Question: (Present value of an annuity due) Determine the present value of an annuity due of $3,000 per year for 25 years discounted back to the

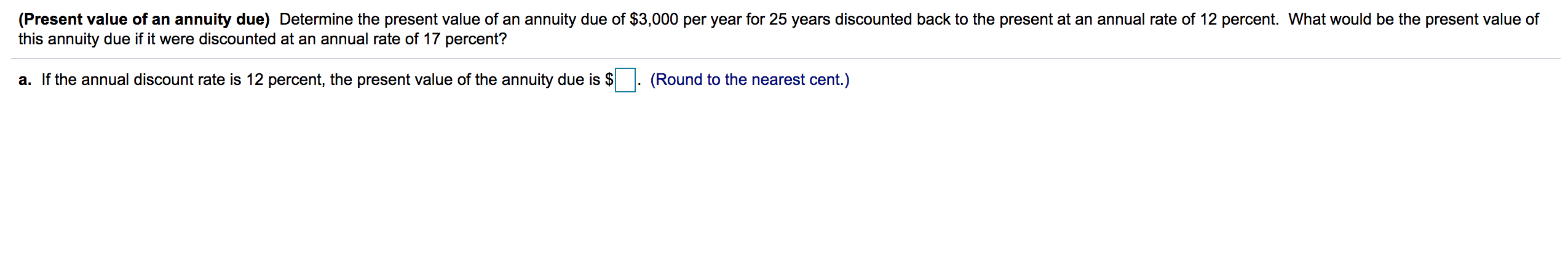

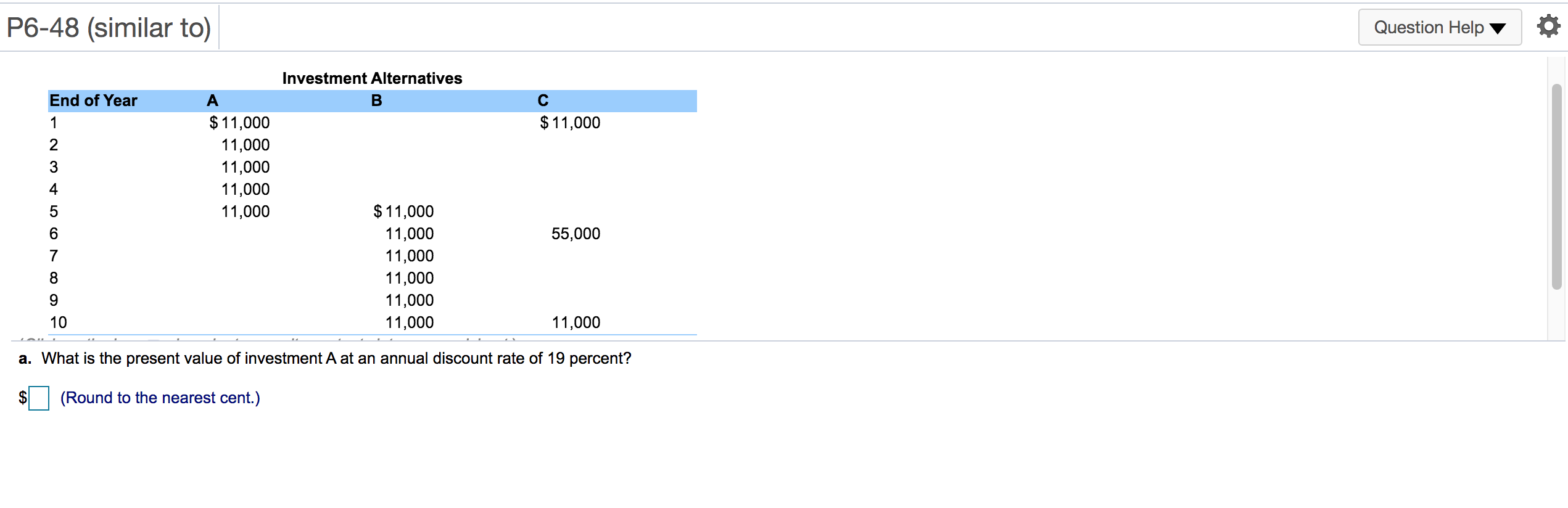

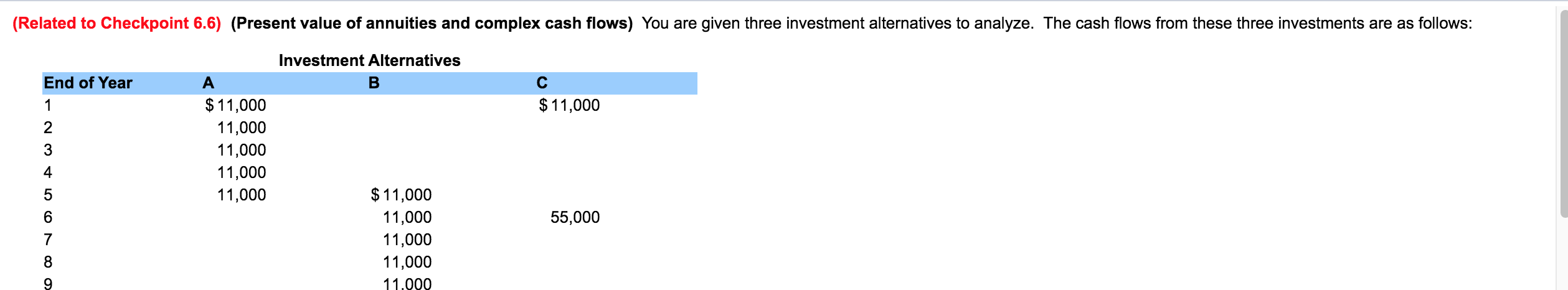

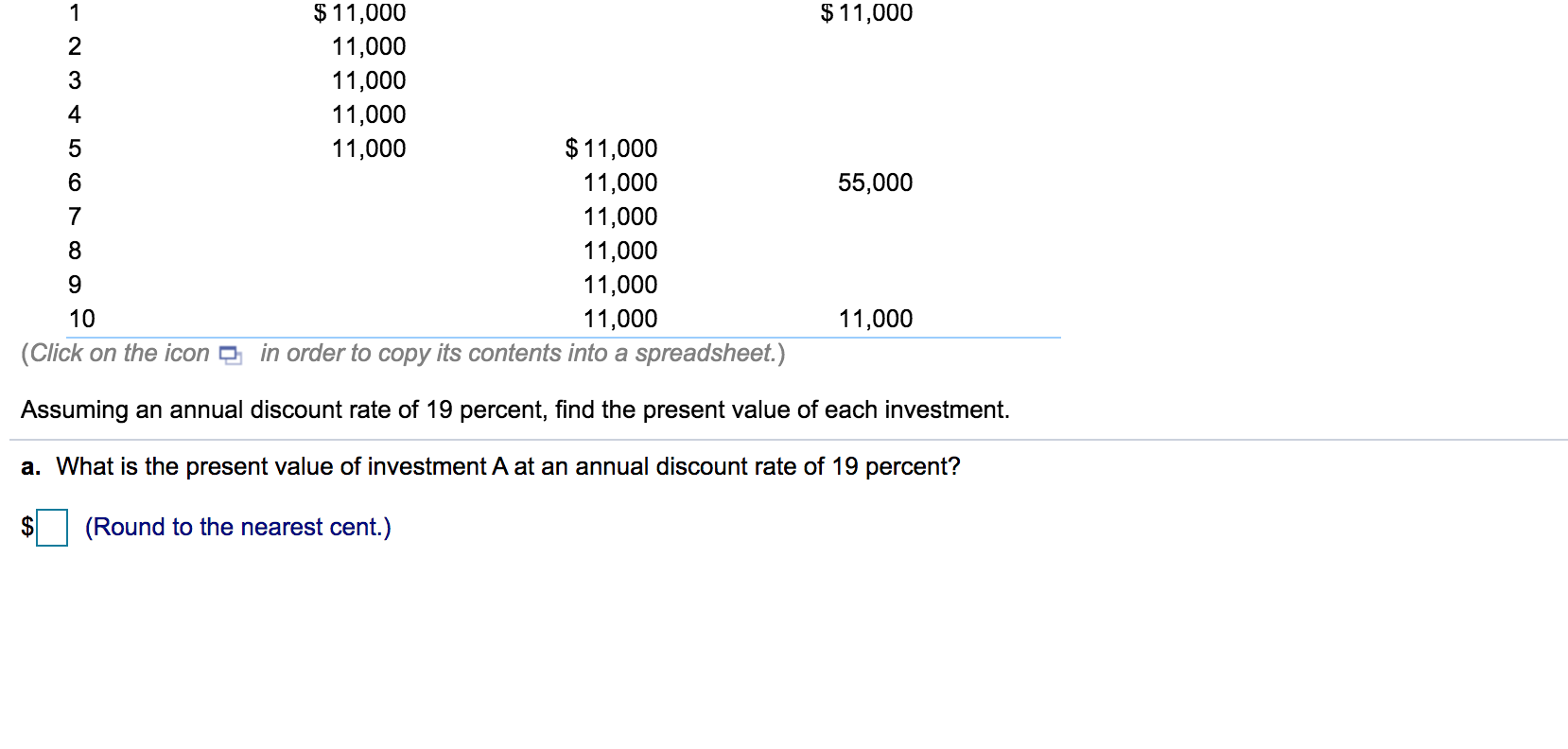

(Present value of an annuity due) Determine the present value of an annuity due of $3,000 per year for 25 years discounted back to the present at an annual rate of 12 percent. What would be the present value of this annuity due if it were discounted at an annual rate of 17 percent? a. If the annual discount rate is 12 percent, the present value of the annuity due is $ (Round to the nearest cent.) P6-48 (similar to) Question Help Investment Alternatives B End of Year 1 C $ 11,000 2 A $ 11,000 11,000 11,000 11,000 11,000 3 4 5 6 55,000 7 $ 11,000 11,000 11,000 11,000 11,000 11,000 8 9 10 11,000 a. What is the present value of investment A at an annual discount rate of 19 percent? (Round to the nearest cent.) (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives B End of Year 1 C $ 11,000 2 3 4 A $ 11,000 11,000 11,000 11,000 11,000 5 55,000 6 7 $11,000 11,000 11,000 11,000 11.000 8 9 $ 11,000 1 $ 11,000 2 11,000 3 11,000 4 11,000 5 11,000 $ 11,000 6 11,000 7 11,000 8 11,000 9 11,000 10 11,000 (Click on the icon in order to copy its contents into a spreadsheet.) oco voo AWNA 55,000 11,000 Assuming an annual discount rate of 19 percent, find the present value of each investment. a. What is the present value of investment A at an annual discount rate of 19 percent? $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts