Question: Present Worth (PW) values = Net Present Values : NPV(rate, value 1, [Value2...) Internal Rate of Return (IRR) IRR(values, (guess]) and many more. Please explore

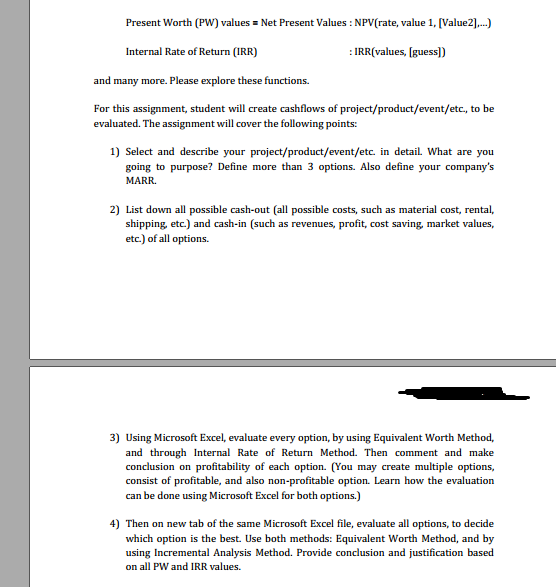

Present Worth (PW) values = Net Present Values : NPV(rate, value 1, [Value2...) Internal Rate of Return (IRR) IRR(values, (guess]) and many more. Please explore these functions. For this assignment, student will create cashflows of project/product/event/etc., to be evaluated. The assignment will cover the following points: 1) Select and describe your project/product/event/etc. in detail. What are you going to purpose? Define more than 3 options. Also define your company's MARR. 2) List down all possible cash-out (all possible costs, such as material cost, rental, shipping, etc.) and cash-in (such as revenues, profit, cost saving market values, etc.) of all options. 3) Using Microsoft Excel, evaluate every option, by using Equivalent Worth Method, and through Internal Rate of Return Method. Then comment and make conclusion on profitability of each option. (You may create multiple options, consist of profitable, and also non-profitable option. Learn how the evaluation can be done using Microsoft Excel for both options.) 4) Then on new tab of the same Microsoft Excel file, evaluate all options, to decide which option is the best. Use both methods: Equivalent Worth Method, and by using Incremental Analysis Method. Provide conclusion and justification based on all PW and IRR values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts