Question: Presented below are several figures reported for Post Incorporated and Mitchell Company as of Decemher 3 1 of the current year which was the second

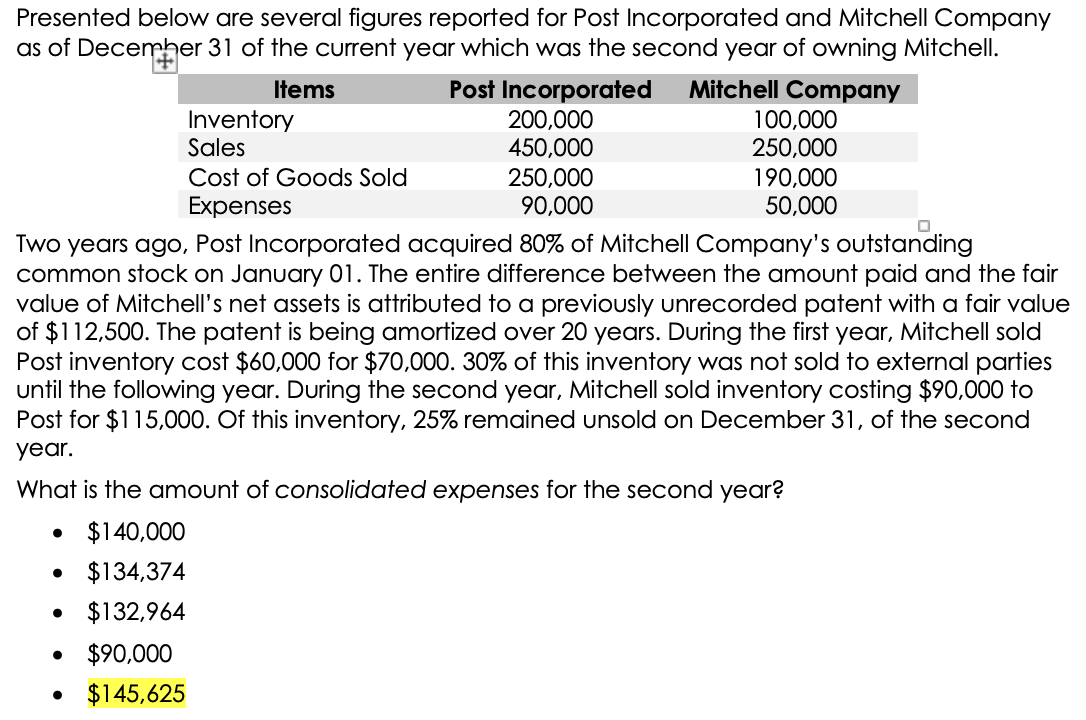

Presented below are several figures reported for Post Incorporated and Mitchell Company as of Decemher of the current year which was the second year of owning Mitchell.

Two years ago, Post Incorporated acquired of Mitchell Company's outstanding common stock on January The entire difference between the amount paid and the fair value of Mitchell's net assets is attributed to a previously unrecorded patent with a fair value of $ The patent is being amortized over years. During the first year, Mitchell sold Post inventory cost $ for $ of this inventory was not sold to external parties until the following year. During the second year, Mitchell sold inventory costing $ to Post for $ Of this inventory, remained unsold on December of the second year.

What is the amount of consolidated expenses for the second year?

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock