Question: Presented below are the income statement items from Guns Up Corp. for the year ended December 31, 2020. Sales revenue $ 5,400,000 Cost of goods

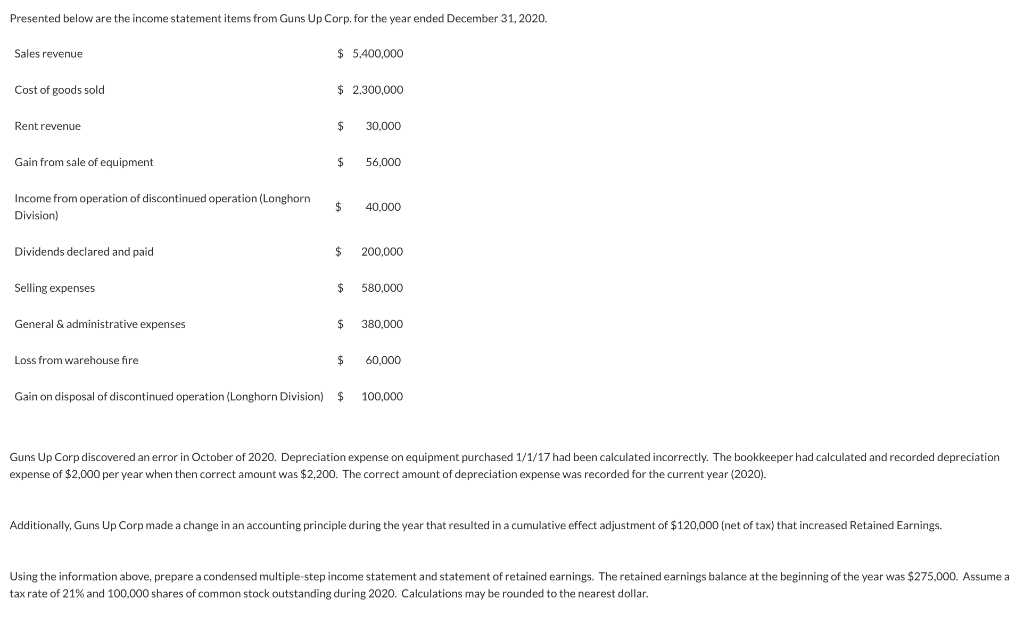

Presented below are the income statement items from Guns Up Corp. for the year ended December 31, 2020. Sales revenue $ 5,400,000 Cost of goods sold $ 2,300,000 Rent revenue $ 30,000 Gain from sale of equipment $ 56,000 Income from operation of discontinued operation (Longhorn Division) $ 40,000 Dividends declared and paid $ 200,000 Selling expenses $ 580,000 General & administrative expenses $ 380,000 Loss from warehouse fire $ 60,000 Gain on disposal of discontinued operation (Longhorn Division) $ 100,000 Guns Up Corp discovered an error in October of 2020. Depreciation expense on equipment purchased 1/1/17 had been calculated incorrectly. The bookkeeper had calculated and recorded depreciation expense of $2,000 per year when then correct amount was $2,200. The correct amount of depreciation expense was recorded for the current year (2020). Additionally, Guns Up Corp made a change in an accounting principle during the year that resulted in a cumulative effect adjustment of $120,000 (net of tax) that increased Retained Earnings. Using the information above, prepare a condensed multiple-step income statement and statement of retained earnings. The retained earnings balance at the beginning of the year was $275,000. Assume a tax rate of 21% and 100,000 shares of common stock outstanding during 2020. Calculations may be rounded to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts