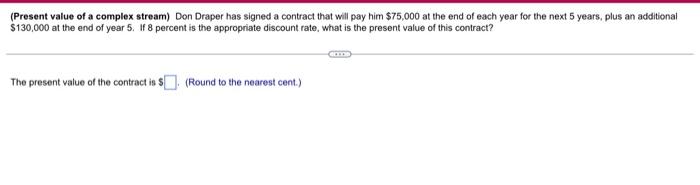

Question: (Present value of a complex stream) Don Draper has signed a contract that will pay him $75,000 at the end of each year for the

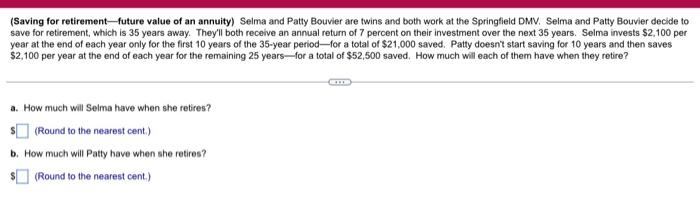

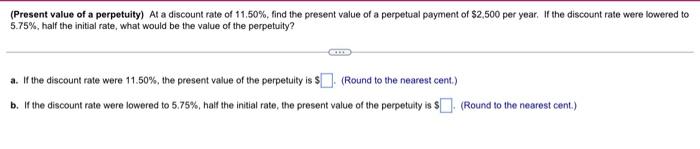

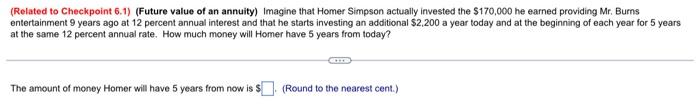

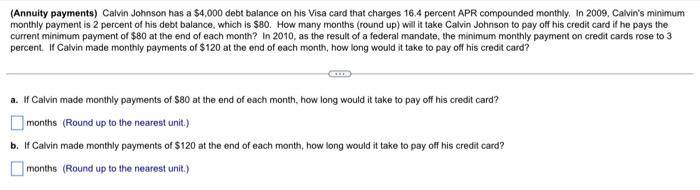

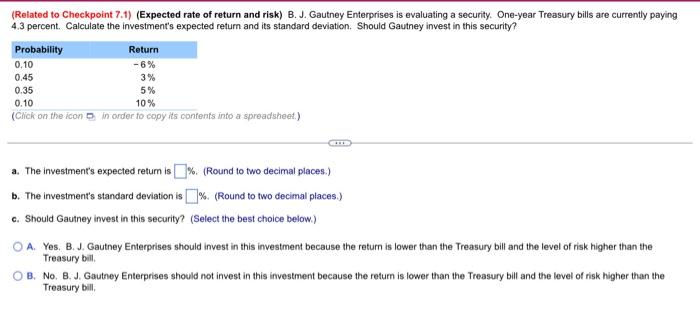

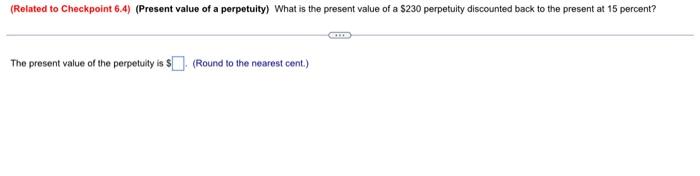

(Present value of a complex stream) Don Draper has signed a contract that will pay him $75,000 at the end of each year for the next 5 years, plus an additional $130,000 at the end of year 5. If 8 percent is the appropriate discount rate, what is the present value of this contract? COLOD The present value of the contract is $. (Round to the nearest cent.) (Saving for retirement-future value of an annuity) Selma and Patty Bouvier are twins and both work at the Springfield DMV. Selma and Patty Bouvier decide to save for retirement, which is 35 years away. They'll both receive an annual return of 7 percent on their investment over the next 35 years. Selma invests $2,100 per year at the end of each year only for the first 10 years of the 35-year periodfor a total of $21,000 saved. Patty doesn't start saving for 10 years and then saves $2,100 per year at the end of each year for the remaining 25 years--for a total of $52,500 saved. How much will each of them have when they retire? a. How much will Selma have when she retires? (Round to the nearest cent) b. How much will Patty have when she retros? (Round to the nearest cent.) (Present value of a perpetuity) At a discount rate of 11.50%, find the present value of a perpetual payment of $2,500 per year. If the discount rate were lowered to 5.75%, half the initial rate, what would be the value of the perpetuity? a. If the discount rate were 11.50%, the present value of the perpetuity is $. (Round to the nearest cent.) b. If the discount rate were lowered to 5.75%, half the initial rate, the present value of the perpetuity is S. (Round to the nearest cent.) (Related to Checkpoint 6.1) (Future value of an annuity) Imagine that Homer Simpson actually invested the $170,000 he earned providing Mr. Burns entertainment 9 years ago at 12 percent annual interest and that he starts investing an additional $2,200 a year today and at the beginning of each year for 5 years at the same 12 percent annual rate. How much money will Homer have 5 years from today? The amount of money Homer will have 5 years from now is (Round to the nearest cent) (Annuity payments) Calvin Johnson has a $4.000 debt balance on his Visa card that charges 16.4 percent APR compounded monthly, in 2009, Calvin's minimum monthly payment is 2 percent of his debt balance, which is $80. How many months (round up) will it take Calvin Johnson to pay off his credit card if he pays the current minimum payment of $80 at the end of each month? In 2010, as the result of a federal mandate, the minimum monthly payment on credit cards rose to 3 percent. If Calvin made monthly payments of $120 at the end of each month, how long would it take to pay off his credit card? a. If Calvin made monthly payments of $80 at the end of each month, how long would it take to pay off his credit card? months (Round up to the nearest unit.) b. If Calvin made monthly payments of $120 at the end of each month, how long would it take to pay off his credit card? months (Round up to the nearest unit.) (Related to Checkpoint 7.1) (Expected rate of return and risk) B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 4.3 percent. Calculate the investment's expected return and its standard deviation. Should Gautney invest in this security Probability Return 0.10 -6% 0.45 3% 0.35 5% 0.10 10% (Click on the icon in order to copy its contents into a spreadsheet.) a. The investment's expected return is % (Round to two decimal places.) b. The investment's standard deviation is % (Round to two decimal places.) c. Should Gautney invest in this security? (Select the best choice below) O A. Yes, B.J. Gautney Enterprises should invest in this investment because the return is lower than the Treasury bill and the level of risk higher than the Treasury bill OB. No. B.J. Gautney Enterprises should not invest in this investment because the return is lower than the Treasury bill and the level of risk higher than the Treasury bill (Related to Checkpoint 6.4) (Present value of a perpetuity) What is the present value of a $230 perpetuity discounted back to the present at 15 percent? GE The present value of the perpetuity is $(Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts