Question: Present value: Mixed streams Consider the mixed streams of cash flows shown in the following table, a. Find the present value of each stream using

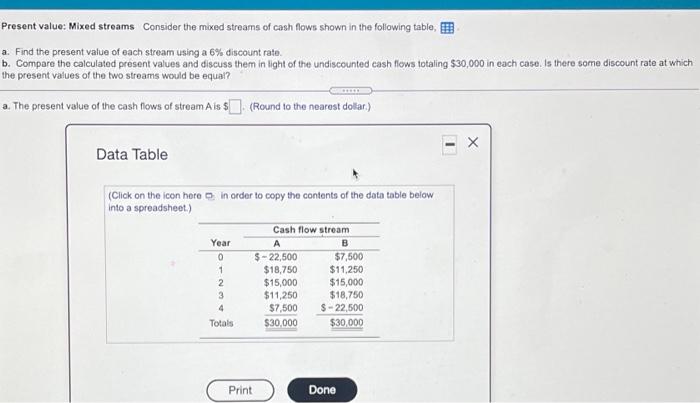

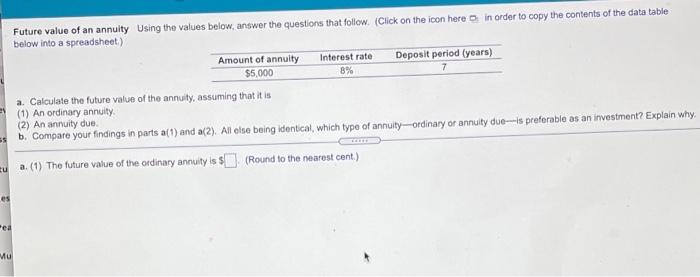

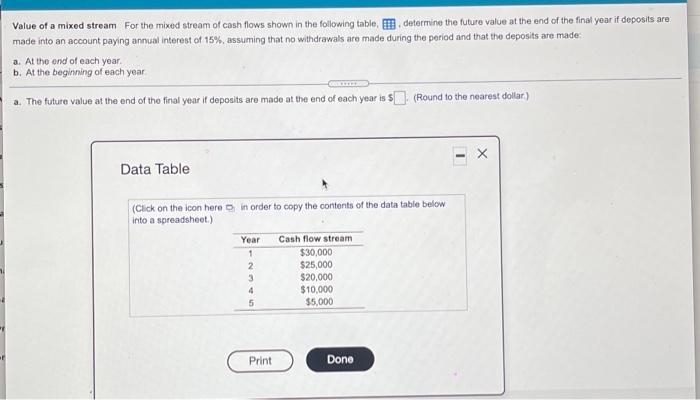

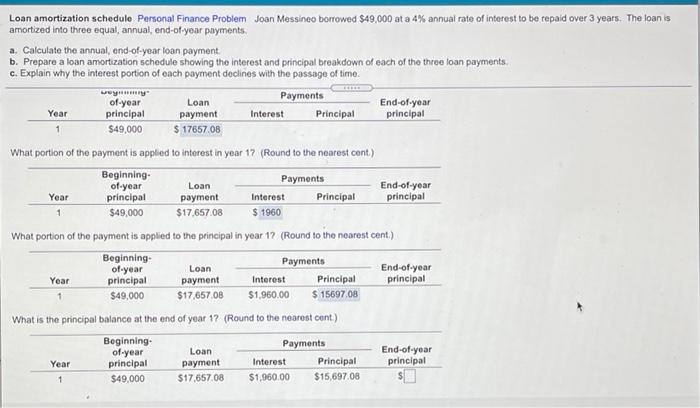

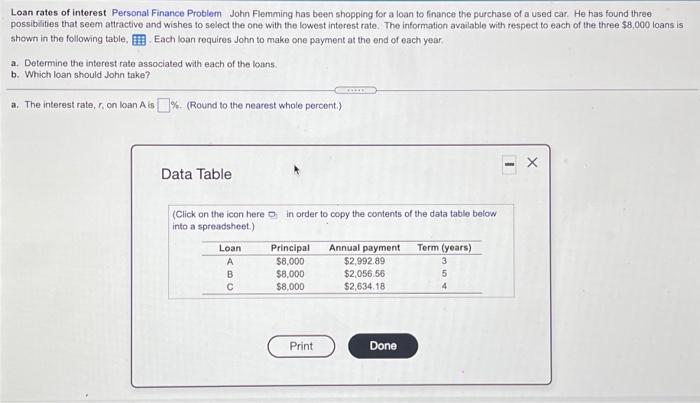

Present value: Mixed streams Consider the mixed streams of cash flows shown in the following table, a. Find the present value of each stream using a 6% discount rate. b. Compare the calculated present values and discuss them in light of the undiscounted cash flows totaling $30,000 in each case. Is there some discount rate at which the present values of the two streams would be equal? a. The present value of the cash flows of stream Als $.(Round to the nearest dolar) Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Cash flow stream Year B 0 $-22,500 $7,500 1 $18,750 $11,250 2 $15,000 $15,000 3 $11,250 $18,750 $7,500 S-22,500 Totals $30,000 $30,000 4 Print Done Future value of an annuity Using the values below, answer the questions that follow. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Amount of annuity Interest rate Deposit period (years) $5,000 8% a. Calculate the future value of the annuity, assuming that it is (1) An ordinary annuity (2) An annuity due b. Compare your findings in parts (1) and (2). All else being identical, which type of annuity-ordinary or annuity due-is preferable as an investment? Explain why. 5 cu a. (1) The future value of the ordinary annuity is $ (Round to the nearest cent.) Pea Mu Value of a mixed stream for the mixed stream of cash flows shown in the following table, determine the futuro value at the end of the final year if deposits are made into an account paying annual interest of 15%, assuming that no withdrawals are made during the period and that the deposits are made: a. At the end of each year b. At the beginning of each year a. The future value at the end of the final year if deposits are made at the end of each year is 5 (Round to the nearest dollar) 1 Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Year Cash flow stream $30,000 2 $25,000 3 $20,000 4 $10,000 5 $5,000 1 Print Done Loan amortization schedule Personal Finance Probler Joan Messinco borrowed $49.000 at a 4% annual rate of interest to be repaid over 3 years. The loan is amortized into three equal, annual end-of-year payments a. Calculate the annual end-of-year loan payment b. Prepare a loan amortization schedule showing the interest and principal breakdown of each of the three loan payments. c. Explain why the interest portion of each payment declines with the passage of time WYTY Payments of-year Loan End-of-year Year principal payment Interest Principal principal 1 $49,000 $ 17657.08 What portion of the payment is applied to interest in year 17 (Round to the nearest cont) Beginning Payments of year Loan End-of-year Year principal payment Interest Principal principal 1 $49,000 $17.657.08 $ 1960 What portion of the payment is applied to the principal in year 19 (Round to the nearest cent) Beginning Payments of year Loan End-of-year Year principal payment Interest Principal principal $49,000 $17.657 08 $1,960,00 $ 15697.08 What is the principal balance at the end of year 19 (Round to the nearest cont.) Beginning. Payments of-year Loan End-of-year Year principal payment Interest Principal principal $49,000 $17.657.08 $1,960,00 $15,697.08 Loan rates of interest Personal Finance Problem John Flemming has been shopping for a loan to finance the purchase of a used car. He has found three possibilities that seem attractive and wishes to select the one with the lowest interest rate. The information available with respect to each of the three $8,000 loans is shown in the following tableEach loan requires John to make one payment at the end of each year a. Determine the interest rate associated with each of the loans. b. Which loan should John take? a. The interest rato, , on loan Ais % (Round to the nearest whole percent) - Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Loan B Principal $8.000 $8,000 $8,000 Annual payment $2,992.89 $2,056.56 $2,634.18 Term (years) 3 5 4 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts