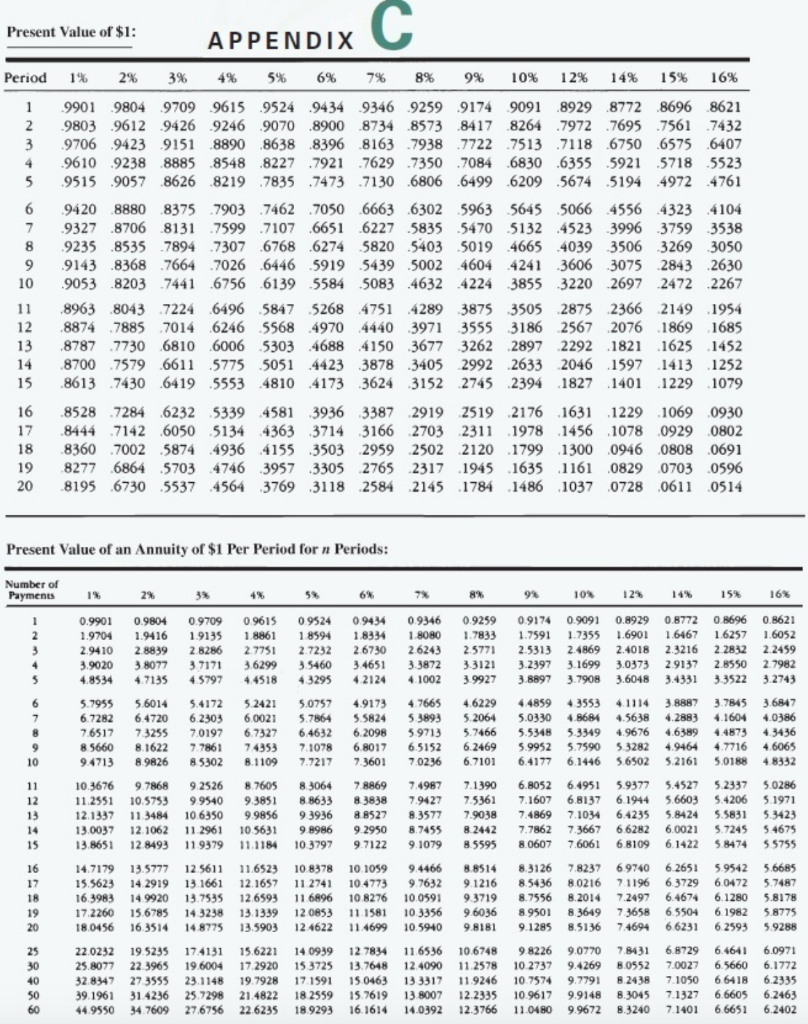

Question: Present Value of $1: APPENDIX Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 2 6 8 9 10

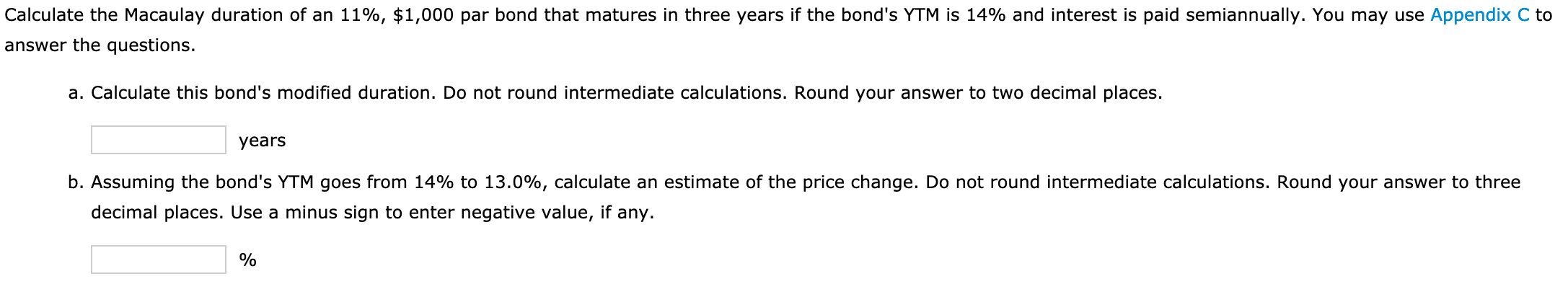

Present Value of $1: APPENDIX Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 2 6 8 9 10 99019804 9709 9615 9524 94349346 92599174 9091 8929.8772 8696 8621 9803 9612 9426 9246 9070 8900 8734 .85738417 8264 7972 7695 7561 7432 9706 9423 9151 8890.8638 8396 8163 .7938 7722 7513 7118 67506575 6407 96109238 8885 8548 8227 7921 7629 .7350 7084 6830.6355 5921 5718 5523 9515.9057 8626 8219 7835 7473 7130 6806 64996209 5674 5194 4972 4761 9420 88808375 7903 7462 7050 6663 6302 5963 5645 5066 4556 4323 4104 9327.8706 8131 75997107 .6651 6227 58355470 5132 4523 3996 3759 3538 9235.8535 7894 73076768 .6274 5820 5403 5019 4665 4039 3506 32693050 9143 .8368 7664 7026 6446 5919 543950024604 4241 3606 3075 2843 2630 .9053 82037441 6756 6139 5584 5083 4632 4224 3855 3220 2697 2472 2267 .8963 8043 7224 6496 5847 5268 4751 4289 3875 3505 2875 2366 21491954 .8874 7885 70146246 5568 49704440 3971 3555 3186 2567 2076 1869 1685 .8787 7730 6810 6006 5303 4688 4150 3677 3262 2897 2292 1821.1625 1452 .8700 7579 6611 5775 5051 4423 3878 3405 2992 2633 2046 1597 1413 1252 .8613 7430 64195553 4810 4173 3624 3152 2745 2394 1827 1401 1229 1079 .8528 7284 6232 5339 4581 3936 3387 2919 2519 2176 1631 1229 1069 0930 8444 7142 6050 5134 4363 3714 3166 2703 2311 1978 1456 1078 0929 0802 .8360 7002 5874 4936 4155 3503 2959 2502 2120 1799 13000946 0808 0691 .8277 6864 5703 4746 3957 3305 2765 2317 1945.1635 1161.0829 0703.0596 8195 6730 5537 4564 3769 3118 2584 2145 1784 1486 1037 0728.0611.0514 12 13 17 18 19 20 Present Value of an Annuity of $1 Per Period for n Periods: Number of Payments 1% 1% 2% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 0.9901 0.9804 0.9709 0.9615 09524 09434 09346 0.9259 09174 0.9091 1.9704 1.941619135 1.8861 18594 1,8334 1.8080 1.7833 1.759117355 2.9410 2.8899 2.8286 2.7751 2.723226730 2.62432.5771 2.5313 2.4869 3.90203 8077 3.7171 3.62993 5460 3.4651 3.3872 3.3121 3.2397 3.1699 4.8534 4.71354.5797 4.4518 4.3295 42124 4.1002 3.9927 3.8897 3.7908 5.7955 5.6014 5.41725.2421 5.0757 4.91734.7665 4.6229 4485943553 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 53893 5.2064 5.0330 4.8684 7.6517 7.3255 70197 6.7327 6.4632 6.2098 59713 5.7466 5.5348 5.3349 8 5660 8.1622 7786174353 7.1078 6.8017 6.5152 6.2469 5.9952 5.7590 9.471389826 85302 8.1109 7.7217 7.3601 7.0236 6.71016.4177 6.1446 0.8929 0.8772 0.8696 1.6901 1.6467 1.6257 2.4018 2.3216 22832 3.0373 2.9137 2.8550 3.6048 3.4331 3.3522 4.1114 3.8887 3.7845 4.5638 4.2883 4.1604 4.9676 4.6389 4.4873 532824.9464 4.7716 5.6502 5.21615.0188 0.8621 1.6052 2.2459 2.7982 3.2743 3.6847 4.0386 4.3436 4.6065 4.8332 6.8052 6.4951 7.1607 6.8137 7.4869 7.1034 7.78627.3667 8.0607 7.6061 5.9377 6.1944 6.4235 6.6282 6.8109 5.4527 5.2337 5.6603 5.4206 5.8424 5.5831 6.00215.7245 6.1422 5.8474 5.0286 5.1971 5.3423 5.4675 5.5755 10.3676 11.2551 12.1337 13.0037 13.8651 14.7179 15.5623 16 3983 17,2260 18.0456 22.0232 25.8077 32.8347 39.1961 44.9550 9.786892526 8.7605 8.3064 78869 7.4987 7.1390 10.5753 99540 9.38518.86338 38387.9427 7.5361 11 3484 10 6350 9.9856 9 3936 8.8527 8.3577 7.9038 12.1062 11 2961 10.5631 9.8986 9.2950 8.7455 8.2442 12 8493 119379 11.1184 10 37979.7122 9.107985595 13.5777 12.5611 11.6523 10.8378 10 1059 9.4466 8.8514 14.291913.166112.1657 11 2741 10.4773 9.763291216 14 9920 13.753512659311 6896 10.8276 10.05919.3719 15.6785 14 3238 13.1339 12 0853 11.1581 10 3356 9.6036 16 3514 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181 19.5235 17.4131 15.6221 14 0939 12.7834 11.6536 106748 22 3965 19.6004 17.2920 15 3725 13.7648 12.4090 11.2578 273555 23.1148 19.7928 17 1591 15 0463 13 3317 11.9246 31 4236 25.7298 21.4822 18 2559 15.7619 13.8007 12.2335 347609 27.6756 22.6235 18.9293 16.1614 14.0392 12.3766 8.3126 8.5436 8.7556 8.9501 9.1285 98226 102737 10.7574 10 9617 11.0480 7.8237 6.9740 6.2651 5.9542 5.6685 8.0216 71196 6.37296.0472 5.7487 8.2014 72497 6.4674 6.1280 5.8178 8.3649 73658 6.5504 6.1982 5.8775 8.5136 7.4694 66231 6.25935.9288 9.0770 7.8431 6.8729 6.4641 6.0971 9.4269 8.0552 7.0027 6.5660 6.1772 9.779182438 7.1050 6.6418 6.2335 9.9148 8.3045 71327 6.6605 6.2463 9.9672 8.3240 71401 6.6651 6.2402 Calculate the Macaulay duration of an 11%, $1,000 par bond that matures in three years if the bond's YTM is 14% and interest is paid semiannually. You may use Appendix C to answer the questions. a. Calculate this bond's modified duration. Do not round intermediate calculations. Round your answer to two decimal places. years b. Assuming the bond's YTM goes from 14% to 13.0%, calculate an estimate of the price change. Do not round intermediate calculations. Round your answer to three decimal places. Use a minus sign to enter negative value, if any

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts