Question: Present Value Index Tasty Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as

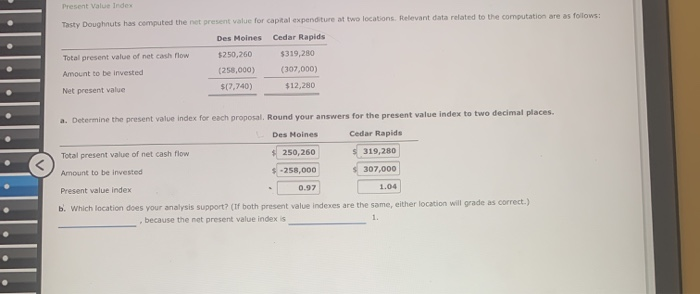

Present Value Index Tasty Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: Des Moines Cedar Rapids $250,260 $319,280 Total present value of net cash flow Amount to be invested (258,000) $17,740) (307,000) $12,280 Net present value a. Determine the present value index for each proposal. Round your answers for the present value index to two decimal places. Des Moines Cedar Rapids Total present value of net cash flow $250,260 S319,280 Amount to be invested 307,000 $ -258,000 - 0.97 1.04 Present value index b. Which location does your analysis support? (If both present value indexes are the same, either location will grade as correct.) because the net present value index is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts