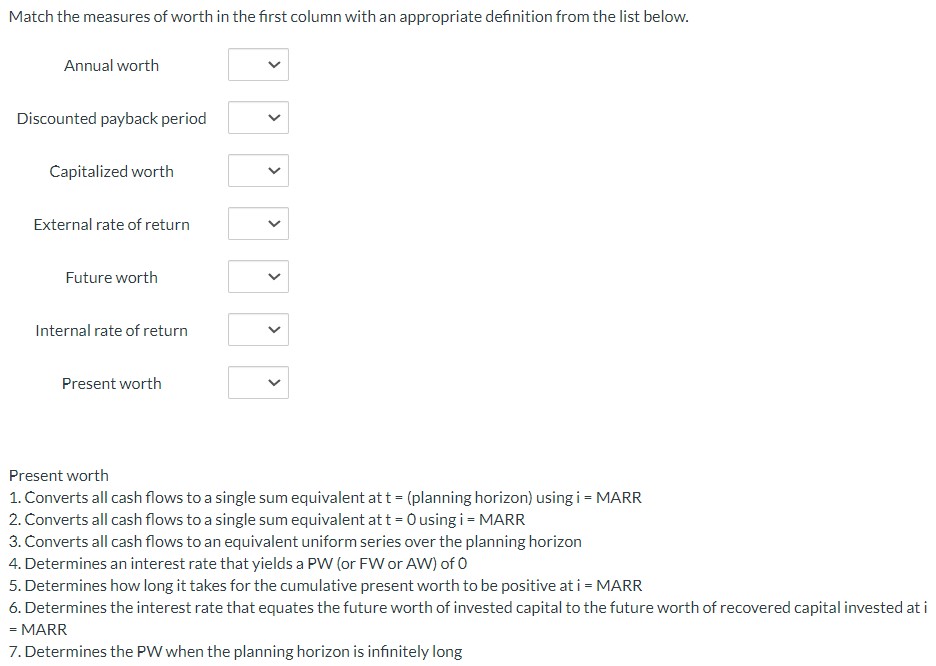

Question: Present worth 1. Converts all cash flows to a single sum equivalent at t= ( planning horizon) u sing i= MARR 2. Converts all cash

Present worth 1. Converts all cash flows to a single sum equivalent at t= ( planning horizon) u sing i= MARR 2. Converts all cash flows to a single sum equivalent at t=0 using i= MARR 3. Converts all cash flows to an equivalent uniform series over the planning horizon 4. Determines an interest rate that yields a PW (or FW or AW) of 0 5. Determines how long it takes for the cumulative present worth to be positive at i= MARR 6. Determines the interest rate that equates the future worth of invested capital to the future worth of recovered capital invested at i = MARR 7. Determines the PW when the planning horizon is infinitely long

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock