations using the net present value method. Relevant data related to the computation are as follows: Billings Great Falls Total present value of net cash flow Amount to be invested $231,280 236,000 $289,430 281,000 a. Determine the present value index for each proposal. Round to two decimal places. Present Value Index Billings Location 2.03 Great Falls Location 2.03 b. If Montana Grill can fund only one location, which location should be funded? Great Falls Feedback Check My Work a. Divide the total present value of the net cash flow by the amount to be invested. b. Know that a project will have a present value index greater than 1 when the net present value is positive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts