Question: Presented below are financial statements (except cash flows) for two not-for-profit organizations. Neither organization has any permanently restricted net assets. ABC Not-for-Profit XYZ Not-for-Profit Statement

Presented below are financial statements (except cash flows) for two not-for-profit organizations. Neither organization has any permanently restricted net assets.

| ABC Not-for-Profit | XYZ Not-for-Profit | |||||||||||||||

| Statement of Activities | Unrestricted | Temporarily Restricted | Unrestricted | Temporarily Restricted | ||||||||||||

| Revenues | ||||||||||||||||

| Program service revenue | $ | 6,995,000 | $ | 2,390,000 | ||||||||||||

| Contribution revenues | 3,467,500 | $ | 764,000 | 3,340,000 | ||||||||||||

| Grant revenue | 110,000 | $ | 1,039,000 | |||||||||||||

| Net gains on endowment investments | 18,900 | |||||||||||||||

| Net assets released from restriction | ||||||||||||||||

| Satisfaction of program restrictions | 478,000 | (478,000 | ) | 797,000 | (797,000 | ) | ||||||||||

| Total revenues | 10,959,400 | 396,000 | 6,527,000 | 242,000 | ||||||||||||

| Expenses | ||||||||||||||||

| Education program expenses | 7,021,000 | 1,573,000 | ||||||||||||||

| Research program expense | 1,270,000 | 2,956,000 | ||||||||||||||

| Total program service expenses | 8,291,000 | 4,529,000 | ||||||||||||||

| Fund-raising | 596,000 | 426,000 | ||||||||||||||

| Administration | 664,000 | 1,243,000 | ||||||||||||||

| Total supporting service expenses | 1,260,000 | 1,669,000 | ||||||||||||||

| Total expenses | 9,551,000 | 6,198,000 | ||||||||||||||

| Increase in net assets | 1,408,400 | 396,000 | 329,000 | 242,000 | ||||||||||||

| Net assets January 1 | 4,222,000 | 773,000 | 1,051,500 | 334,000 | ||||||||||||

| Net assets December 31 | $ | 5,630,400 | $ | 1,169,000 | $ | 1,380,500 | $ | 576,000 | ||||||||

| Statement of Net Assets | ABC Not-for-Profit | XYZ Not-for-Profit | ||||||||||

| Current assets | ||||||||||||

| Cash | $ | 219,000 | $ | 370,000 | ||||||||

| Short-term cash equivalents | 279,000 | 100,400 | ||||||||||

| Supplies inventories | 46,000 | 164,000 | ||||||||||

| Receivables | 453,500 | 202,500 | ||||||||||

| Total current assets | 997,500 | 836,900 | ||||||||||

| Noncurrent assets | ||||||||||||

| Noncurrent pledges receivable | 279,000 | |||||||||||

| Endowment investments | 2,730,000 | |||||||||||

| Land, buildings, and equipment (net) | 3,189,000 | 1,782,000 | ||||||||||

| Total noncurrent assets | 6,198,000 | 1,782,000 | ||||||||||

| Total assets | $ | 7,195,500 | $ | 2,618,900 | ||||||||

| Current liabilities | ||||||||||||

| Accounts payable | $ | 37,000 | $ | 143,000 | ||||||||

| Total current liabilities | 37,000 | 143,000 | ||||||||||

| Noncurrent liabilities | ||||||||||||

| Notes payable | 192,500 | |||||||||||

| Total noncurrent liabilities | 192,500 | |||||||||||

| Total liabilities | 229,500 | 143,000 | ||||||||||

| Net Assets | ||||||||||||

| Unrestricted | 4,039,000 | 2,378,500 | ||||||||||

| Donor restricted for purpose | 169,000 | 97,400 | ||||||||||

| Donor restricted for endowment | 2,730,000 | 0 | ||||||||||

| Total net assets | 6,938,000 | 2,475,900 | ||||||||||

| Total liabilities and net assets | $ | 7,167,500 | $ | 2,618,900 | ||||||||

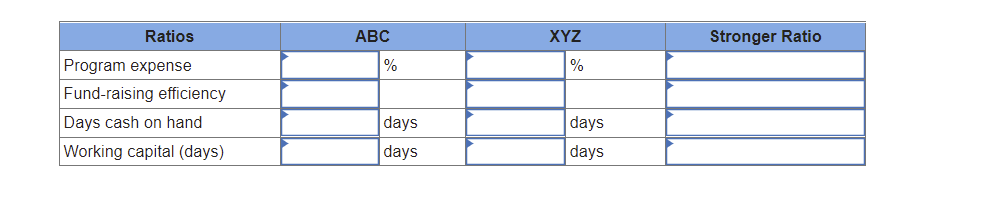

Required: a. Calculate the following ratios (assume depreciation expense is $764,000 for both organizations and is allocated among program and supporting expenses):

- Program expense.

- Fund-raising efficiency.

- Days cash on hand.

- Working capital (expressed in days).

b. For each ratio, which of the two organizations has the stronger ratio. (Assume 365 days in a year. Do not round intermediate calculations. Round "Program expense" answers to 1 decimal place and "Fund-raising efficiency" answers to 3 decimal places and "Days cash on hand", "Working capital" answers to nearest whole numbe r.)

r.)

Ratios ABC Stronger Ratio XYZ % % Program expense Fund-raising efficiency Days cash on hand Working capital (days) days days days days Ratios ABC Stronger Ratio XYZ % % Program expense Fund-raising efficiency Days cash on hand Working capital (days) days days days days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts