Question: Presented below is a condensed version of the comparative balance sheets for Ravensciaw Corporation for the last two years at December 31 and the

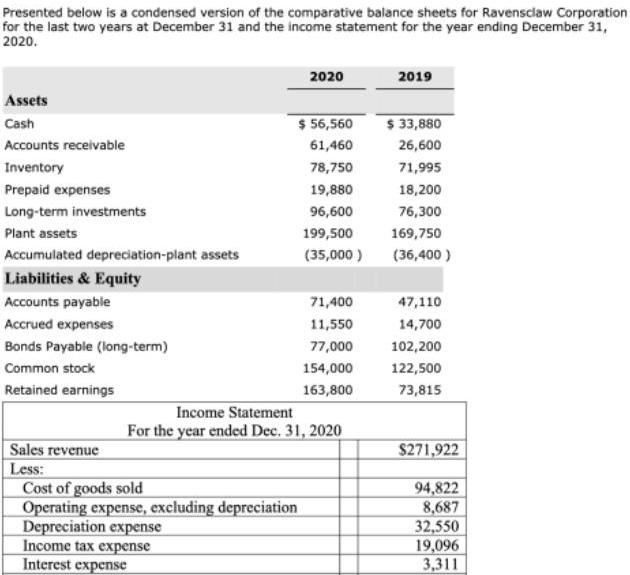

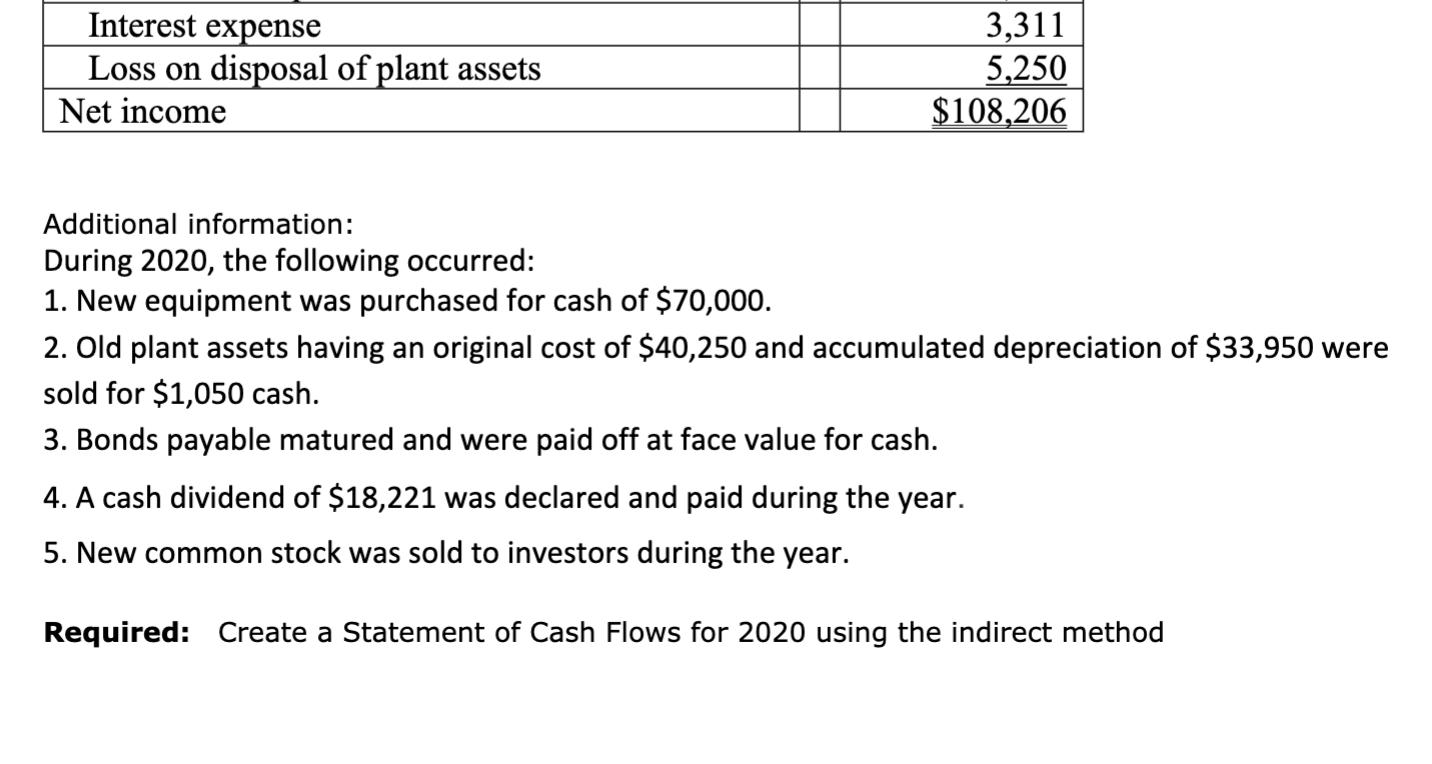

Presented below is a condensed version of the comparative balance sheets for Ravensciaw Corporation for the last two years at December 31 and the income statement for the year ending December 31, 2020. 2020 2019 Assets Cash $ 56,560 $ 33,880 Accounts receivable 61,460 26,600 Inventory 78,750 71,995 Prepaid expenses 19,880 18,200 Long-term investments 96,600 76,300 Plant assets 199,500 169,750 Accumulated depreciation-plant assets (35,000 ) (36,400 ) Liabilities & Equity Accounts payable 71,400 47,110 Accrued expenses 11,550 14,700 Bonds Payable (long-term) 77,000 102,200 Common stock 154,000 122,500 Retained earnings 163,800 73,815 Income Statement For the year ended Dec. 31, 2020 Sales revenue Less: $271,922 Cost of goods sold Operating expense, excluding depreciation Depreciation expense Income tax expense Interest expense 94,822 8,687 32,550 19,096 3,311 Interest expense Loss on disposal of plant assets 3,311 5,250 $108,206 Net income Additional information: During 2020, the following occurred: 1. New equipment was purchased for cash of $70,000. 2. Old plant assets having an original cost of $40,250 and accumulated depreciation of $33,950 were sold for $1,050 cash. 3. Bonds payable matured and were paid off at face value for cash. 4. A cash dividend of $18,221 was declared and paid during the year. 5. New common stock was sold to investors during the year. Required: Create a Statement of Cash Flows for 2020 using the indirect method

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Ravensclaw Corporation Statement of Cash Flows Indirect method For the Year Ended December 31 2020 C... View full answer

Get step-by-step solutions from verified subject matter experts