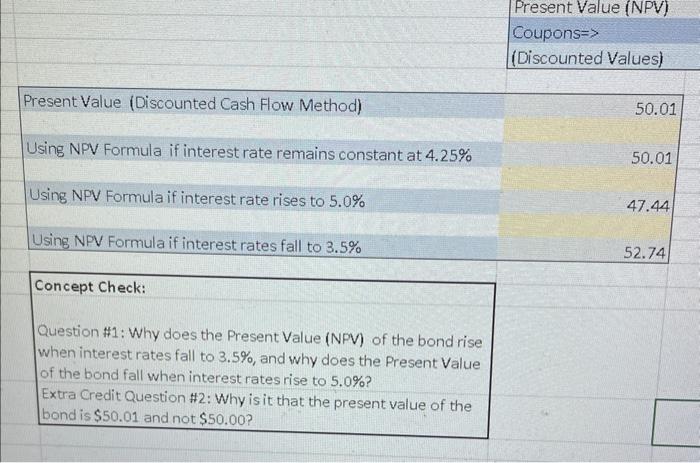

Question: Present Value (NPV) Coupons (Discounted Values) Present Value (Discounted Cash Flow Method) Using NPV Formula if interest rate remains constant at 4.25% Using NPV Formula

Present Value (NPV) Coupons (Discounted Values) Present Value (Discounted Cash Flow Method) Using NPV Formula if interest rate remains constant at 4.25% Using NPV Formula if interest rate rises to 5.0% Using NPV Formula if interest rates fall to 3.5% 52.74 Concept Check: Question \#1: Why does the Present Value (NPV) of the bond rise when interest rates fall to 3.5%, and why does the Present Value of the bond fall when interest rates rise to 5.0\%? Extra Credit Question #2 : Why is it that the present value of the bond is $50.01 and not $50.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts