Question: Presented below are selected transactions at Whispering Winds Corp. for 2 0 2 0 . Jan 1 . Retired a piece of machinery that was

Presented below are selected transactions at Whispering Winds Corp. for

Jan Retired a piece of machinery that was purchased on January The machine cost on that date. It had a useful life of years with no salvage value. June Sold a computer that was purchased on January The computer cost It had a useful life of years with no salvage value.The computer was sold for

Dec Discarded a delivery truck that was purchased on Jan The truck cost It was depreciated based on a year useful life with a salvage value.

Journalize all entries required on the above dates, including entries to update depreciation, where applicable, on assets disposed of Whispering Winds Corp. uses straight line depreciation. To record depreciation to date of disposal

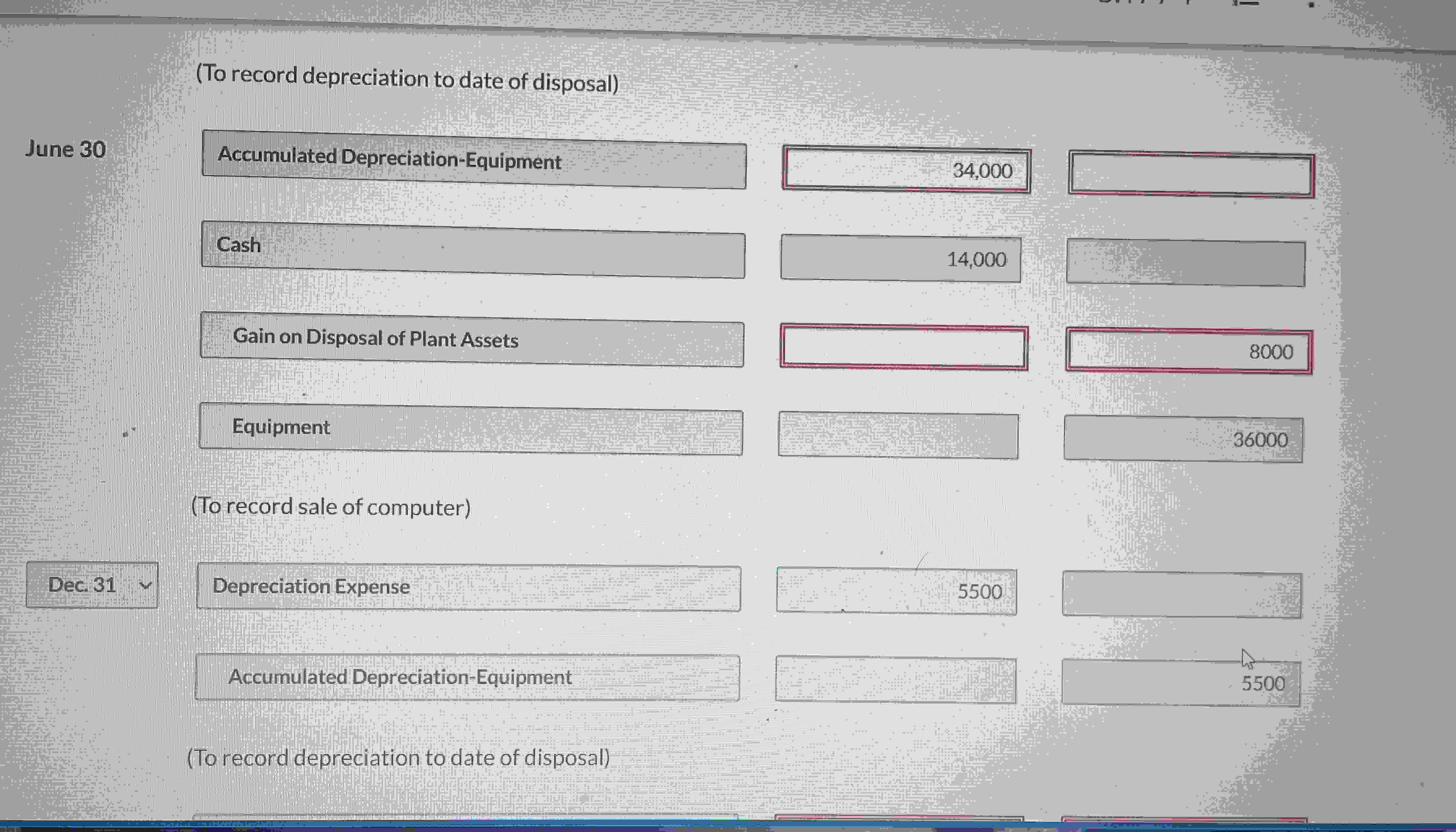

To record depreciation to date of disposal

Accumulated DepreciationEquipment

Cash

Gain on Disposal of Plant Assets

Equipment

To record sale of computer

To record depreciation to date of disposal

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock